As the Venezuelan people are plunged further into fiscal despair, the Maduro government is attempting to resuscitate the broken economy by pegging the petro, an “oil backed cryptocurrency,” to the bolivar.

While the credibility of the petro is in question, there is a growing movement within the Venezuelan community: Real cryptocurrency adoption. These digital currencies, such as Dash and Bitcoin, are beginning to make their ways into the everyday lives of struggling Venezuelans.

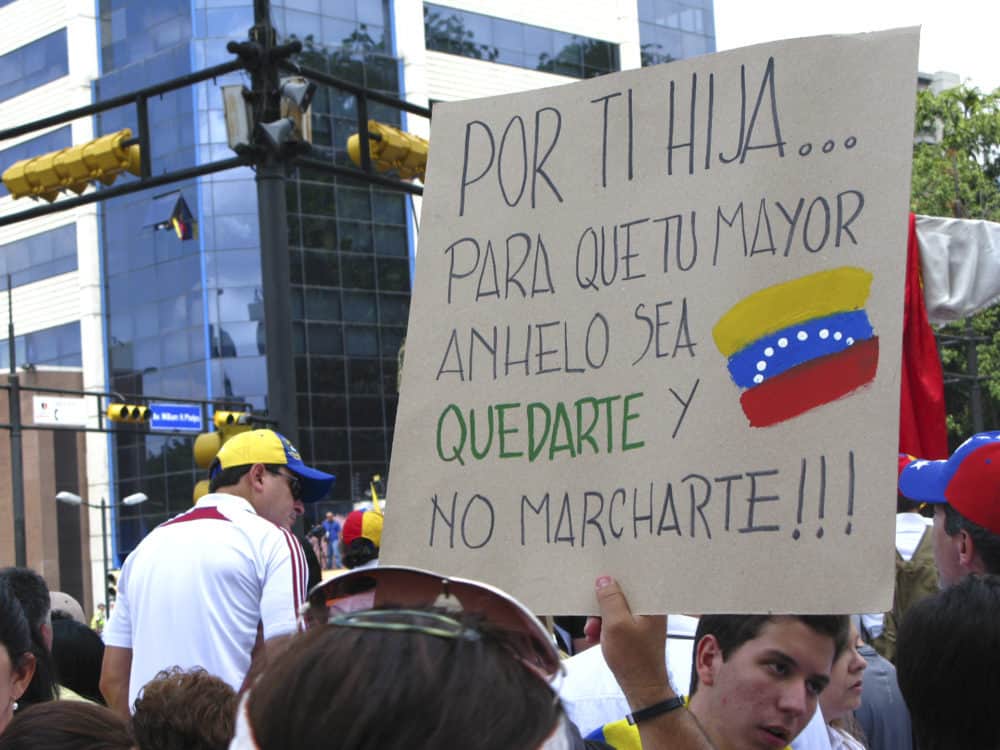

Venezuela is Shaken

The economy in Venezuela is in ruin. With hyper-inflation of more than one million percent, Venezuelans are fleeing their country in an attempt to find economical and humanitarian safety outside of the border. Many are hungry after the bolivar is collapsing so fast that the price of a cup of coffee doubles between weekly paychecks.

A once rich nation now ranks worst in the world, bar North Korea, in the economic freedom index for 2018. Mayer Mizrachi, CEO of Criptext, believes that we are yet to see the worst of the economic disaster in Venezuela. He told us:

“The economic despair of Venezuela will only get worse before it gets any better. So long as Maduro and his crew are in charge, the country will inevitably continue in the accelerated downward spiral that has taken place since he took office in 2013. The Petro is a cry for help, a mere scheme to bring money into the country without changing the government’s autocratic policies. The truth is, Venezuela’s problem is not one that crypto will solve. Crypto is seeking to improve the future of the world economy, and Venezuela is stuck in a system of the past that can be only resolved by human will. There’s no need for bits or bytes here – just plain sensible public policy.”

The Petro. Not a Solution

Nicolás Maduro, the president of Venezuela, announced the decision two weeks ago to “convert the petro into the reference that pegs the entire economy’s movements.” The petro, which was launched earlier in the year, was touted as an instrument created merely to circumvent economic sanctions.

Jonha Richman is a leading influencer in the blockchain space, and venture partner at JJRichman, a private investment firm specializing in investing in diversified assets around the globe, including cryptocurrencies. Speaking to [blokt], she said:

“The country is swimming in debt and Petro is its last attempt keep the country from turning into an utter financial chaos.”

Kyle Asman, partner and co-founder of the blockchain business advisory firm BX3 Capital told us that he believes “the Petro could significantly help the economy if the holders of the token had a right to the oil reserves backing it in the case of failure.” The issue is that this is probably not the case. Asman continued:

“Asset-backed currency always creates inherent value, but it is tough to trust that the Petro truly is being backed by oil. “

Some experts believe that this bold move from Maduro will end in complete failure. Albert Goldson, Executive Director of Indo-Brazilian Associates LLC, believes that a “yet to be globally officially accepted financial instrument” used as a tool to prevent economic collapse is ironic. Goldson believes that the new petro-pegged bolivar is “merely a tactic to buy some time because all other avenues of economic relief have been either cut-off or highly restricted.”

Goldson thinks that Venezuela’s revival rests on Maduro being out of the picture. He told [blokt]:

“Positive change is only possible if there’s aninternal military coup that removes Maduro followed by the establishment of a junta. The junta would then re-establish friendly ties with the US and its South American neighbors enabling them to seek and successfully receive IMF bailout assistance to prevent the worst economic and humanitarian crisis in the western hemisphere.”

Eiland Glover, Kowala CEO, said:

“The implementation of the Petro is a last-ditch attempt by Maduro’s regime to maintain control over the economy, and it will not succeed. Asset-backed cryptos already face trust problems, even when their assets exist within free market economies. An asset-backed crypto that operates within a nationalized economy, with no outside accountability, will never provide the trust needed to win over users.”

A Solution, For Now: Cryptocurrencies

The Venezuelan community has been running out of options. While cryptocurrencies, so far, are notoriously volatile – people in Venezuela are embracing them. Digital currencies such as Bitcoin, Dash, Litecoin and Bitcoin Cash are used as “stores of value” and transfer mediums by people and small businesses in Venezuela.

These digital currencies may, perhaps, seem like an unusual safe haven for capital, but compared to the inevitable and seemingly endless devaluation of the bolivar, the choice to move wealth into a digital format might not be so absurd.

Richman, who has been following the adoption of real cryptocurrencies in Venezuela told us:

“Failed by its government, Venezuelans are frustrated and are now turning to Bitcoin, DASH or even Litecoin to make ends meet and to purchase necessities as the very currency and institution that they’ve trusted has failed to meet their needs.”

Jeffrey Tucker is a Bitcoin Evangelist and the author of bitcoin treatise “Bit By Bit.” He also serves as the editorial director of libertarian think tank American Institute of Economic Research (AIER). He believes that cryptocurrency usage in Venezuela is here to stay. Tucker told [blokt]::

“Nothing will curb the use of crypto in Venezuela. It can’t and won’t be stopped. The miners are there and the consumers love it. It’s math. You can’t abolish math. You can try and you can beat people up but it won’t stop it.“

While various cryptocurrencies are gaining usage in Venezuela, one, in particular, has seen an enormous uptick in merchant sign-ups and wallet downloads: Dash.

Dash: Network-funded Local Initiatives Increase Adoption

There have been numerous reports and photos on social media of Dash being adopted by merchants and consumers across Venezuela. Dash’s merchant adoption in Venezuela is reported to exceed all other cryptocurrencies combined.

Google trends reveals that Venezuela is second only to the USA regarding searches for the keyword “Dash“:

We reached out to Ryan Taylor, CEO of Dash Core Group Inc. to discuss the current increase in adoption seen in the region.

Greg Adams: Have you noticed an increase in Dash adoption in Venezuela?

Ryan Taylor: We have noticed an increase in Dash adoption within Venezuela on both sides; more users acquiring and spending their Dash as well as more businesses accepting Dash as an alternative form of payment. While volatility in cryptocurrency prices is a disincentive to use cryptocurrency for people in most countries, in places like Venezuela, it’s the fiat that’s actually more volatile. This naturally leads to people looking for alternative options, such as Dash.

GA: Have you seen any statistics that confirm an uptick?

RT: We’ve seen a strong acceleration in Dash adoption. It started late last year where we saw Venezuela become our second largest market in web traffic to Dash.org. On the ground, adoption has increased exponentially: In April of this year, we had around 116 business accepting Dash In Venezuela. By early July, we hit 400. As of last week, we now have over 1,000 business accepting Dash, including both locally run and mainstream chains such as Subway and Calvin Klein. We attribute this to our strong community on the ground, initiatives funded by the network which have led to our Dash Merchants team acting as a direct sales force signing up businesses, and Dash Help Me, a help desk created to help users to engage and familiarise themselves in using Dash.

GA: Why are Venezuelans choosing Dash?

RT: There are a few variables that are leading to our adoption growth:

- Dash as a product; we simply offer a better way to pay and get paid. Our InstantSend feature, with Visa-like transaction confirmation speeds, enables commerce at the physical point of sale, unlike most cryptocurrencies.

- It’s a testament to the commitment and focus of our Dash community on the ground in Venezuela. Who, through network-funded initiatives, were able to set up their own dedicated merchant acquisition team to sign up new business to accept Dash, as well as the regular conferences that are held which offer an educational component for the beginner as well as the expert. Additionally, they’ve created a help desk dedicated to assisting new users in familiarising themselves in all aspects of Dash; from setting up the wallet and getting their first Dash, to the actual payment process and security requirements. We’re not doing airdrops like a lot of our competitors, rather we’re building out a functional ecosystem to directly address our users’ needs.

GA: I’ve read that you are partnering with Kripto Mobile. How could this help?

RT: With Dash becoming increasingly popular in Venezuela, the partnership with Kripto Mobile will provide a growing number of users with easy access to a universal and effective cryptocurrency with which many are already familiar. KRIP phones include, for all of Latin America, a paper wallet which will come with Dash already preloaded for users to scan and upload into their new Dash digital wallets. From there, users can use their phones to quickly and easily send or spend their Dash as they see fit, without exposing themselves to the impacts of hyperinflation, the need to physically visit bank branches, the security risks of carrying large amounts of cash, or the fees associated with fiat payments.

GA: Going forward, do you have any prediction on the outcome of the economic situation in Venezuela?

RT: Economists are predicting that inflation in Venezuela could reach 1 million percent before the end of this year. We certainly hope that the situation improves for the people of Venezuela, but as it’s also a core part of our strategy, we look to play a role in its recovery.

Opportunity: Could Cryptocurrencies Gain Permanent Adoption As Transfer Mediums and Stores of Value?

The suffering that everyday people in Venezuela have to endure through a crisis such as this is saddening. But what if a positive could come of it? Mugabe’s Zimbabwean government adopted the US dollar as legal tender after experiencing similar hyper-inflation to Venezuela. But now, it’s not just fiat currency which is on the table. When the smoke clears, perhaps there will be an opportunity for permanent adoption of cryptocurrencies, free from state manipulation.

Mizrachi believes that cryptocurrency will be a part of Venezuela’s financial system in the years to come:

“When Venezuela does recover (and it will, eventually) they will have set an unequivocal precedent for a future in which crypto is part of the country’s financial systems with regulations that welcome it, instead of banning it. I’m very optimistic that Venezuela will spearhead the utility of crypto in the world because they’ve actually had the need for it. This puts them in an advantageous position to innovate in the field in the future.”

Taylor is also optimistic for future of cryptocurrencies, particularly Dash, in Venezuela:

“Early indicators certainly point to mass adoption of Dash as a real possibility. Cryptocurrencies in general, and Dash specifically, offer multiple benefits to users, but the security is also a major component. Just keeping the massive amounts of cash required to make small purchases in Venezuela creates a major risk for it to be stolen or damaged/lost in some way. When you combine this with the lower volatility, high transaction speed, and low cost in which Dash can be used as a form of payment, it makes a compelling case for why everyday users would look to Dash as a better way to pay and get paid. Governments can certainly make life more difficult for the average cryptocurrency user, but we hope that this technology will viewed as a way to improve and enhance the economy rather than a threat. Ultimately, I think trust in the local currency has been severely damaged, so I suspect there is a real opportunity to bring some stability in this environment.”

Venezuela has its work cut out for it, in what will likely be a slow recovery from the ongoing economic collapse. The petro is unlikely to assist in this recovery, but perhaps other cryptocurrencies can provide Venezuelans respite during the dark months ahead. And perhaps these cryptocurrencies will be around in everyday life after the economy recovers.