It’s now official. The Kodak-branded cryptocurrency mining computer — dubbed the KashMiner — is going the way of the iconic Kodak camera as it is about to go extinct even before it started rolling out. Spotlite, the Bitcoin mining computer’s manufacturer, confirmed that the scheme fell through after the Securities and Exchange Commission (SEC) barred it from happening.

Spotlite’s Kodak KashMiner Scheme

Spotlite, the US-based company behind the Kodak KashMiner, first unveiled the machine at the CES technology show in Las Vegas early this year, reports Engadget. Spotlite also revealed a scheme where the crypto mining rig will be leased out to people for a two-year period for an upfront fee of $3,400.

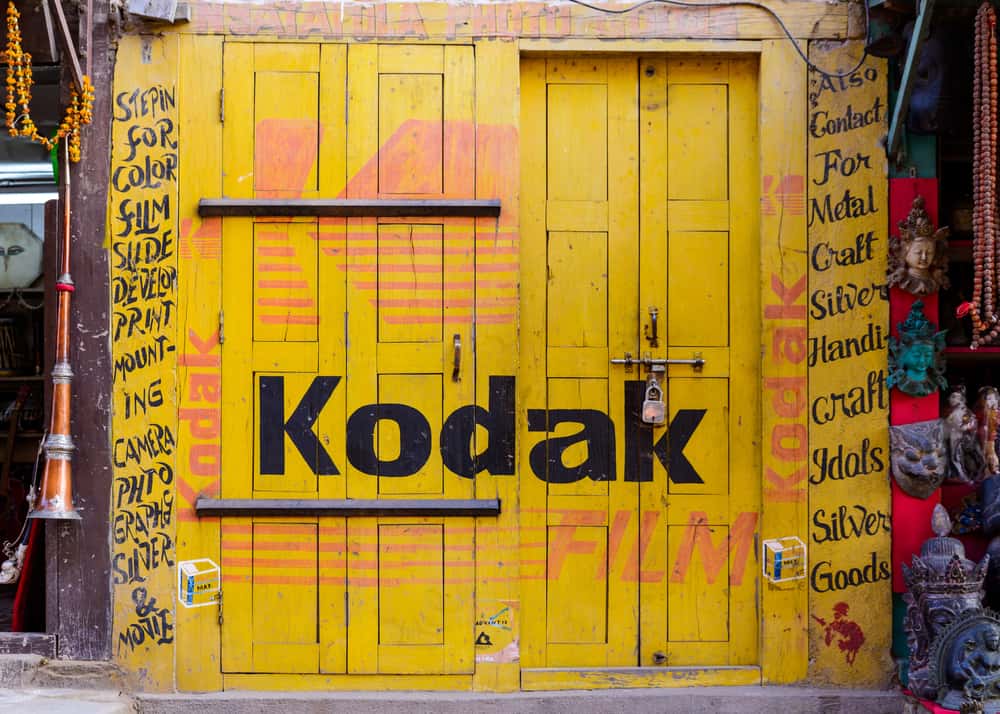

Of course, the actual Eastman Kodak Company had nothing to do with the KashMiner as it no longer manufactures any hardware at all after emerging from bankruptcy in 2003, reports the Inquirer. These days, it acts as a holding firm for the Kodak brand, making money from other companies that want to use the Kodak name to market their own products, like Spotlite.

According to Spotlite’s marketing spiel, the Bitcoin-focused Kodak KashMiner will be able to generate around $375 a month by mining the token. This means that for the duration of the lease period of two years, the total value of the Bitcoin tokens mined would be around $9,000.

Critics React

But not everyone was impressed with Spotlite’s optimistic estimates. In fact, many felt that the advertised profits were misleading, and some critics even called it a “scam,” according to BBC.

The reason for this strong negative reaction is that many feel that the advertised $9,000 revenue is highly improbable, considering Bitcoin’s current market price. An unnamed economics professor was reported to have estimated what’s needed to make Spotlite’s promised returns become a reality. According to him, in order for it to happen, Bitcoin’s price must be near $28,000.

Currently, Bitcoin is around $7,400, which about a fourth of the $28,000 price that Bitcoin must reach for the Kodak KashMiner to churn out $9k earnings in two years.

Given the current market trend, it is highly unlikely that Bitcoin would climb high enough to approach that mark. The highest it managed thus far was only $19,783, and that was back when the crypto industry was in a full upward swing in December 2017.

Bitcoin Mining to Get Tougher

Spotlite’s optimistic prediction also failed to account for one Bitcoin mining fact — mining the tokens will become increasingly difficult the more the tokens are already mined. By design, there is only a finite number of Bitcoins that can be uncovered by mining, and as of January 2018, only 20 percent remains, according to Investopedia. This means that mining output will only diminish. And even if Bitcoin does reach $28k, KashMiner will still fail to meet its advertised revenue.

But Spotlite will no longer have to worry about offering an appropriate explanation if the KashMiner fails to meet its advertised revenue. Spotlite CEO Halston Mikail confirmed to the BBC that the SEC “had prevented the scheme from going ahead.” Mikail, however, did not elaborate on why SEC barred the company’s plans.