What is Red Pulse?

Across the globe, market data and financial research information has never been more available or more valuable. According to Red Pulse’s website, the entire research content industry is dysfunctional, monopolized by a small group of “key players” in content production and distribution.

Red Pulse argues that in spite of the sheer amount of information that is available, having access to accurate, transparently-sourced data is an ongoing struggle. Smaller researchers who may have more reliable insight (i.e. former employees, professional investors, and industry experts) are essentially priced out of the market.

Over the last two decades, China has “leapfrogged” to its current status as “one of the most mobile- and internet-connected societies in the world.” As a result, China is particularly afflicted by the problems that come with an overabundance of information; Red Pulse writes about a frustratingly regular occurrence in the country:

“China market pundits and reputable news sources [report] on a market rumor in the morning, only to have it be denied in the afternoon.”

Red Pulse is attempting to make analysts’ lives easier and to provide companies and the general public with more accurate information using a blockchain-based platform that “simplifies incentives and directly compensates research producers for their valuable insights.”

At the same time, Red Pulse’s platform will ensure that “research consumers can access the research that is most relevant to them.”

How Red Pulse Will Work

The Red Pulse platform will be powered by its native token, RPX. Researchers contribute information to RPX’s platform; Red Pulse’s editorial team will vet the information and the source, and then approved information will be added to the Red Pulse data marketplace. Content consumers can then purchase data directly from the content creators using RPX tokens.

The Red Pulse platform will also make use of a credibility scoring system that will rate contributors based on the accuracy of the content they provide. Users with higher credibility scores will earn more RPX tokens for their contributions.

RPX holders will also have a stake in influencing credibility scores and curating content. Users who hold more RPX tokens have more “sway” in upvoting or downvoting content based on accuracy.

History of Red Pulse

Red Pulse was founded as a non-blockchain based financial research firm in 2015. Between then and now, Red Pulse has developed a large community of interested consumers–there are more than 50,000 subscribers to Red Pulse’s China markets newsletter; Red Pulse also claims that it works with “50 institutional clients including global asset managers and top investment banks.”

Additionally, Red Pulse has “formed partnerships and integration” with Thompson Reuters, Bloomberg, S&P Capital IQ, and FactSet.

Who’s Behind Red Pulse?

Red Pulse was founded by three men who have more than 43 years of financial industry experience between them. Principle founder and CEO Jonathan Ha has worked as a management consultant for AMS, IBM, and EMC; Co-founder and Head of Data Science Stanley Chao has “eleven years of experience in investment management and financial services.” Co-founder and Non-executive Chairman Peter Alexander is the founder of Z-Ben, a Shanghai-based consulting firm.

In addition to the founders, Red Pulse has a team of eight advisors (https://coin.red-pulse.com/#team), including Hongfei Da, founder of NEO, and TF Cheng, Managing Director at BNP Paribas Asset Management.

FinTech Innovation Lab, Onchain, NEO, Z-Ben Advisors, #Hashed, and Kenetic Capital back the Red Pulse coin.

The Red Pulse ICO

The Red Pulse ICO took place on October 8, 2017, and was able to reach its very reasonable fundraising goal of US$15 million and close on the same day. The sale was not open to citizens of the United States, Mainland China (because of China’s ICO ban), or Singapore.

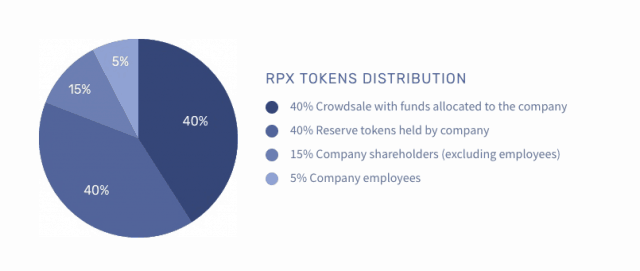

There is a total supply of 1,358,371,250 RPX tokens; 543,348,500 RPX are currently in circulation. Coins have been distributed according to this chart:

The 5% of RPX reserved for employee distribution have a vesting period of 12 months from the date of the ICO. 25% of each employee’s allotment of RPX will be distributed every quarter; the amount each employee will receive is correlated to that employee’s tenure in the company.

RPX tokens were sold at a rate of 1000 RPX for 1 NEO (the only token that was accepted during the sale). 40% of the funds raised during the sale were put towards platform development; 20% went toward the research and editorial staff; 20% to marketing and sales travel expenses; the rest was distributed evenly between operational costs and legal/accounting expenses.

Red Pulse tokens can be stored in NEO’s native wallet, Neon.

The popular NEO wallet Neon has updated to 0.0.8 and supports our token. You can now store and withdraw your RPX tokens on the Ledger Nano S.

Do note NEO is decentralizing and to reward commercial master nodes asks GAS to transfer.https://t.co/OsuGcqJDjV

— Red Pulse (@red_pulse_china) January 4, 2018

Red Pulse as an Investment: The Future of Red Pulse

Red Pulse has a few good things going for it. The platform is addressing a genuine need for transparency and accuracy in the Chinese information market; the fact that the company has existed as a successful entity with an active community and a solid customer base since 2015 is also a positive indication for the coin’s future.

At the time of press, Red Pulse is rated as the 116th cryptocurrency in the world concerning market cap. A single RPX token is worth roughly $0.41, having enjoyed a bullish run since its public release at the end of October.

This is especially notable when you take into account the fact that Red Pulse is only listed on two exchanges–Kucoin and TDAX. Red Pulse’s circulation and token value have undoubtedly taken a hit from the unfortunate timing of the ICO, which took place after China’s sudden decision to ban ICOs within the country.

Red Pulse appears to be doing well so far, but to become a genuinely successful cryptocurrency, it can be argued that the company will need to expand its operations outside of China. The Chinese government has developed a track record of acting rashly when it comes to cryptocurrency; unfortunately, Red Pulse’s stability hangs in the balance because of this.

The Red Pulse company has a detailed roadmap leading up to the scheduled release of the blockchain in Q4 of 2018. Until then, we can only hope that the legal circumstances change in the company’s favor–or at least allow it to survive.

What do you think about the future of Red Pulse? Will the company find a way to thrive in spite of the dicey political situation regarding blockchain-based companies and ICOs? Please leave your thoughts in the comments–we would love to hear your insight.