Introduction

There are some interesting blockchain projects that are trying to solve the pain points of the cryptocurrency industry. ChainLink is one such project that is bringing interoperability to the world of blockchains.

To date, prominent blockchain networks have existed in isolation like Bitcoin, Ethereum, Ripple, and others. Previously, there was no way to connect all these blockchains together, and to connect them to real-world data that exists outside of the blockchain.

Interoperability helps users and developers get access to varying features of different blockchains, all the while ensuring that the integrity of both the networks remains intact.

Bitcoin introduced the world to blockchains and brought the idea of decentralization mainstream. Ethereum then went on to unleash the true power of the blockchain mechanism using smart contracts.

ChainLink is the next step in blockchain revolution- helping different chains interact with each other and with external data sources.

At present, different consensus mechanisms in different blockchains do not allow free interaction between these chains. ChainLink solves this problem using a secure Oracle network to create a fully decentralized solution.

It helps in limiting trust in a single party while enabling tamperproof and quality smart contracts. We will learn more about ChainLink, its native asset LINK, and how it creates a more sustainable blockchain environment.

What is ChainLink?

ChainLink is a truly unique blockchain project, the first of its kind. The decentralized oracle service is currently based on Ethereum and brings the power of developing blockchain solutions for traditional businesses as well as enterprises.

On its website, ChainLink describes itself as,

Many factors make ChainLink unique. It is a concept dedicated entirely to making smart contracts more connected to the outside world. The smart contract concept was first introduced by Ethereum; however, their smart contracts can only manage data on the blockchain.

They miss a bridge to real-world businesses. ChainLink aims to help in decentralizing the internet to create a link between blockchain and their real-world applications.

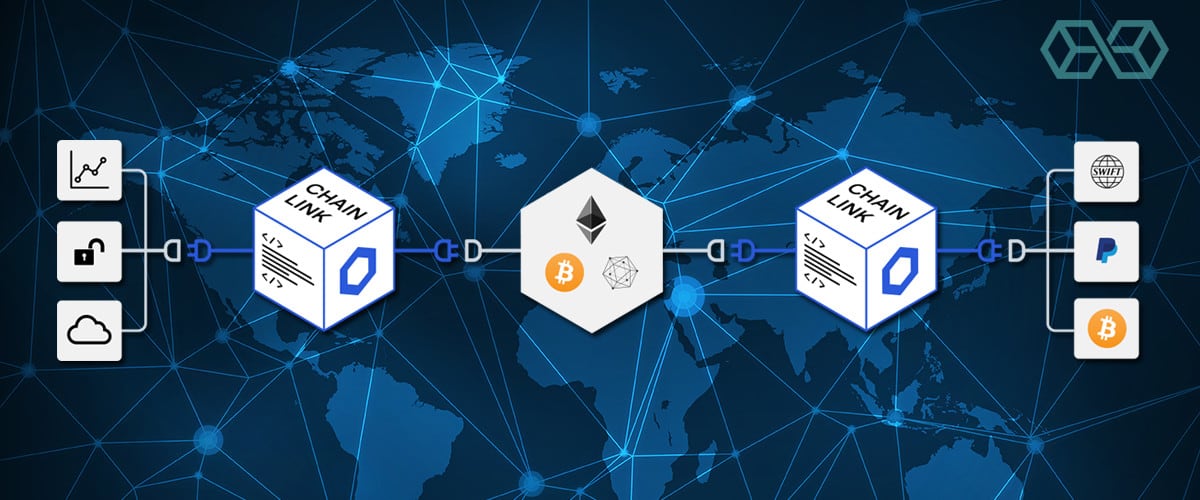

Users of smart contracts can utilize the oracles in the network to retrieve data from off-chain APIs, data pools, and other resources. It can then be integrated into the blockchain. In essence, it takes data from external applications via APIs and puts it into the blockchain network.

It could connect existing applications like PayPal with the Ethereum blockchain. It could also help users in sending payments directly from their smart contracts to their bank accounts.

How does ChainLink work?

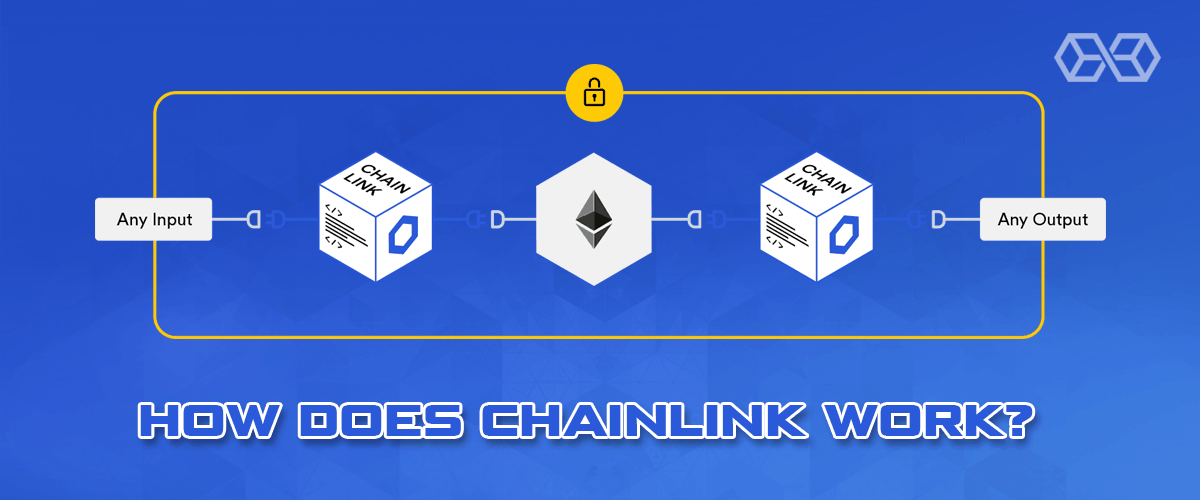

ChainLink works by connecting the blockchain ecosystem to external applications. On one end, it connects to the blockchain, and on the other, it is integrated with an API. The solution’s base is built on oracles, which help in limiting trust in a single party and work seamlessly in a decentralized infrastructure.

The core functions of ChainLink depend on two processes – On-chain and off-chain. The smart contracts in ChainLink are “externally aware” which means that carry a component that helps them integrate with non-blockchain applications as well. The on-chain infrastructure helps in oracle selection and creating an Oracle record.

Once done, the agreement is executed off-chain before getting reported back to the on-chain infrastructure. The off-chain architecture is equipped with subtask schemas and external adaptors, along with the ChainLink Core.

All components of the infrastructure can be updated. The solution currently works on Ethereum, but it will be updated in the future to allow cross-chain transactions as well.

How it works on-chain?

The on-chain architecture of ChainLink is developed on the Ethereum blockchain. In this method, smart contracts do the majority of the work, and data is retrieved within the node. The smart contract supplies the queries nodes need to carry out.

It has three unique components or contracts. First is a reputation contract that keeps track of oracle metrics. Second is the order matching contract which takes bids from the individual nodes based on the SLA and the parameters set by the creator of a smart contract.

The third is the aggregating contract, which collects answers by the nodes and provides a final result to the user’s query. It also supplies metrics to the reputation contract.

Therefore, on-chain aggregation can be broken into three steps– oracle selection, data reporting, and result aggregation.

Oracle selection is controlled by the end-user or the smart contract creator to specify the criteria needed by the contract. This could include the type of information the contract should contain, the collection and reputation of nodes used in the assignment, etc.

The users will be provided a listing service to make the oracle selection easier, which works off-chain but would eventually be added on-chain. Nodes can be determined automatically on their suitability for the assignment using an order-matching contract.

Nodes will also be preconfigured to decide if they will automatically bid on the assignment or not.

Once the criteria of the node are matched with the contract, it will bid by paying the penalty. This amount could be lost if the node does not return acceptable data. The assignment will select the nodes and ones which are not selected get to withdraw their penalty.

In the second step of data reporting, nodes will carry out the assignment as determined by the SLA. It could connect to the API endpoints, process data through external adapters, sign responses digitally, and then return the answers on-chain.

In the final step of result aggregation, the aggregating contract gets results from nodes. It then calculates an answer to the smart contract creator’s query. It will use the response from all oracles to signal back to the reputation contract of each node’s timeliness and validity. The contract creator may also configure the aggregating contract to ignore a few answers.

How it works off-chain?

The off-chain architecture of ChainLink is the most interesting and unique thing about this blockchain solution. The ChainLink network is part of its off-chain architecture, which connects all nodes together. Each of the nodes is connected to off-chain reserves via APIs to gather responses for every contract.

They may also have external adapters that could help them in extending their connections to 3rd party API endpoints.

All off-chain data is translated off-chain via the ChainLink core software in such a way that it can be read on-chain. The sub-tasks of the assignments are also processed by this software. An important component of this architecture is an external adapter.

These adapters can be used for connecting to 3rd party API endpoints, helping bridge the gap between blockchain and real-world applications. All adapters have to be written in ChainLink’s schema format.

What do the ChainLink smart contracts do?

Before we dive into the ChainLink smart contracts, let’s first take a primer on what smart contracts are and what is the purpose of an oracle.

A smart contract is basically a program that contains code, providing trustless execution on the blockchain. These contracts help in removing intermediaries and transaction friction.

Oracles can be used to retrieve and verify data originating outside of a blockchain. The concept is not new, but its inroads into the blockchain industry are making it a more popular topic in the space.

The unique thing about ChainLink’s smart contracts is that they inculcate the working of oracles into their contracts. It provides a decentralized oracle feed that is aggregated to meet the conditions of the smart contract off-chain and then converted into on-chain data.

Basically, the smart contract framework is based on several components or processes, which are processed both on-chain and off-chain to ensure trustless third-party external data can be added to a smart contract.

The incentive-driven system bridges the gaps between existing real-world solutions and their blockchain counterparts.

What is an Oracle and how are they useful?

Oracles are programs that can be used to retrieve and verify external data on blockchain networks and smart contracts. They use market data feeds and web APIs to fulfill this purpose. Getting price data from the NYSE, or payment information from PayPal to a blockchain network are the kind of tasks an oracle can accomplish.

In order to utilize the power of oracles, a data source is queried for specific information, which is then connected to a blockchain. Smart contracts can be created to work on specific information flowing in from the data feed.

For instance, a smart contract can be generated for lottery users, and the oracle can be used to generate a random lottery number from an external source.

When two people from different regions, speaking entirely different languages meet, they depend on interpreters (think about political figures who tour other countries with personal interpreters by their side). The job of these interpreters is to bridge the language gap between the two people and help them understand each other.

Oracles do exactly the same for blockchains and other existing platforms. They take queries from blockchains, inquire on the external platform, and return with the response.

They are very useful for real-world applications of blockchain technology, which is still in its infancy and may need to connect with existing technologies and platforms to mature and gain mainstream adoption.

Is ChainLink decentralized?

Yes, ChainLink is a decentralized network. Anyone who is interested in running an oracle can participate in the network. ChainLink also has a robust reputation system. Every Oracle is given an on-chain identity and a reputation that helps in defining its reliability.

Even the nodes in the network have to stake LINK tokens which could be forfeited as a penalty for providing bad data. This makes the network freely available to all and discourages bad data, while maintaining a completely decentralized architecture.

The network will be enriched further when new blockchain systems gain support ontop of Ethereum, creating decentralized interoperability solutions.

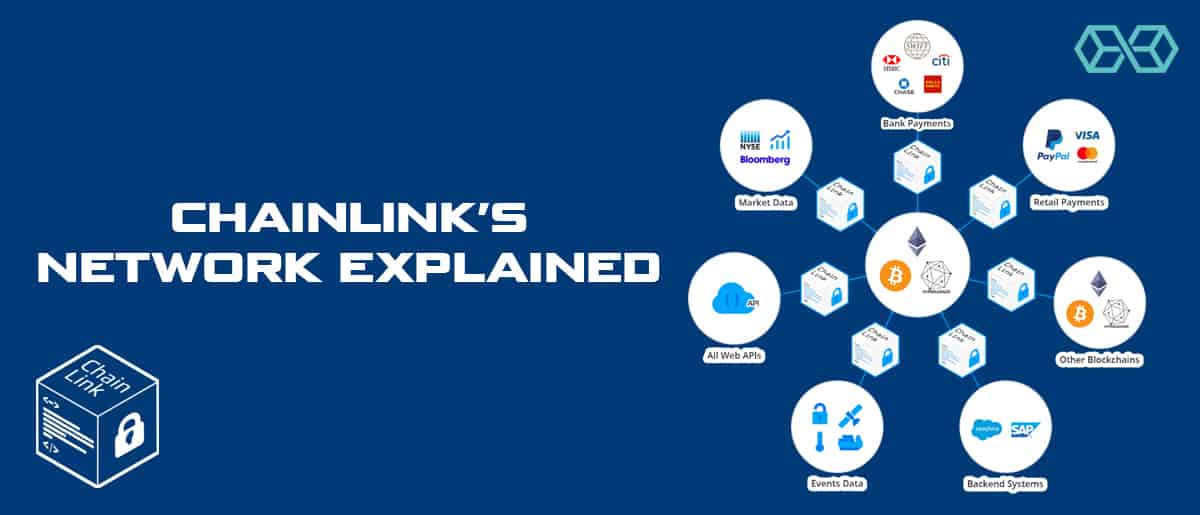

ChainLink’s network explained

Chainlink is a decentralized network of ChainLink nodes. Each node sells the use of specific data feeds, off-chain payments, and APIs directly to the smart contract.

The network is divided into two distinctive sections- on-chain and off-chain, which interact with each other to execute contracts.

Smart contracts originate on-chain, but their external data is verified and collected off-chain which is then sent back on-chain. The nodes have to stake LINK tokens which could be forfeited if they provide bad data. Oracles also have reputation systems and unique identities which signal their reliability to the users.

The network is built to be upgradable which means that different components in the network can be changed over time when better technologies arrive.

Any API provider, individual developer, or payments or e-signature provider, is free to join the network. The users can become ChainLink Node Operators by connecting their API to ChainLink.

The LINK Token, what is it for?

The LINK token is the native token of the ChainLink network. It is an ERC20 token, which means it has been built on the Ethereum platform.

The developers describe LINK as :

The token helps in paying Node operators on the network. The value and the demand for these tokens are dependent directly on the number of operators that work on the off-chain architecture of the network.

The token also derives its value from the use cases of the network- the more use cases the ChainLink platform can be put to, the more valuable the LINK token will be.

What network is the LINK token on?

The LINK token is native to the ChainLink network and is used to incentivize the ecosystem. The token is built on Ethereum ERC20 standards.

Currently, the LINK token has no other use cases apart from being a payment currency for the Node Operators and a possible asset for buyers on different exchanges. The value and utility of the token depend almost entirely on the adoption of the ChainLink network.

Which wallets support ChainLink’s LINK token?

As LINK is an ERC20 token, it is supported by any wallet that supports Ethereum and ERC20 tokens. MyEtherWallet is one example of a wallet that can be used for holding these tokens. For those looking to store more securely, the Ledger Nano S hardware wallet is a good example.

Browser wallets like MetaMask also support ERC20 tokens, which makes them compatible with LINK. Users can also use wallets provided by their respective exchanges where they buy and sell these tokens.

It’s best to use a hardware wallet for storing tokens where possible.

What is the total supply of LINK?

The total supply of LINK tokens is limited to 1 billion, which means that it is not possible to create new LINK tokens beyond a point, creating some scarcity and adding value to the token as time progresses.

The company has kept 30 percent of the token to ensure continued development and payment to its staff.

35 percent of the tokens were dedicated to the ICO. The remaining 35 percent tokens (i.e., 350 million tokens) will be available for incentivizing the network, i.e., Node Operator payments.

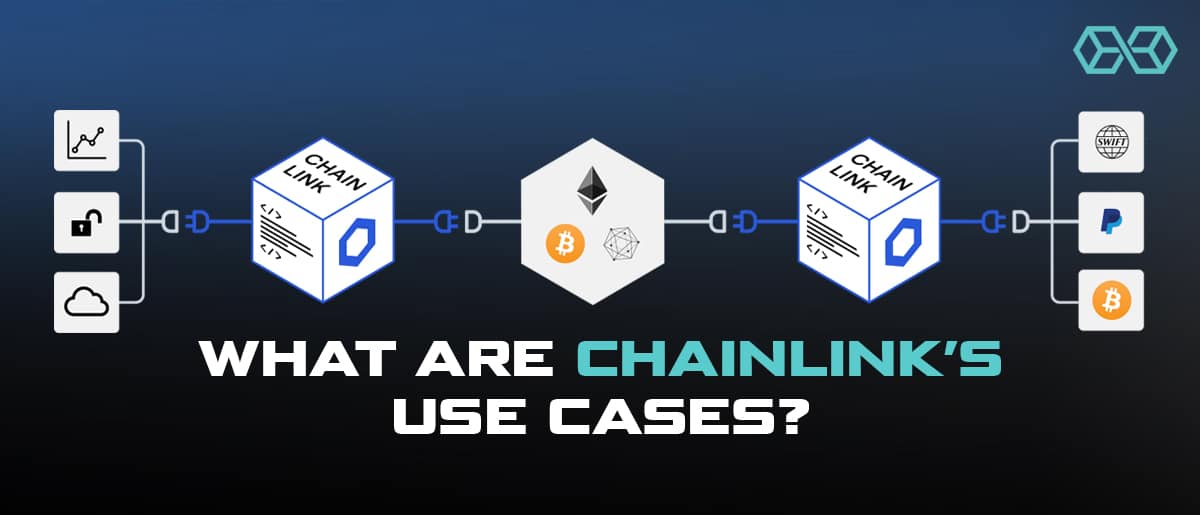

What are ChainLink’s use cases?

ChainLink can be put to as many real-world use cases as one can imagine. From fetching weather data to ensuring that payments processing networks help in executing smart contracts, the network is capable of using any external data and converting it into a blockchain-suitable response.

ChainLink’s value becomes more pronounced in three fields, as named in its whitepaper.

Securities smart contracts– ChainLink can be used effectively for bonds and smart contracts based on interest rate derivatives. They depend on data available on different financial websites and will require APIs to report on market prices and more.

Insurance smart contracts– data from external sources can be used in case of an insurable event. Data feeds from IoT devices could be used to define insurable events and if payments need to be made for them.

Trade finance smart contracts– these contracts could be used for confirming the fulfillment of contractual obligations. The contracts could be fed data via GPS or the ERP systems of supply chains to ensure that all conditions are being met.

ChainLink team, partners, history and roadmap

We will learn more about ChainLink, the people who built it, the history of the project, and its future prospects as well. We’ll touch on the establishment of ChainLink, the company and people behind the project, and more.

The readers will be introduced to Sergey Nazarov, Steve Ellis, and Ari Juels and the company SmartContract, which started four years ago to use digital technologies to make logic-based contractual agreements and went on to partner with the SWIFT banking system.

The ChainLink founders and team

The roots of ChainLink is in a startup called SmartContract which was established in 2014; the company aimed to harness technology, especially smart contracts to make contractual agreements that can be used by all participants in the industry- regardless of their skill level and expertise.

Their efforts were backed by a San Francisco based investment group Data Collective. SmartContract was selected as a “2017 Blockchain Applications Cool Vendor” by Gartner.

Sergey Nazarov is the co-founder and CEO of the company. He has worked in the blockchain space before, as the founder of Secure Asset Exchange, a ShapeShift like cryptocurrency exchange. He also founded the decentralized email service called CryptoMail.

Steve Ellis is the co-founder and CTO of the company who has worked previously on the Secure Asset Exchange platform. His experience as a software engineer in Pivotal Labs came before he made his debut in the blockchain industry.

The third most important person on the team is Ari Juels, who along with Nazarov and Ellis wrote the whitepaper of ChainLink. A computer science professor at Cornell Tech and the director of IC3. He is an advisor to ChainLink.

Andrew Miller, who has worked as an associate professor of computer science at the University of Illinois, is also an advisor to ChainLink. He is also an adviser to Tezos and Zcash.

Hudson Jameson is another strong advisor on the team who is one of the prominent Ethereum developers.

The Whitepaper

The Whitepaper for ChainLink was written by Steve Ellis, Ari Juels and Sergey Nazarov. ChainLink whitepaper v1.0 was released on September 4, 2017.

It contains details of the project’s infrastructure, the problems it solves, its on-chain and off-chain architecture, the use of oracles, reputation management and penalty stakes for nodes, and the utility of the LINK token.

The whitepaper also introduces us to ChainLink’s vision for creating ‘smarter’ smart contracts that connect external APIs to blockchains.

The ChainLink ICO- How did it go?

35 percent of 1 billion tokens of ChainLink were available to users during the ICO. ChainLink launched the ICO of the LINK token in September 2017.

The ChainLink ICO How did it go? – Source: Shutterstock.comThe ERC20 token’s ICO accepted Ethereum as payment. The initial price of 1 LINK was 0.11 USD or 0.00038462 ETH. The maximum personal cap for the ICO was 7 ETH. The project aimed to raise $32 million from the sale which was completed successfully.

ChainLink Partnerships

The most interesting partnership that we have seen for ChainLink is with the SWIFT banking system. SmartContract developed a proof of concept for SWIFT using ChainLink. The concept demonstrated how ChainLink solutions could be used to automate bond coupon payments.

ChainLink demonstrated the PoC at the SWIFT Sibos Conference in October 2017, where it pulled off-chain interest rate data from five different banks – Fidelity, BNP Paribas, Barclays, Santander, and Societe Generale. It then generated an ISO20022 SWIFT message to make the payment.

It was also the winner of the Innotribe Industry Challenge 2016. Note that Innotribe is a segment of SWIFT, focused on innovation.

It has also partnered with Zeppelin OS, which helps in creating a smarter, quicker, and easier smart contract development process.

IC3’s Town Crier, a patent-pending system that leveraged trusted hardware to verify data is also a ChainLink partner.

Factom, a decentralized data storage system using blockchain and smart contracts is also a partner.

The Request Network, which creates an open-sourced, standardized and decentralized PayPal like currency agnostic network is also working with ChainLink to look into a possible fiat integration.

Where can I buy ChainLink?

See our list of the best crypto exchanges to find a good exchange to buy Chainlink. Binance is a good option which accounts for a huge percentage of the total volume of LINK traded.

Should I Buy ChainLink?

Just like other cryptocurrencies, ChainLink is a highly volatile asset, and users who are not completely aware of the intricacies of crypto investing should not invest in LINK.

Should I Buy ChainLink?That said, it is important to note that LINK is a very strong token and its native blockchain is solving one of the biggest pain points in the blockchain industry. It has a very strong team and has fared very well in the market compared to other cryptocurrencies since its inception.

Conclusion

It is difficult to find projects in the blockchain space that do not make noise about becoming the next Bitcoin or Ethereum. ChainLink is a solution to a real blockchain problem with huge potential.

Given the strength of the company’s founders and advisors and the robustness of the solutions that it offers, it is worth keeping an eye on this project.

Chainlink has done extremely well since its inception, and with more adoption, it is quite possible that it will excel further in the future.

References

- Chainlink Markets

- CEEk Whitepaper

- Understanding JSON Schema

- Chainlink Known and Speculated Partnerships

- ISO20022 Defined

- What is Proof of Concept?

- What is Proof of Stake?

- Initial Coin Offering Explained

- What is IoT?

- ERC20 Explained

![A Beginner’s Guide to Monero – What Is XMR? [Updated 2023]](https://cd.blokt.com/wp-content/uploads/2019/04/Beginners-guide-to-Monero-2-218x150.png)

![Best 5 Bitcoin Sports Betting Sites [2023] (Analyzed & Approved) Best Bitcoin Betting Sites](https://cd.blokt.com/wp-content/uploads/2020/05/best-bitcoin-betting-sites-218x150.png)