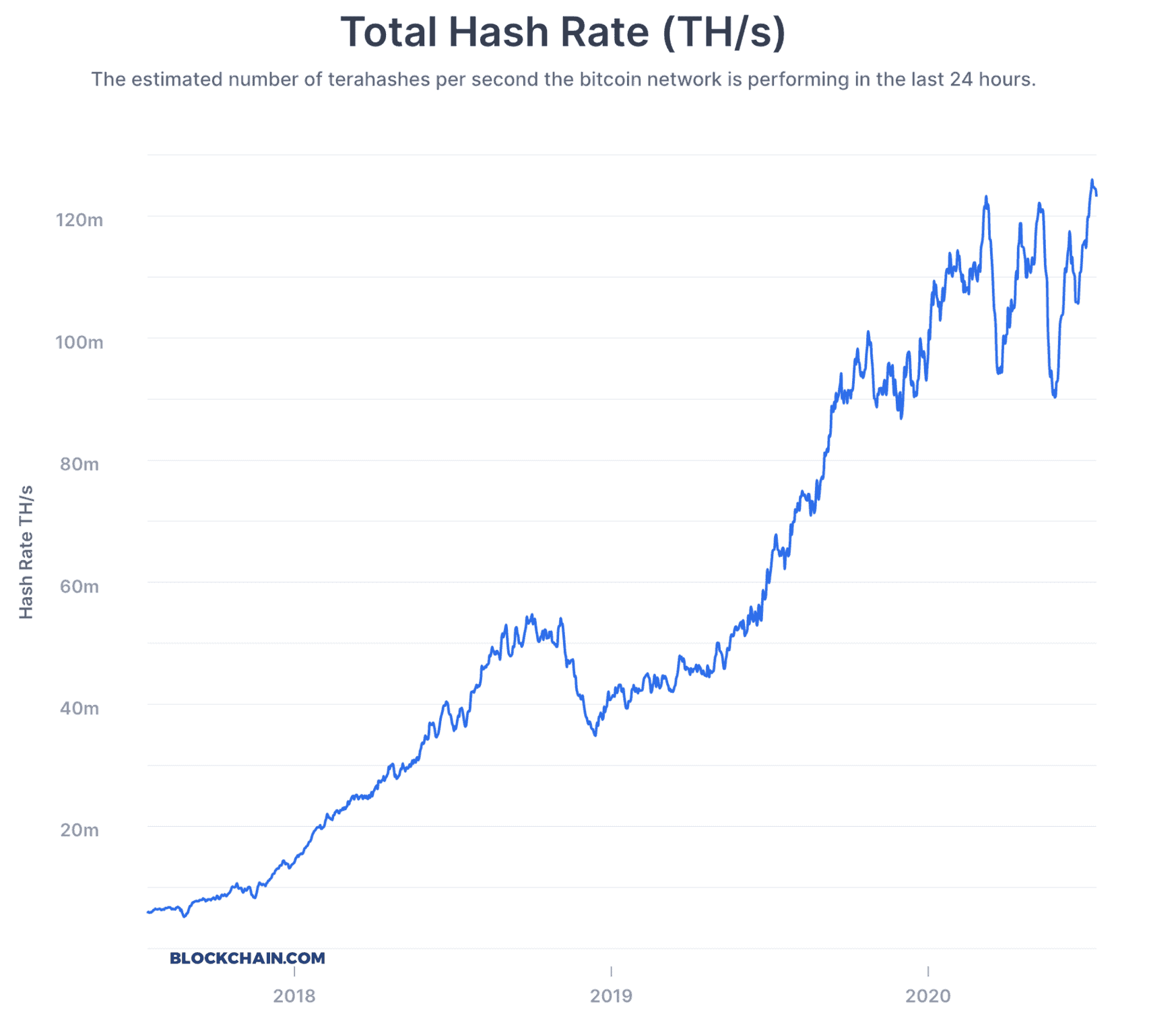

This week, Bitcoin’s hash rate, a key metric measuring the health of the underlying decentralized blockchain protocol, reached a new all-time high. The higher Bitcoin’s hash rate, the more secure and robust the network itself becomes.

Following the new record, financial analyst Max Keiser says that the price of the leading cryptocurrency by market cap will soon follow its hash rate to a new all-time high. The analyst in the past has called for Bitcoin to reach $400,000 per BTC.

The asset’s ascent toward a new peak could now be beginning, according to the new record in hash rate coinciding with one of the cryptocurrency’s most profitable buy signals in its entire history.

PrimeXBT analysis reveals the past results of these critical signals and their impact on Bitcoin, potentially providing clues as to what to expect in the days to come. Is Bitcoin hash rate reaching a new all-time a sign that Bitcoin price will shatter its record next?

Bitcoin Hash Rate Reaches All-Time High, But What Does This Mean For Crypto?

Bitcoin’s halving is now in the past, and the expectation is a few years of bullish momentum until the cycle restarts all over again.

But prior to the bull run beginning, during past Bitcoin market cycles, after the halving came a “death spiral” in the cryptocurrency’s hashrate. The dangerous drop would be due to miners capitulating, shutting down their machines for good, and selling off any remaining BTC supply they hold.

The resulting selloff of any BTC supply from capitulating miners would not only cleanse the network of the weakest miners, but it would also act as the final crash in Bitcoin price ahead of a new bull run.

Except Black Thursday may have been an anomaly that caused the early capitulation of miners, leaving the bull market to brew over the last several months. And instead of hash rate death spiraling, as a result, the network is stronger than ever.

Hash Ribbons Suggest BTC Miners Have Finished Capitulating Post-Halving

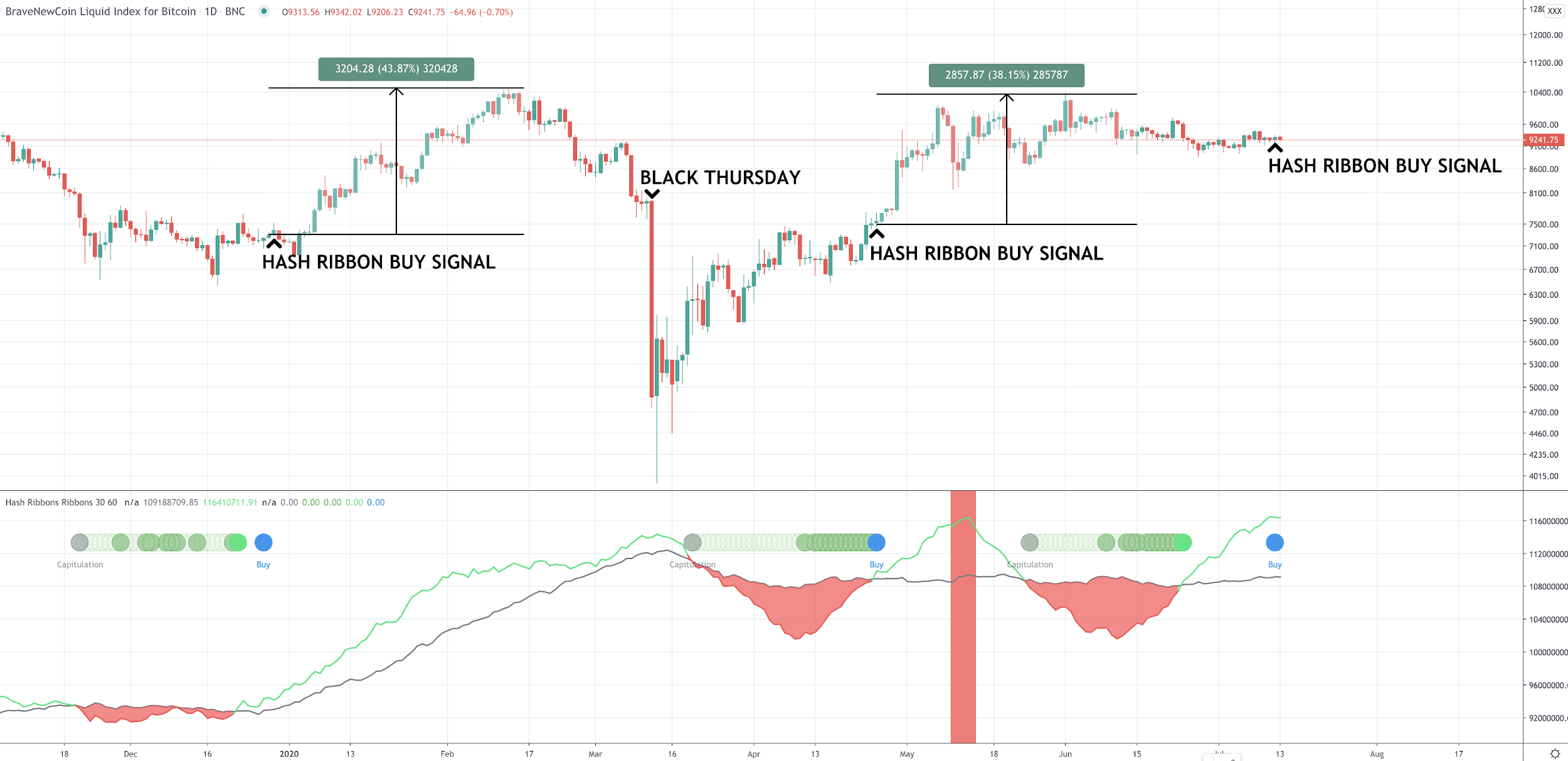

According to the hash ribbons, a unique moving average-based take on hash rate and mining difficulty, miners capitulated following the Black Thursday collapse that crushed stocks and took Bitcoin down by over 50%.

The fundamental tool turned technical analysis indicator was created by Bitcoin expert Charles Edwards.

In past Bitcoin market cycles, the hash ribbons signaled miners capitulating four times. The fourth and final time arrived after the asset’s halving in 2016.

During this cycle, the drop to $3,200 in late 2018 marked the first, and the second arrived when Bitcoin bottomed around $6,500 in late 2019.

The third capitulation event happened just ahead of the halving, thanks to the pandemic taking BTCUSD down to revisit lows. After the historic selloff, Bitcoin was trading at prices so low, miners were better off buying spot due to the cost of production being so high.

Bitcoin’s halving cuts the reward miners receive in half, instantly doubling the cost of production. It was this increase in the cost of producing each BTC that was expected to take out the weakest miners.

However, Black Thursday likely already cleared the path.

Most Profitable Buy Signal Ever Triggered By Hash Rate Growth

Post-halving, Bitcoin has had its fourth and hopefully final miner capitulation, and has since triggered a buy signal on the hash ribbons indicator.

With weak miners out of the way, the hash rate reaching new highs, and all other signs pointing to a new bull market in Bitcoin, what’s left standing in the way?

Another pandemic-panic selloff could cause stocks to tumble once again, taking Bitcoin and the rest of crypto down with it.

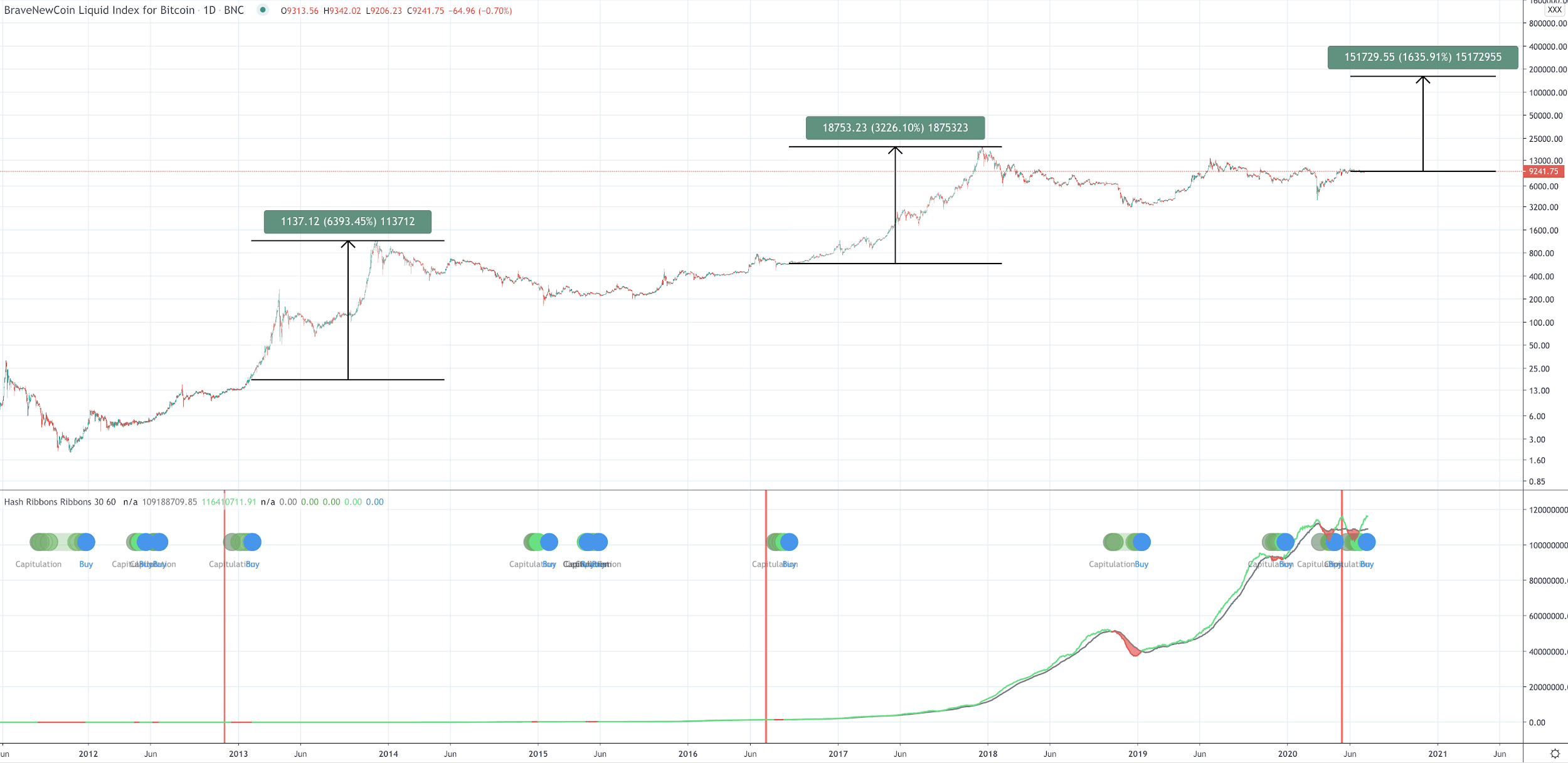

However, the hash ribbons signaling buy in the past has resulted in over 1000% returns in Bitcoin and has occurred during the start of nearly every major rally in the last several years.

The most recent hash ribbon buy signal came just after Black Thursday, taking Bitcoin to nearly $10,000. Prior to that, Bitcoin was trading around $6,500 in late December 2019. Weeks later, the asset topped out at $10,500.

Before that, the buy signal was triggered at Bitcoin’s bear market bottom at $3,200 and resulted in a nearly 300% rally to $14,000. And before that, the final buy signal of the previous bear market resulted in over the asset reaching its all-time high of $20,000.

With the hash rate this healthy, the hash ribbons signaling buy, and the halving in the past, nearly all signs point to Bitcoin’s bull run beginning now.

Get Positioned For Bitcoin’s Bull Run With PrimeXBT

If Bitcoin’s bull market is truly here, there’s never been a better time to trade on PrimeXBT, an award-winning Bitcoin-based margin trading platform.

With Bitcoin at such a critical moment, getting into position now utilizing the advanced trading tools found on the platform could make sure you don’t miss out on what may be another parabolic rally in cryptocurrencies. And with analysts like Max Keiser making such wild Bitcoin price predictions as $400,000 BTC, the next rally is not to be missed.

All accounts are denominated in BTC also, meaning that any of the instruments traded on PrimeXBT, which includes forex, stock indices, commodities, and more, add to a trader’s BTC stack ahead of any further upside.

Not only can traders trade Bitcoin itself, but they can bolster their BTC holdings trading traditional markets like oil, gold, and others.

The asset’s hash rate is setting a new all-time high, and a new record price could be next. Are you ready for Bitcoin’s next major move?