What is EQUI?

EQUI is a new cryptocurrency and a revolutionary investment platform that will work together to bridge the venture capital market with the crypto community. On the EQUI platform, there will be an ever-evolving selection of investment projects for EQUI token holders to invest in.

The venture capital investment sector has traditionally been reserved for ultra-high net worth individuals and institutions. EQUI is using blockchain technology to bring venture capital into the modern era, and give everyone access to these potentially high-growth investment opportunities.

Projects available will be carefully selected by the EQUI team, who have a breadth of business experience and proven success in their fields of expertise. They will seek early-stage ventures that have the potential to grow into future market leaders, focusing on projects utilizing technological advances and blockchain technology.

Not only will selected projects receive investment from the EQUI community, but they will also receive ongoing mentorship, operational support, strategic advice and resources from the EQUI team. This will help these ambitious companies grow and succeed, and therefore help generate significant returns for investors.

When EQUI token holders invest in projects on the EQUI platform, they will enter into a smart contract which locks them in until the investment reaches maturity. Upon exit of the investment, 75% of the net profits will be returned to investors, while 25% will go to the EQUI team as a performance reward.

Each project will have a minimum investment target relevant to its requirements. If a project does not receive the required level of investment before the investment closing date, all funds will be returned to investors.

Venture capital

VC is a form of financing for early-stage, emerging companies that are considered to have high growth potential but cannot access equity markets. Venture capital investments are considered high-risk, but they can also provide impressive returns.

Different stages of venture capital investment:

- Seed stage – The first stage of investment that aims to get a company off the ground.

- Early stage – Investment when a company has successfully proven its concept, to accelerate sales and marketing efforts.

- Growth stage – Further rounds of investment to provide additional support (usually through enhanced marketing and sales strategies), with the aim of growing the venture to its next stage of development.

EQUI Founders

Both the founders of EQUI are Scottish with working-class backgrounds, who through hard-work and determination have become the successful business people they are today. They also share a strong belief in giving back to society with both actively involved in charitable work.

Lead Founder – Doug Barrowman

Doug is a qualified chartered accountant and successful businessman with 30 years of experience in the venture capital industry. He built and grew Aston Ventures a successful private investment vehicle which made 13 acquisitions over a 10-year period with a total turnover of more than £400 million. He also built the Knox Group of companies, which cover property, private equity and wealth management, with over 350 staff internationally and £3 billion of funds under its management and administration.

Doug has been a strong supporter of blockchain, and he believes it will disrupt the thinking of markets and governments. In 2017 he successfully launched the first large-scale property development available for sale in Bitcoin. He states: “Through EQUI, I’m now bringing this investment experience to the world of cryptocurrency.”

Co-Founder – Baroness Michelle Mone of Mayfair

Michelle is an award-winning entrepreneur and influential businesswoman. She founded and grew Ultimo into a global lingerie brand, patenting 17 worldwide inventions and creating 105 design registrations. Since selling Ultimo, she has been involved in multiple business ventures, including tech companies, property, interior design, and jewelry. She was awarded an OBE from Her Majesty the Queen in 2010 for her contributions to business. In 2015 she was honored a life peerage to the House of Lords by the former UK Prime Minister and became the UK’s Start-Up Business Tsar.

During 2017 she pioneered the successful sale of multiple apartments in Bitcoin and a $250 million retail development in Dubai. She states: “EQUI for me represents a continuation of my life’s work in business. Working to create and promote the next generation of business entrepreneurs.”

EQUI token

The EQUI tokens are ERC20 tokens supported on the Ethereum network. EQUI tokens grant holders access to the EQUI platform where they can be held or used to invest in EQUI projects.

There will be an EQUI loyalty program that will encourage active participation on the EQUI platform by rewarding those who hold or invest their tokens there. The loyalty program will be facilitated by a 5% increase in the EQUI token supply each year.

EQUI holders will also be able to trade their tokens on independent exchanges freely like other cryptocurrencies.

Token distribution:

- 65% will be available to the public via the pre-sale and ICO.

- 12% will go to the EQUI Founders (Six-month lock-in period.)

- 15% will go the EQUI Team, quarterly, over a two-year period. (Six-month lock-in period.)

- 6% will go to the Advisory Board, quarterly, over a two-year period. (Six-month lock-in period.)

- 2% will be available for Bounty Rewards.

EQUI Token sale

- Public ICO: 15th March to 30th June 2018

- Total token supply: 250 million

- Token price: $0.50

- The minimum investment is $100

- Payable in Bitcoin, Ether, Litecoin & Ripple

Note: Citizens of the USA, Canada, South Korea, China, and Singapore are unable to invest in the ICO.

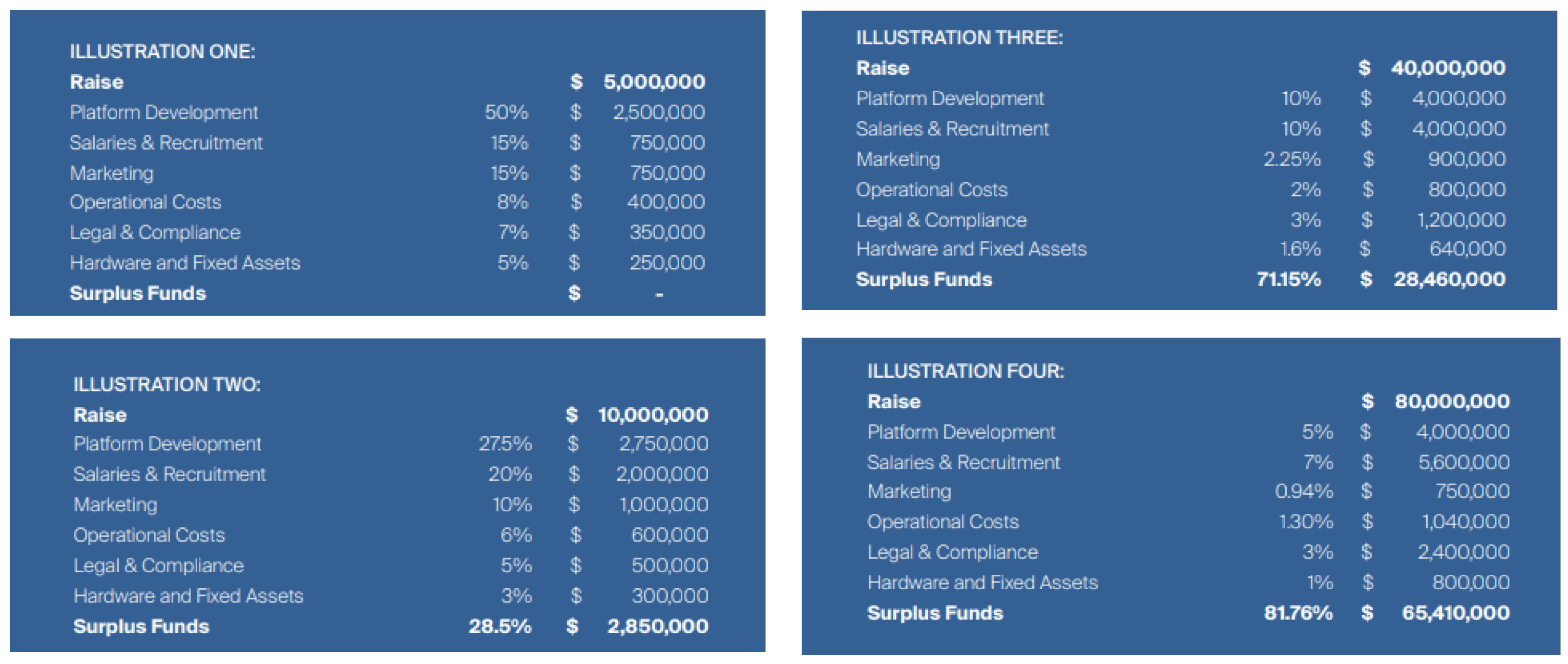

The funds raised from the pre-sale and public ICO will be used for platform development, salaries & recruitment, marketing, operating costs, legal & compliance and hardware & fixed assets. Surplus funds will be used to support the long-term value of EQUI tokens. The amount allocated to each will depend on how much they raise, here are the examples they provide:

Thoughts on EQUI

EQUI looks set to disrupt venture capital with blockchain technology. Not only will everyone now have access to early-stage and potentially high-growth investment opportunities, but they will also have the added confidence of knowing that the projects available have been selected by a highly skilled team of successful individuals. Of course, there is always risk involved with any investment, and in the EQUI whitepaper, they promote a diversification strategy, investing in multiple projects to spread risk.

Useful Links

| DISCLAIMER: Investing or trading in digital assets, such as those featured here, is extremely speculative and carries substantial risk. This analysis should not be considered investment advice, use it for informational purposes only. Historical performance of the assets discussed is not indicative of future performance. Statements, analysis, and information on blokt and associated or linked sites do not necessarily match the opinion of blokt. This analysis should not be interpreted as advice to invest, buy, sell or hold and should not be taken as an endorsement or recommendation of a particular asset. Blokt may receive financial compensation in exchange for publishing this article. |