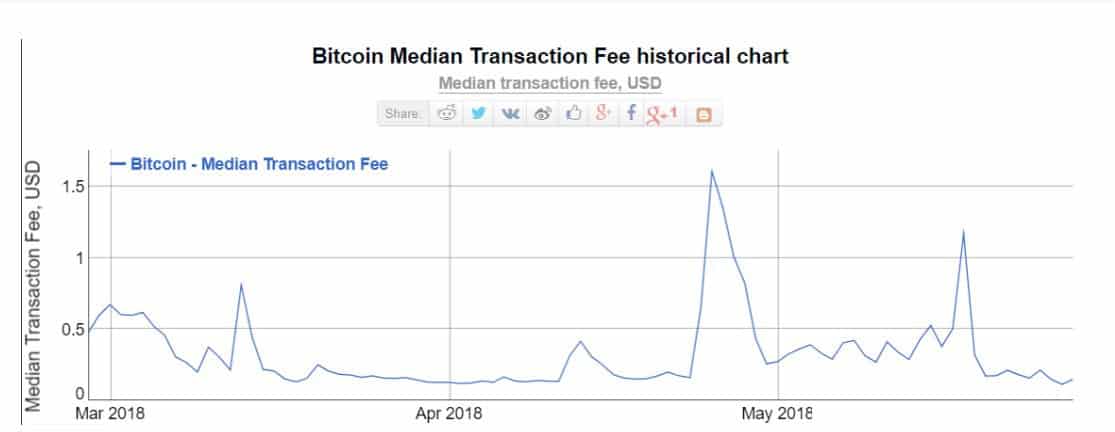

Bitcoin’s median transaction fees have reached significant lows in the last few months. In December 2017, transaction fees were over $30, but they’ve fallen to less than 20 cents per transaction in May 2018.

BitInfoCharts suggested that Bitcoin’s median fee hit a very low point, falling to 0.113 as a median transaction fee on May 27. Bitcoin transactions were consistently low throughout April 2018. It was only until the beginning of May 2018 when there was a small spike, but it quickly fell as the month progressed.

Potential Reasons As to Why Transaction Fees Have Fallen

These low levels are a result of a variety of factors in the cryptocurrency market. Records suggest that there has been a decline in transactions from almost 400,000 transactions per day in December 2017 to approximately 200,000 transactions in May 2018. Some believe that it is a result of Segregated Witness (SegWit), which is a feature designed to help Bitcoin scale and a process called batching.

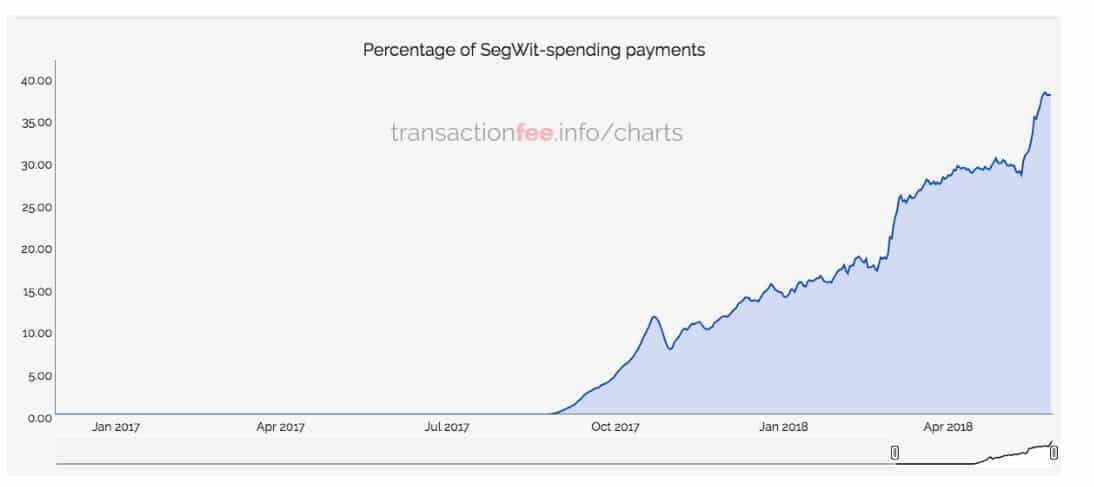

SegWit adds extra space to the blockchain, reduces transaction fees, and is growing very quickly. However, a TransactionFee.info chart suggested that less than 40 percent of the Bitcoin community use it.

SegWit may assist with the reduction in fees, however, batching may be another contributing factor. Batching results in fewer transactions as many trades are bundled together as one. Hence, why the number of transactions may not always be the most accurate measure of the network’s popularity.

Bitcoin Vs. Bitcoin Cash Transaction Fees

Bitcoin Cash, which is a fork of the original Bitcoin, was created as a result of the concern for Bitcoin’s extremely high fees and lack of scalability in 2017. Bitcoin Cash was, therefore, designed to be like Bitcoin. However, it would function better as a digital medium exchange with lower fees and faster transaction times.

Bitcoin’s fees have fallen lower than Bitcoin Cash in a few instances with SegWit, batching, and potentially a variety of other factors.

On closer inspection, Bitcoin Cash appears to hold lower transaction fees for the majority of the time. Although Bitcoin Cash, generally, has lower fees and faster transaction times, many in the cryptocurrency community refuse to support Bitcoin Cash because of its internal team and Roger Ver, who is one of the primary supporters of the token. Roger Ver, also known as Bitcoin Jesus, has caused quite a stir in the cryptocurrency community.

While the technology behind Bitcoin Cash is admirable, Ver’s tactics to boost the coin’s popularity has frustrated the online community. Ever since the Bitcoin fork, Ver has been accused of purposely creating brand confusion by calling Bitcoin Cash as Bitcoin and calling Bitcoin as Bitcoin Core. Some also claim that he centrally controls the Bitcoin Cash coin.

Cryptocurrency technologist and entrepreneur Erik Voorhees even took to Twitter to even state:

“Roger – please stop referencing me to back up your opinion that Bitcoin Cash is Bitcoin. It isn’t. Bitcoin is the chain originating from the genesis block with the highest accumulated proof of work. The Bitcoin Cash fork failed to gain majority, thus it is not Bitcoin.”