Introduction

Deribit is a cryptocurrency futures and options exchange platform, which allows cryptocurrency traders to trade with up to 100x leverage. Deribit went live in June 2016 and is a European based exchange with headquarters in Amsterdam, the Netherlands. Although recently they have moved themselves to Panama.

Started by John Jansen, now CEO, the Deribit exchange was in production for several years before its release, and boasts multiple transactions per second with super low latency (<1 ms), a speed which Deribit maintain is the fastest in the industry.

Since its launch, Deribit has become one of the best crypto exchanges for futures trading and the leader in crypto options worldwide.

One of the most attractive features of Deribit is that in addition to fixed expiration futures, Deribit offers perpetual swap contracts. Unlike traditional futures contracts which expire and go to settlement, sometimes catching out inexperienced traders, Deribit’s option to use perpetual swaps means contracts never expire.

So, what other features does Deribit offer which set it apart from market leader BitMEX? Blokt finds out in this Deribit exchange review.

Exchange Overview

We’ll run through how to get started and some of the features of the Deribit exchange further down, but first, let’s look at Deribit’s available contracts, its trading fees, margin fees, and which jurisdictions it serves.

Available Contracts

The Deribit exchange does a great job of providing a range of options instruments for traders to use, which opens up opportunities for multiple different trading strategies for Deribit users.

And to date it still has the most widely traded bitcoin settled options in the industry, bigger than FTX, Binance or other players. If you are not familar how options work then check out their instruction article on it here.

However, in terms of markets, Deribit only features BTC and ETH at present. Ethereum contracts were added in April 2019, and in a recent roadmap announcement, Deribit states that adding new currency markets going forward is going to be more streamlined.

The contracts traders have access to, and their respective leverage, are:

- Bitcoin (BTC/USD) up to 100x leverage – perpetual swaps, futures, options

- Ethereum (ETH/USD) up to 50x leverage – perpetual swaps, futures, options

Compare this to BitMEX, which offers 8 available contracts, including Bitcoin, Ethereum, Cardano, EOS, Tron, Ripple and Litecoin, and Deribit’s available contracts do look somewhat limited.

However, it’s worth noting that the ETH options offered by Deribit are the first of their kind in the cryptocurrency market, being cash settled, European style options. Likewise, Deribit has committed to increasing the number of available cryptocurrency options on its platform throughout 2019.

Deposits on Deribit are only available through BTC, and there are currently no fiat payment options on the platform.

Minimum Trades & Fees

Deribit has a fee structure similar to other trading platforms, which operates around makers and takers fees. In this model, market ‘makers’ pay a significantly lower fee than those who take, i.e. sell, except on options contracts.

Minimum Trades & Fees – Source: Shutterstock.com

Likewise, Deribit imposes a larger fee on those positions which are liquidated, which occurs when traders no longer have enough margin left to maintain their open positions. Like the BitMEX trading platform, liquidation fees contribute to the Deribit ‘insurance fund’.

The full range of fees on Deribit are:

| Futures Contracts | Perpetual Futures Contracts | Options Contracts | |

| Maker’s Fee | 0.02% | 0.025% | 0.04% |

| Taker’s Fee | 0.05% | 0.075% | 0.04% |

| Delivery Fee | 0.025% | 0.025% | 0.02% |

| Liquidation | 0.15% | 0.15% | 0.15% |

Deribit doesn’t charge users for depositing to the exchange, and BTC deposits are credited after just 1 confirmation on the blockchain, allowing for quick trading.

However, withdrawals do carry a fee equal to the BTC mining fee at the time, and likewise, Deribit cannot process large withdrawals instantly, as for security reasons it only keeps a portion of its funds in a hot wallet, replenished daily.

Served Jurisdictions

Deribit users can sign up from any jurisdiction which supports futures and options trading, but Deribit does not serve customers from the United States or Canada and blocks IP’s from these countries.

Trading on the Deribit Platform

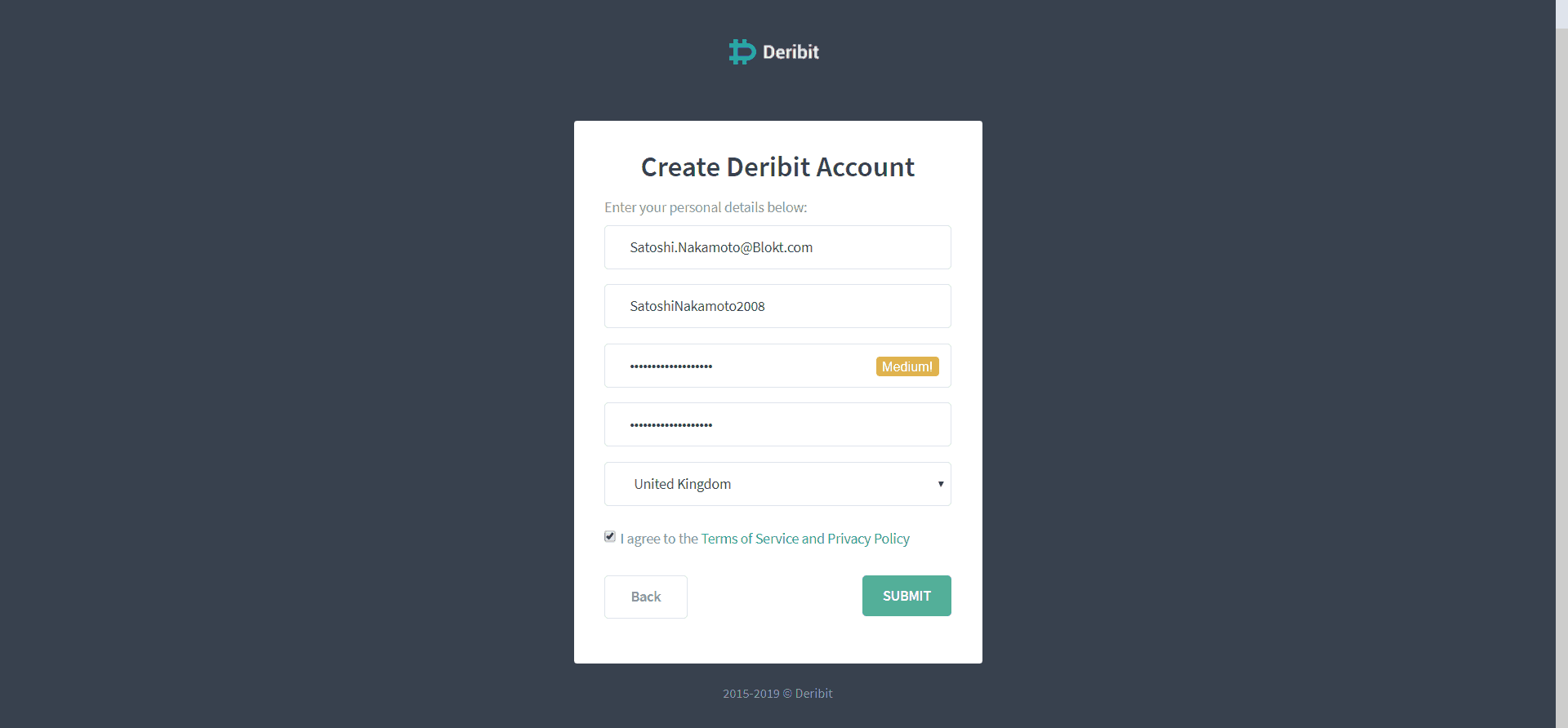

Deribit Signup

Like other futures trading platforms, signing up to Deribit is easy and quick, and just requires users to provide their email address and password, as well as confirming their jurisdiction.

Once users have confirmed their email, they can deposit funds into their account, enable two-factor authentication to protect their account, and start trading.

There are no KYC or AML reporting requirements on the Deribit platform, nor are users required to provide identification to withdraw funds.

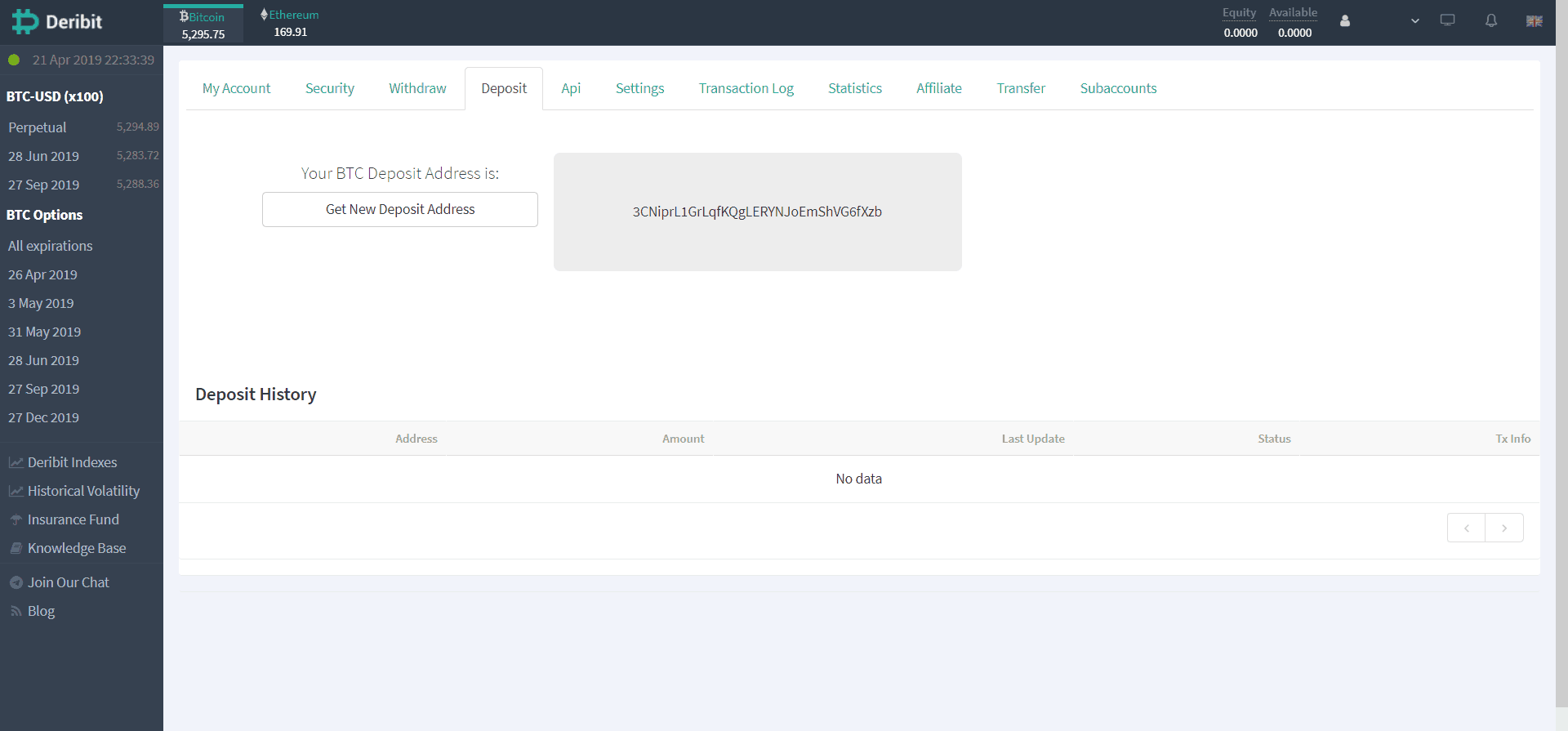

Depositing Funds

When users first make a deposit into their accounts, they will choose the dropdown box in the top right corner next to their username, and select ‘deposit’.

Deribit will then generate a unique Bitcoin deposit address, which users can copy and use to send funds. A new address can be generated each day.

Users could credit their account from any popular BTC wallet, or an integrated exchange account such as Coinbase. Deribit also gives a short introduction on how to buy Bitcoin via its FAQ.

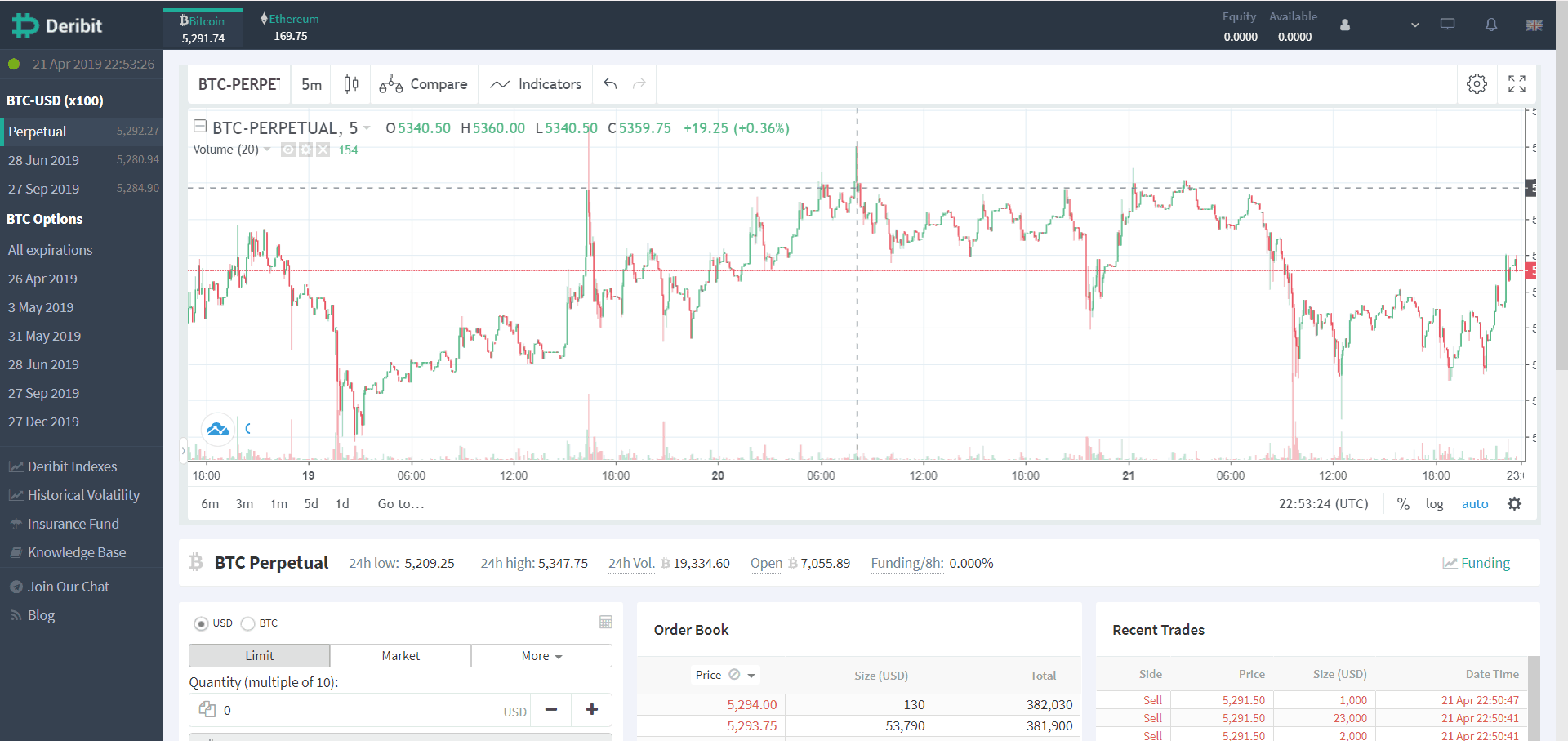

Deribit Trading Interface

Deribit’s exchange interface will be familiar to most traders, as, like many other exchanges, the charts are pulled from TradingView. This gives a generally good, if not simplistic trading experience.

Traders can set intervals from 1 day to 1 minute but doesn’t offer trading intervals on individual price ticks.

Deribit charts allow traders to apply a large range of indicators including Bollinger bands, RSI, and a range of moving average (MA) analysis.

Likewise, traders can select several different charts including Heikin Ashi candles, standard candles, hollow candles, bars, or area graphs.

The Deribit interface is spread out down the page, however, and users have to scroll down to place buys and sells, view the order book, and recent trades.

This can detract from the trading experience for those who like to trade tight time intervals and need to keep a close eye on the charts; currently, there’s no way to change the layout. Traders can also choose between light and dark themes.

Support and Security

Although Deribit doesn’t have a live chat option on its interface, it does have a dedicated support email which users can contact. Additionally, Deribit has an extensive F.A.Q which users can refer to.

Security wise, Deribit stores over 99% of customers BTC funds in cold storage. This means that at any given time, there is only 1% of Deribit’s total BTC holdings, and therefore users holdings, in a hot wallet for daily exchange operations.

This not only reduces the number of funds which could be stolen during a security breach, but it also limits the likelihood of hackers targeting the platform – so far, Deribit hasn’t experienced a single exchange hack.

Similarly, users can protect their accounts with 2FA, and also ‘IP pinning’, which locks accounts to a single IP address and prevents unauthorized sign-ins from unknown devices or locations.

Conclusion

So, should traders try out the Deribit exchange? Overall, as one of the top three crypto futures exchanges, Deribit offers seamless functionality and a rich user experience, with an easy trading UI and a very fast signup process.

Deposits are only available in BTC, although Deribit does say on its F.A.Q that it might announce fiat deposits in the future.

However, trading pairs on Deribit are limited, with just two supported contracts for BTC and ETH. Despite this, Deribit does offer the largest number of options instruments to accommodate multiple trading strategies and has hinted that contracts for more assets will be added in the future.

Deribit is also the first platform to offer cash-settled European style options for cryptographic instruments.

Overall, Deribit is a safe and secure exchange for traders and has become one of the most trusted derivatives exchanges in the cryptocurrency industry.

Disclosure: Blokt strives to provide transparent, honest reviews, and opinions. The writer of this article is a user of the product(s) or service(s) mentioned in this article and was not influenced by the respective owners.

We rarely run ads, but sometimes earn a small commission when you purchase a product or service via a link on our site. Thank you kindly for your support.

Read more or donate here.

![A Beginner’s Guide to Monero – What Is XMR? [Updated 2023]](https://cd.blokt.com/wp-content/uploads/2019/04/Beginners-guide-to-Monero-2-218x150.png)

![Best 5 Bitcoin Sports Betting Sites [2023] (Analyzed & Approved) Best Bitcoin Betting Sites](https://cd.blokt.com/wp-content/uploads/2020/05/best-bitcoin-betting-sites-218x150.png)