A recent paper by Boston College researchers on ICO returns concluded that the average ICO investor earned 82% returns, with significant evidence of ICO underpricing.

Hugo Benedetti and Leonard Kostovetsky wrote the paper titled “Digital Tulips? Returns to Investors in Initial Coin Offerings” and dated May 20, 2018. Benedetti is a former Fulbright Scholar and a current finance Ph.D. candidate at the university’s prestigious Carroll School of Management. Kostovetsky, who holds an economics Ph.D. from Princeton, is an Assistant Professor of Finance at the school.

The paper studied a dataset of 4,003 executed and planned ICOs taken from five ICO aggregator websites: icodata.io, icobench.com, icorating.com, icodrops.com, & ico-check.com. However, since only 2,390 ICOs were completed before April 30, 2018, this was the main sample set that the researchers studied.

ICO Investors Earn a 179% Average Return and an 82% Abnormal Return

The paper found that ICO investors earned an average return of 179%, with an average holding period of 16 days. The holding period refers to the time between the end of the ICO to the token being listed on an exchange. This 179% return already takes into account the large negative returns (-100%) from tokens that are not listed within 60 days.

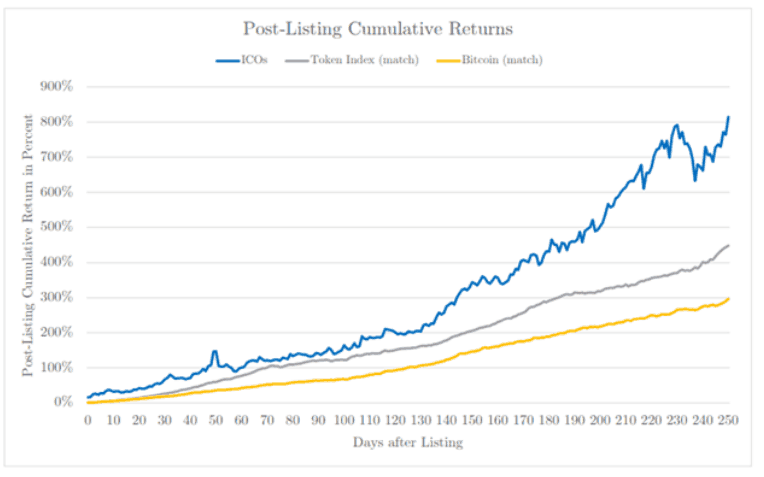

The 82% figure refers to “abnormal returns,” which are returns earned above that of the asset class; in this case, cryptocurrencies. The graph below shows ICO outperformance when compared to both Bitcoin and a weighted index of all tokens.

Interestingly, ICOs continue to outperform regardless of how the overall cryptocurrency market is doing. The paper noted that ICO returns are “positive and significant” whether or not the overall market is up or down.

The paper also found that, at least for the moment, investing in ICOs might be a better deal compared to traditional IPOs. The researchers state that:

“In contrast to IPOs, crypto-tokens continue to generate abnormal positive average returns after the ICO… ICO investors are receiving extraordinary compensation for providing capital to an unproven firm and product through unregulated means.”

The paper also found some evidence of “significant underpricing.” However, when it comes to ICOs, the researchers noted that this is not surprising given the lack of expertise of most founders and the higher degree of uncertainty involved. Also, unlike IPOs, the age of the company does not correlate to underpricing.

Nevertheless, the researchers discovered that returns to ICO investors have declined over time, which suggests that platforms are learning and underpricing is reduced. The increased popularity of presales also reduces underpricing.

ICOs Are Still Risky, With a 44% Survival Rate

Commensurate with such high returns is a high degree of risk, and this is reflected in the ICO survival rate. The researchers found that, after 120 days, only 44.2% of ICOs were still active based on official Twitter activity. This can be broken down into, 1) a 17% survival rate for ICO that do not list and do not report capital; 2) a 48% survival rate for ICOs that raise some capital but don’t list and; 3) an 84% survival rate for those that raise capital and list.

As the researchers put it:

“This is consistent with the tight relationship between risk and return that we would expect in markets with rational agents.”

However, considering that the higher risk is more than compensated for with abnormal returns, the researchers concluded with what appears to be a parting shot to financial regulators, saying that:

“It flies in the face of many regulators and governments who view token sales as scams that take advantage of unsophisticated investors, and thus must be restricted to sophisticated investors or even banned.”