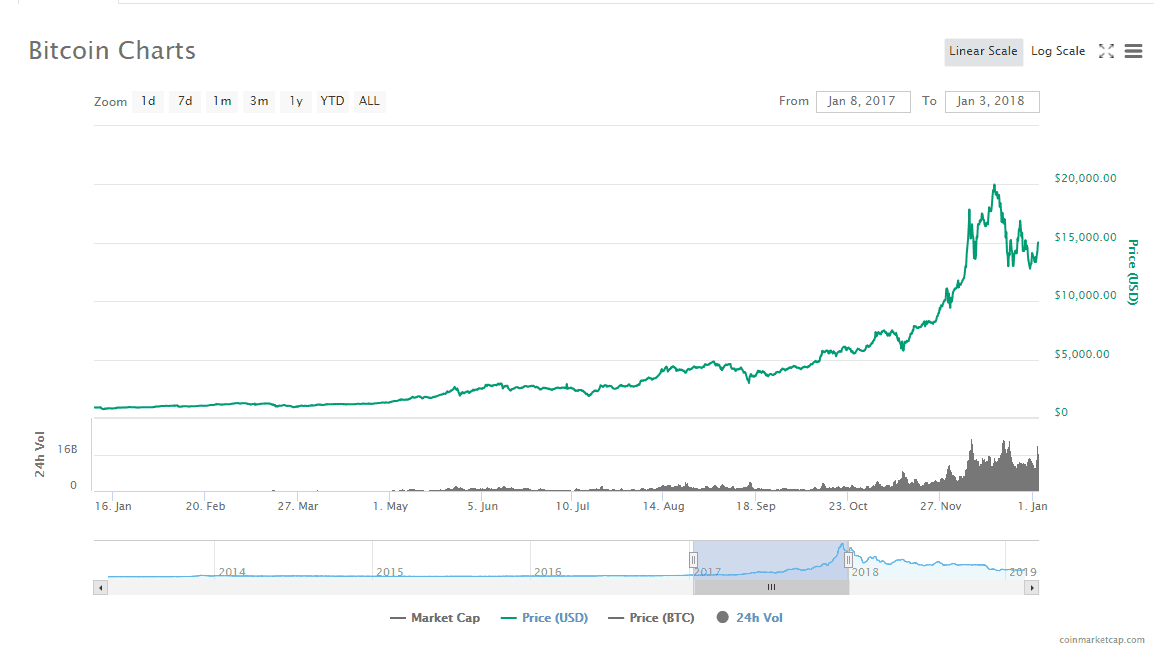

For traders who are just starting out, the cryptocurrency market can sometimes feel like a wild rollercoaster ride. While many traders made their fortunes when the market soared in late 2017, an equal amount lost out when it came crashing back down to earth in the following months.

The cryptocurrency markets promptly declined throughout 2018, and many of these overnight millionaire crypto traders lost their profits just as fast.

However, our beginner’s guide to cryptocurrency trading is designed to give a head start to those who are looking to enter the market.

People Still Want to Trade Cryptocurrency

Thankfully, the lackluster performance of the market in 2018 did not deter investors from trading in cryptocurrencies, which means opportunities to recoup the losses remain in the event of future bull markets.

To support this, a report by the Satis Group predicts that crypto trading volume for 2019 is likely to increase by up to 50 percent.

For those gearing up for another exciting trading year ahead, here are a few tips that might help you come out on top.

Don’t Stick to Bitcoin Trading – Learn to Diversify

The saying “don’t put all your eggs in one basket,” might be old, but it’s advice which still holds true when investing in cryptocurrencies.

According to The Next Web (TNW), diversification of a digital asset portfolio is essential, as it could reduce overall risk – especially if you invest in coins that service different sectors. Sticking to Bitcoin may be a good option for simple trading, but it may limit potential profits.

Diversification might even be a good strategy when it comes to the cryptocurrency exchanges you deal with. Instead of using just one single exchange, it may be better to utilize several different exchanges to handle your trades. Even the biggest exchanges have suffered from hacks, so it pays to spread your holdings across different accounts.

Understanding Cryptocurrency Trading Risks: Quadriga CX – A Tough Lesson

Customers of the Vancouver-based exchange Quadriga CX learned the diversification lesson a little too late when they found out that they could no longer access their digital assets.

This was because the company’s founder Gerald Cotton – the only one who knew the key to the company’s cold wallet password – died in India last December 2018. Beginners to crypto trading learned a hard lesson about what can happen if you keep your crypto stored on an exchange.

While diversification is good, overdoing it won’t help you achieve your investment goals. By spreading yourself too thin, you might miss out on investment opportunities and fail to take advantage of the spectacular performances of a few coins.

This could result in your digital asset portfolio only performing as well as the overall market.

Cryptocurrency Trading for Beginners: Research Is Still Necessary

With the prevalence of ICO scams during 2017 and even into 2018, crypto investors are now more cautious and seem to have learned their lessons.

But even in 2019, scammers are still around looking for easy prey.

These simple steps will help you get started with your research to ensure you are not investing in a scam or fraudulent project:

- Cryptocurrency traders should always research the team. If a team member has a questionable past, investing is probably a bad idea.

- Google the name of the coin plus the word “scam.” Are there reports of fraud? If so, steer clear.

- Is the asset available on established and regulated exchanges, or only small shady exchanges with low volume? If so, it’s probably a safer bet than other assets and probably a better option for crypto trading beginners.

- Is the coin’s GitHub open source and updated regularly? There should be active development.

- Is the team available to answer questions? An organization which is unwilling to communicate with its community is usually a red flag, and beginner traders should watch out.

Of course, one way of steering clear from these predators is for investors to opt-out of the ICO niche and stick to trading in more popular cryptocurrencies.

While their prices may still be volatile at times, you can be more assured that the tried-and-tested, large market capitalization coins such as BTC won’t close up shop soon. Bitcoin traders will always be safer, relatively, than those investing in small-cap coins.

But for those who want to brave the ICO waters and take advantage of potentially undervalued new tokens, research is still a must. Always do this before deciding whether a coin is a good investment opportunity. Remember to read whitepapers thoroughly, you can usually find them in PDF format available for download.

Short Term Crypto Trading? Give Social Trading a Try

With the hundreds of cryptocurrencies available for trading, the hard part is in picking which coins to invest in. This is especially problematic for those who don’t have time to keep track of all that’s happening in the market.

This is where social trading platforms such as eToro come in. Users can track which tokens the site’s top investors are picking up and use their decisions as a guide.

Users can even pair their portfolio to that of a professional investor, and the site automatically does the investing for them by mimicking the moves of the professional.

Trade Cryptocurrency With a Trading-only Email

Data breaches will always remain a threat to cryptocurrency investors. Forbes offers a surprisingly easy way to mitigate this risk, and that is to open a separate email account for one’s trading activities.

Why might you wish to do this? If a hacker can force entry to your email account and it’s the only one you use for all your exchanges, there’s a high chance they will be able to access all of your exchange accounts.

Don’t Forget Two-Factor Authentication (2FA)

This trading-only email account must have two-factor authentication in place for that extra layer of security.

In addition, investors should choose a username and password that does not contain any hint that could give hackers a lead on who the email address belongs to.

Beginner Cryptocurrency Traders – Limit Using Mobile Wallets

Forbes also says that extra caution must be exercised when using mobile phones for crypto trading. According to their experts, smartphones are more prone to physical or electronic tampering and it’s not advisable to use them for trading or storing large amounts of cryptocurrencies.

Despite the ups and downs of the crypto market, the fact remains that people are going to trade in these digital coins more than ever this year.

Cryptocurrency Investors Plan to Increase Their Holdings

A recent cryptocurrency and blockchain survey by SharesPost found that 72 percent of crypto investors plan on buying more tokens this year to boost their digital holdings.

Hopefully, these tips will be useful to these new investors in achieving their goals for 2019.

References

- Benefits of cryptocurrency trading – Why trading crypto has become a popular alternative to investing

- Cryptocurrency day trading – Guide and tips on day trading crypto

- Buying vs trading cryptocurrency – The Telegraph’s take on buying vs trading crypto

- Introduction to cryptocurrency trading – Kraken’s intro to crypto trading

- Avoid scams – How to avoid cryptocurrency scams

![A Beginner’s Guide to Monero – What Is XMR? [Updated 2023]](https://cd.blokt.com/wp-content/uploads/2019/04/Beginners-guide-to-Monero-2-218x150.png)

![Best 5 Bitcoin Sports Betting Sites [2023] (Analyzed & Approved) Best Bitcoin Betting Sites](https://cd.blokt.com/wp-content/uploads/2020/05/best-bitcoin-betting-sites-218x150.png)