WCX is a Bitcoin derivatives trading platform, established in 2017 by experienced co-founders Amatsu Soyonobu, and Tagawa Hayashida, who hold extensive software development and financial services experience.

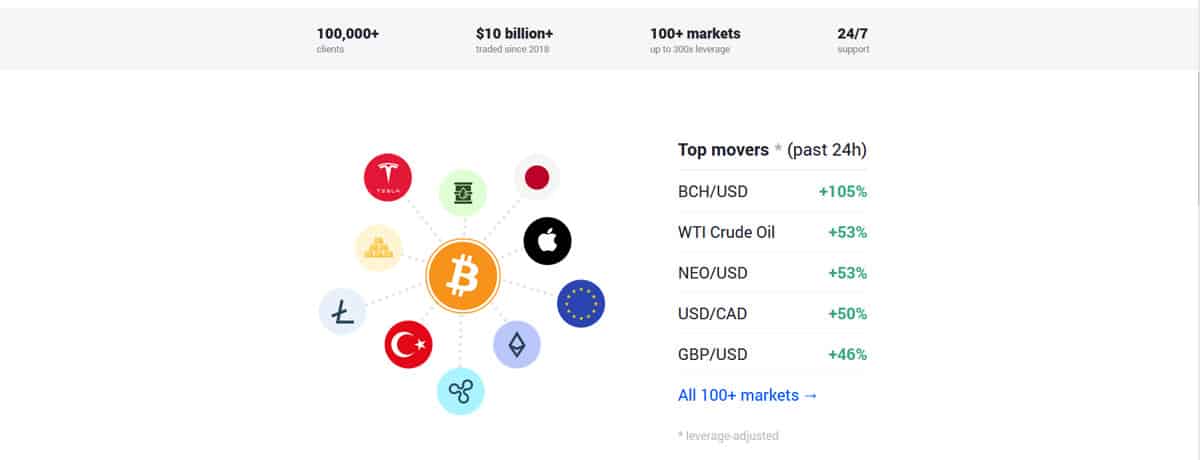

With a vision of offering a fast and secure exchange platform for Bitcoin-funded derivatives, WCX has grown into one of the most trusted and popular platforms in the industry, serving over 100,000 clients, trading in excess of US$10 billion since 2018, and providing access to a huge 100+ markets with up to 300x leverage.

Providing traders with the option to go long or short on a huge variety of assets, especially cryptocurrencies, WCX offers greater trading opportunities than could be realized through average, non-margin trading platforms.

Registration and Jurisdictions

It’s easy to get registered on WCX as users only need to provide an email and password, however all users are required to pass KYC verification to begin trading on WCX.

This is in contrast to a great deal of other Bitcoin derivatives platforms which don’t require KYC, although this does put WCX on much clearer regulatory footing, and also provides greater assurance to their customers that they are serious about compliance.

Users will need to supply a government-issued ID, a proof of residence and a selfie with a handwritten note to become fully KYC verified.

Whilst USA residents cannot currently use WCX, a wide range of other jurisdictions are supported, including all of Europe and most Asian countries. European residents are restricted to trading with up to 30x leverage, to preemptively comply with measures set by The European Securities and Markets Authority (ESMA).

This shows that WCX is building with future regulations in mind, to become a leading regulated exchange in the future.

Supported Assets

WCX has a huge range of assets available, including cryptocurrencies, traditional stocks, and foreign exchange (forex) markets. All trades are settled in BTC.

Users may trade a number of popular crypto’s with both BTC and fiat pairings, including:

There are also many other cryptocurrency pairs to trade. Similarly, traders may trade popular stocks such as Tesla, Apple, and Netflix; Forex pairings such as USD/JPY or AUD/USD; commodities such as gold, oil or silver; and indices such as the FTSE 100 and Nikkei 225.

Deposits and Withdrawals

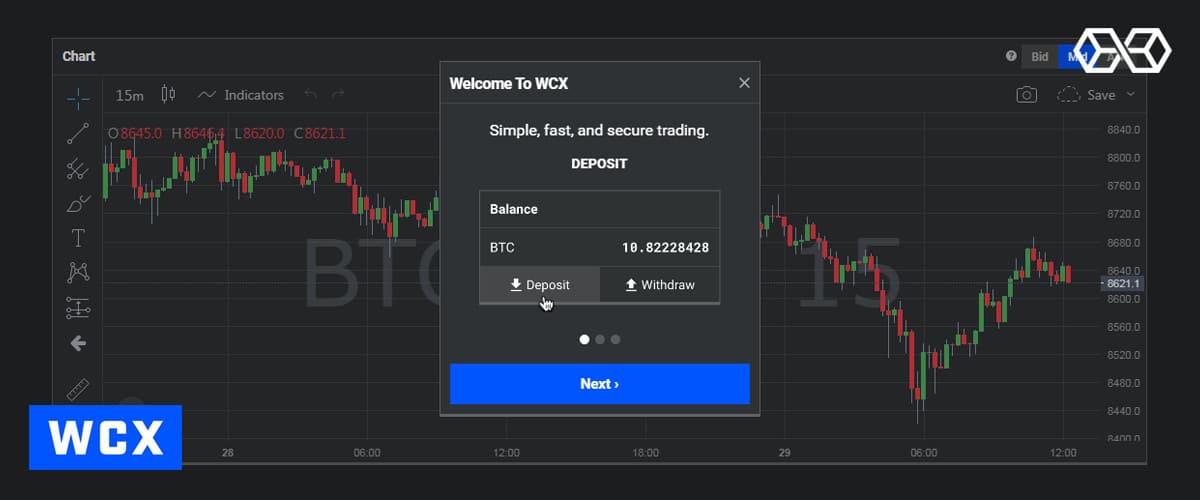

As a Bitcoin-funded derivatives trading platform, and not a crypto-to-crypto, fiat-to-crypto or other asset exchange, both deposits and withdrawals are settled in Bitcoin on WCX.

To deposit, registered and verified users can navigate to the left of the trading interface, and click the ‘deposit’ button. WCX will then generate a Bitcoin deposit address where traders can send funds to credit their account. There will be a fee for deposits from the Bitcoin network, but WCX itself does not charge a fee for deposits.

Depending on the speed of the Bitcoin network, funds should be quickly available in users accounts ready to begin trading, and the balance will show above the deposit button in the trading interface.

Withdrawals are similarly easy, following virtually the same process as deposits but in reverse. There are also no fees on withdrawals.

Trading Interface

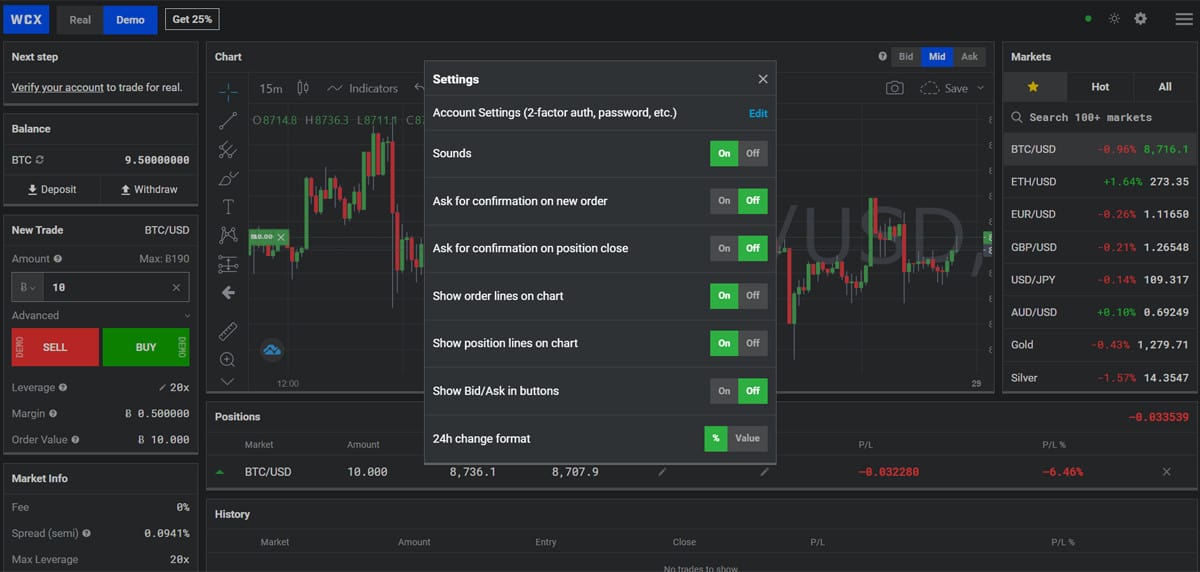

WCX has a minimalistic and easy to use trading interface, which makes trading and tracking open positions simple and intuitive. Users can choose between light and dark themes, and modify their personal settings for a highly customizable trading experience.

The exchange uses charts from popular charting provider TradingView, offering a unified experience that many users will be instantly familiar with. Alongside TradingView charts, traders can set a huge range of indicators, such as RSI, volume, EMA and more. Likewise, users can choose between 7 different charting types, including bars, candles, Heikin Ashi and more.

Fees and Liquidation Limits

There are no fees for trading on WCX. Whilst this might at first seem odd, as virtually every existing exchange charges fees, WCX instead makes money on the spread between the bid and ask when opening trades. This vastly reduces expenses from fees for regular and high volume traders.

Likewise, WCX is the first exchange in the world to publish price sources and spread calculations, in an effort to eliminate conflict of interest with customers.

Positions are liquidated when they are trading at a loss of 80%, but the liquidation price is calculated and reported ahead of a trade being placed. Liquidated positions lose 100% of their margin.

Instead of funding or overnight premiums which are added by some exchanges on leveraged positions, WCX use ‘Decay’. Decay is applied to positions every 8 hours, and subtracted from profit/loss and added to the liquidity pool.

Security and Support

WCX has never been compromised, nor has any customer had their funds or account compromised on the exchange.

WCX deploy the following methods to keep their security high:

- Fund security – Over 98% of customers funds are held in cold storage, with only 2% of funds kept in hot wallets at any one time. Hot wallets are also protected by industry-leading security and insured against losses.

- WCX server security – WCX’s network is segregated and firewalled, with strict access controls. Likewise, WCX servers run the latest security software and DDoS attack protection. WCX has an aggressive approach to backing up data and encrypting existing data stores.

- Client security – 2FA is provided for all customers if they wish. Network traffic is encrypted using High Assurance SSL, and brute-force prevention is implemented through CAPTCHA and rate throttling systems.

In addition to these extensive security measures, WCX also ensures that its staff is vetted and background checked. All these security measures make WCX one of the most trusted and safe trading platforms in the cryptocurrency industry.

Support is available 24/7, either via a dedicated live chat service, ticketed support, or for general queries, it has a huge and comprehensive F.A.Q database. Users can check the status of the exchange via the WCX Status portal.

Accessibility

WCX caters to all levels of ability. Whilst derivatives platforms are usually aimed towards more experienced traders, the WCX platform also offers a full-featured demo mode, where users can ‘trade’ on real-time markets with up to 10 BTC in demo funds. This allows new users to get a feel for the exchange before they commit funds to live trading.

Additionally, WCX has a large tutorial section, where its experts explain the concepts of leverage and margin trading, liquidations, spreads, and how to enter and close positions. This enhances the trading experience and greatly improves accessibility for a wide range of trading abilities.

Conclusion

WCX is an intuitive and feature-rich trading platform for traders of all skill and experience levels. Its comprehensive tutorials, alongside a full-featured demo mode, make getting started on WCX simple and quick, even for those unfamiliar with Bitcoin-based derivatives.

Registration on WCX, including verification, is a fast process. WCX’s commitment to KYC and fulfilling its reporting requirements is a testament to the way it operates, with full transparency, trustworthiness, and planning ahead for a clearer regulatory landscape in the future for crypto.

Security-wise, WCX has never experienced a breach, and its commitment to security, alongside the technology it implements to protect infrastructure and funds, is industry-leading. Likewise, users can easily find support via multiple channels, with fast response times and attentive customer service representatives.

Overall, WCX is one of the most attractive Bitcoin-based derivatives platforms, allowing traders to vastly increase their exposure to assets using generous 300x leverage, among the highest in the industry, and increasing trader’s potential to realize serious gains.

References

- WCX FAQ

- WCX Reviews

- WCX ID verification process

- How does Bitcoin work?

- What is Cryptocurrency?

- What is Relative Strength Index?

- How does the liquidity pool work?

Disclosure: Blokt strives to provide transparent, honest reviews, and opinions. The writer of this article is a user of the product(s) or service(s) mentioned in this article and was not influenced by the respective owners.

We rarely run ads, but sometimes earn a small commission when you purchase a product or service via a link on our site. Thank you kindly for your support.

Read more or donate here.

![A Beginner’s Guide to Monero – What Is XMR? [Updated 2023]](https://cd.blokt.com/wp-content/uploads/2019/04/Beginners-guide-to-Monero-2-218x150.png)

![Best 5 Bitcoin Sports Betting Sites [2023] (Analyzed & Approved) Best Bitcoin Betting Sites](https://cd.blokt.com/wp-content/uploads/2020/05/best-bitcoin-betting-sites-218x150.png)