Popular crypto aggregator site CoinGecko has recently released its Q3 cryptocurrency report, and it highlights some interesting trends in the crypto market. Here are a few of the standout items.

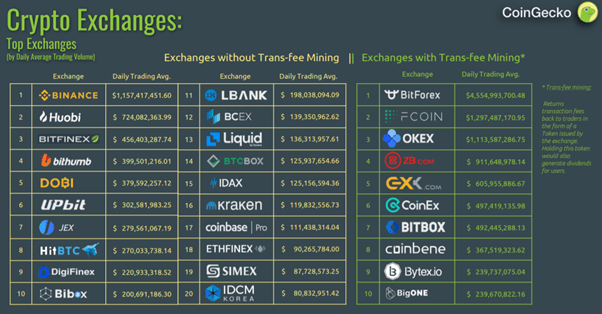

The Sudden Rise of Trans-Fee Mining Exchanges

If you’re not a frequent trader, you might have missed the rise of trans-fee mining exchanges such as Bitforex and Fcoin, which have shot to the top of the trading volume charts after implementing this model.

Here’s a brief summary: when you trade on one of these exchanges, you pay the usual trading fee in BTC or ETH. However, the exchange then reimburses you 100% or more of said trading fee in the form of their own native token.

This incentive model has caused a massive spike in trading volumes on such exchanges. The top two exchanges with these models, Bitforex and Fcoin have quickly surpassed the previous highest volume exchange, Binance, with the former having about 400% the trading volume of Binance.

Trans-fee mining has been quite a controversial practice with many speculating that the high trading volumes to be attributed at least partly to wash trading, meaning inflated trade volumes using bots to reap those incentives. Another criticism is that since traders pay the fees first in BTC or ETH and then receive it back in the form of the native token, this is in essence no different from an ICO,

As the co-founder of CoinGecko, Bobby Ong says:

“Trans-fee mining encourages bad behaviour and renders the exchange’s volume data irrelevant. It incentivises wash trading where traders use bots to buy and sell among themselves to ‘mine’ these tokens. It is an ICO in disguise which should really be conducted in its token sale form or via an airdrop.”

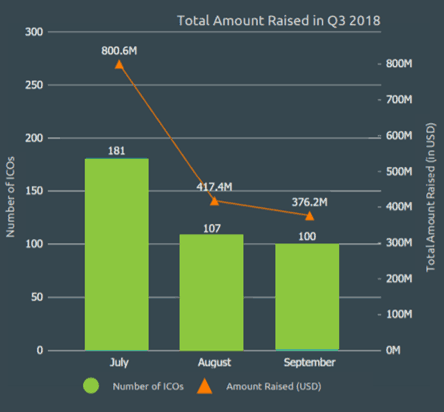

The ICO Market: Fading or Maturing?

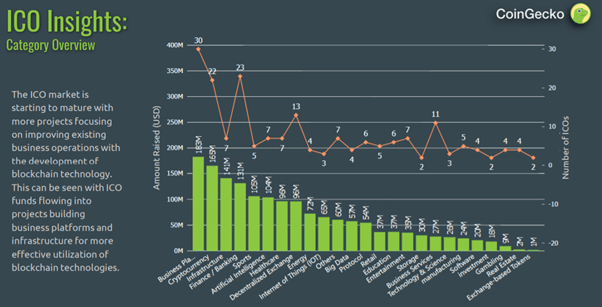

Speaking of ICOs, the report confirms what most people in the crypto world already know; that ICOs have been on the decline. By number, the total dropped from 606 ICOs raising $7.79 billion in Q2 to 388 ICOs raising $1.59 billion in Q3 – a massive decrease. Interestingly, on a month-to-month basis, within Q3 there was a big drop-off from July to August. This was the month where the value of ETH tanked, supposedly due to a large dump by ICOs.

However, the report also notes that although total quantum of ICOs is down, the market may be showing signs of maturity with a higher number of projects focused on business platforms and cryptocurrency infrastructure instead of the more spurious ones. If so, this could mean the ICO market is simply maturing, and it is unrealistic to expect the numbers we saw in ICO-crazy 2017.

Overall High Volatility, Increased Trading Volumes but Diminished Returns

Finally, looking at the crypto market from a more macro perspective, the report also highlights that despite the seemingly lower volatility over the past month, on a year-to-date basis, the crypto market has still been highly volatile and that the recent relative calm may not necessarily be an indication of the future.

Other interesting things highlighted in the report include the rise of masternodes and Non-Fungible Tokens, as well as various ranking tables which put aspects of the market into a new perspective.