Binance is one of the world’s leading cryptocurrency exchanges, providing traders with access to a huge range of coins and tokens against multiple crypto and fiat pairings.

Since its creation in 2017, Binance has not only focused on becoming one of the best cryptocurrency exchanges, it’s also become a large and growing ecosystem of trading products and blockchain protocols which provides some of the most comprehensive tools for traders and crypto enthusiasts.

With the recent addition of dozens of fiat pairs, including USD, GBP, CAD, AUD, EUR, and many more, users can now purchase cryptocurrency using their credit or debit cards.

For new users, the wide range of trading products Binance offers can be difficult to navigate. That’s why we’ve put this complete Binance review together so you can find out everything you need to know about this leading cryptocurrency exchange!

The Binance Ecosystem

As we mentioned, Binance has become much more than simply a crypto exchange.

Binance has built a vast ecosystem of products and services to make it easier and more accessible for people in multiple jurisdictions to participate in the blockchain industry.

The ‘Binance ecosystem’, which includes all of their various trading products, is how most people refer to the company as a whole.

We’re going to be exploring each part of the Binance ecosystem in detail below, so as you read on try to think about how each product Binance offers makes up the bigger picture.

But first, let’s take a look at the main man behind the Binance…

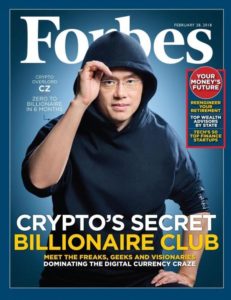

Changpeng Zhao (CZ)

No discussion of Binance is complete without first mentioning its founder, Changpeng Zhao – better known as CZ.

Zhao is the face of Binance, and one of the best-known public figures in the crypto industry. CZ regularly appears in different podcasts, events, magazines, and news sites, and his opinion is highly respected in crypto circles – which has helped Binance grow into one of the most trusted exchanges.

CZ built high-volume trading software before switching over to the blockchain industry, where he worked with prominent companies such as blockchain.info and OKCoin.

Building on this experience, CZ created Binance and financed the exchange through an ICO in 2017. CZ has been instrumental in steering the exchange to success.

ICO

According to CZ, the original Binance whitepaper was written in both English and Chinese in just three days, and their ICO, which introduced and created the Binance Coin (BNB), was launched only a week later.

The timing of the ICO, which occurred in June of 2017 at the beginning of the last bull market, was combined with Binance starting in the world’s then-largest cryptocurrency market, China.

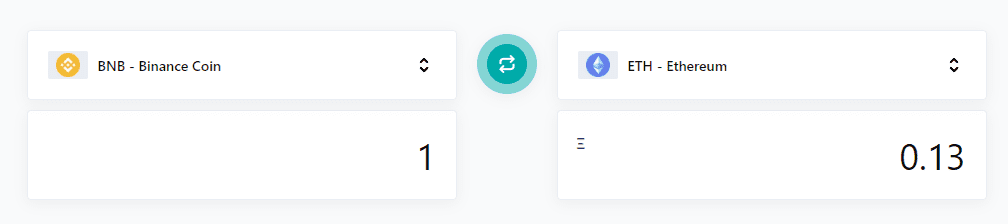

As a result of this fortunate combination of timing and place, Binance was able to raise $15 million USD within ten days of launching its ICO, which at the time was the largest ICO to date in China. During the first week of Binance’s ICO, one Ether worth around $300 at the time would have bought around 2700 BNB tokens – over $40,000 at current prices!

To compare, as of the 4th April 2022, 1 ETH will buy just 7.7 BNB tokens.

Whitepaper

The focus of the Binance whitepaper was to lay the foundations for the exchange functionality, the BNB token, and “The Burn” mechanism – which we’ll explore in more detail below.

From the outset, Binance was designed to be a completely different trading experience from that of existing exchanges; through offering the BNB token, adequate liquidity, and a secure platform built by finance specialists.

Now, two years on, Binance’s whitepaper is most useful to see how the exchange has changed and evolved over time. So, let’s look at some of Binance’s most famous features.

Binance Coin (BNB)

The Binance coin(BNB) is at the heart of Binance’s system and has a total market capitalization of about $62.5 billion as of February 2022 – in the top 10 cryptos by market cap.

BNB was originally created as an ERC20 token on the Ethereum blockchain, but the BNB token is now the basis for Binance’s decentralized exchange ecosystem, the DEX, which we’ll discover later.

Since its creation, the BNB token has functioned as a way to pay fees on the Binance exchange, offering discounted rates for traders.

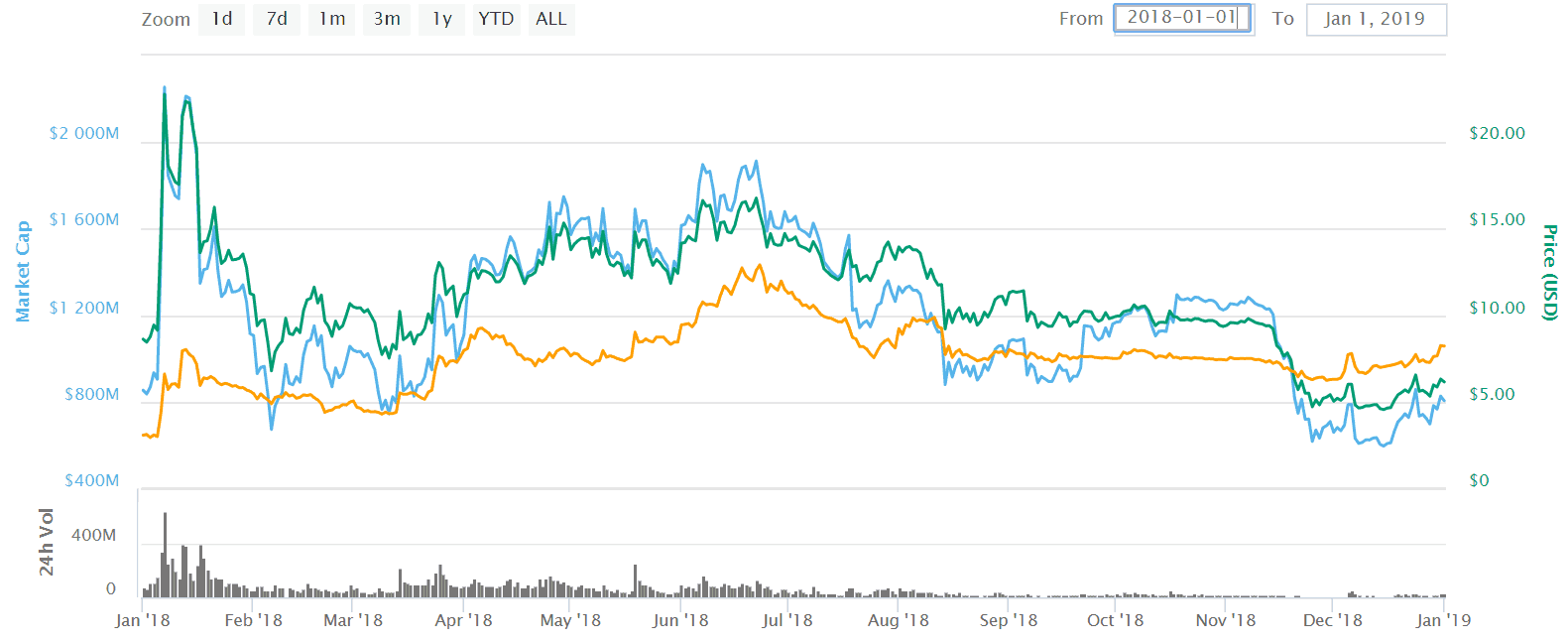

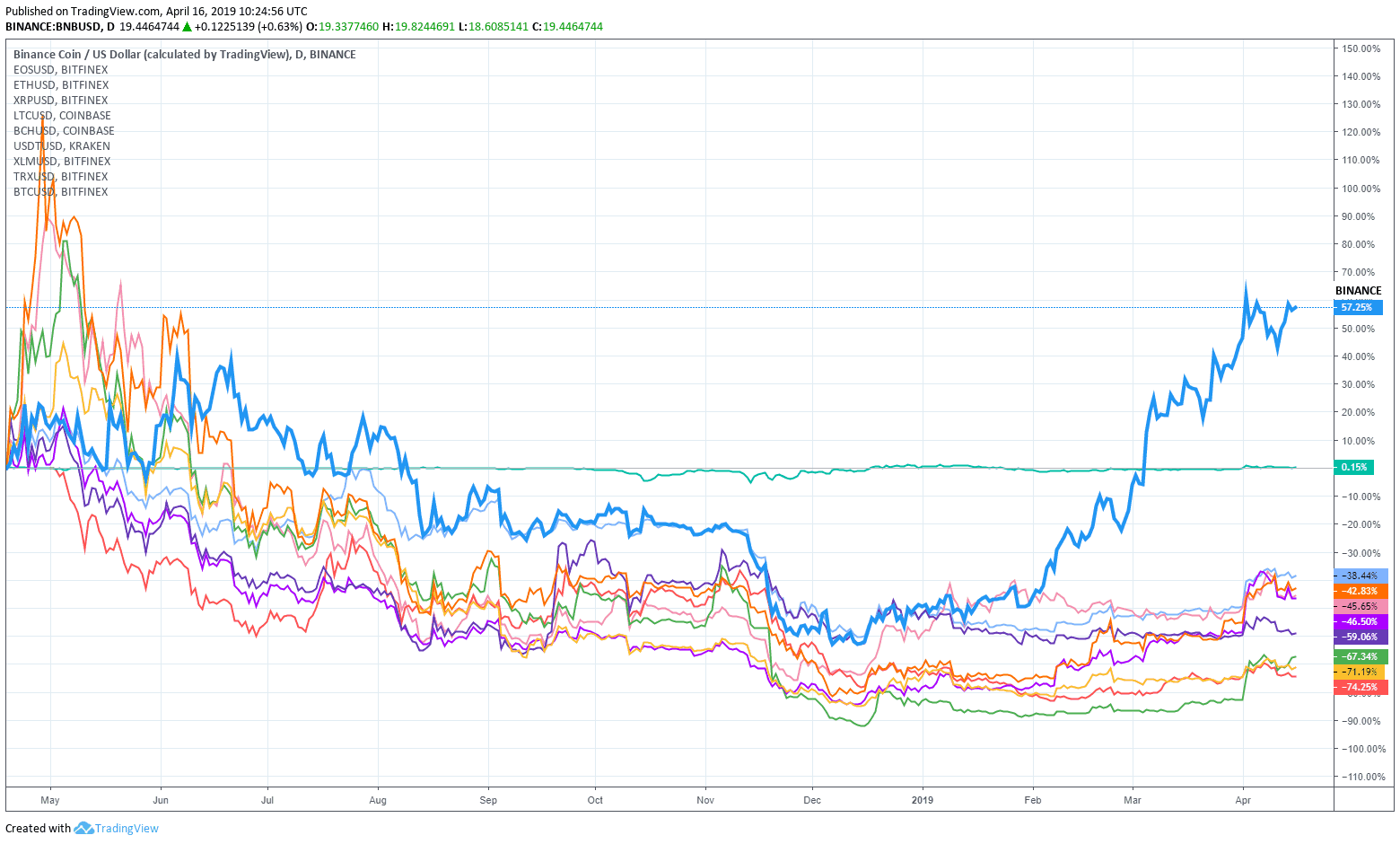

During 2019, BNB rose from just under $6 per coin in January, reaching a peak of over $37 in June, before declining over the remainder of the year to its current price.

As a result, Binance was one of the best performing top 10 market cap coins, and even with its post-June decline in price, it generated exceptional returns for investors.

Throughout 2019 and into 2020, BNB deviated from Bitcoin’s price trend. The divergent correlation is uncommon among most crypto assets, which have a history of closely tracking Bitcoin’s price.

This difference in price could be due to BNB’s regular coin burns, and its increased utility within the growing Binance ecosystem.

The Burn

The BNB token is backed by a unique system called “The Burn,” which was created as a way to increase the value of BNB tokens in the long term.

Every quarter, Binance uses a portion of its profits from Binance fees to buy BNB tokens. This is to affect the coin supply of BNB, which is used directly within the Binance ecosystem.

These tokens that have been bought are then burned or destroyed, effectively removing them from the total BNB supply.

This will carry on until 50% of the 200 million total BNB tokens have been destroyed. Since the total BNB supply decreases, the value of each BNB token should increase in the long run.

Binance’s Growth

So, what events contributed to Binance’s current success, and where are they now?

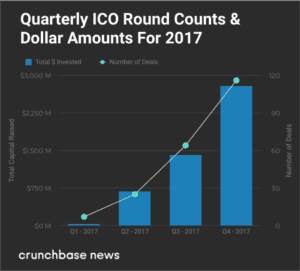

In the fall of 2017, Binance was able to become the biggest exchange by trading volume by being accessible to a very large number of interested crypto asset investors and traders at a time when interest was approaching all-time highs. Because the number of ICOs which were launching increased dramatically, the hype and demand for a larger variety of cryptocurrencies also increased dramatically.

Binance was one of the first large exchanges where people were able to register to the platform using only an email address and gain instant access to a wide variety of tokens.

Taking early advantage of the growing ICO craze allowed Binance to position itself as one of the leading exchanges, and it’s remained so ever since.

During 2018, although the total crypto market cap shrank dramatically, Binance continued to expand its presence and began developing a more complete ecosystem. This included launching Binance Academy and its venture capital fund, acquiring Trust Wallet, and opening new services in Africa.

During this time, Binance moved its headquarters to Malta, which is a particularly crypto-friendly jurisdiction. Nevertheless, during the past few years, Binance has made some big updates, including the addition of margin trading, staking, futures, and a partnership with derivatives exchange FTX.com.

Although Binance has recently removed FTX tokens from their exchange, as traders were holding the tokens rather than using them to trade, the two exchanges are still working closely. Binance invested an undisclosed sum into FTX.com in 2019 and has hinted that new joint-led products will come from the partnership in the coming months.

Binance has also recently acquired CoinMarketCap (CMC), the most popular crypto market cap tracker and API provider. The acquisition successfully closed on March 31st. The $400 million acquisition is the largest deal Binance has made to date, and CZ commented in an interview with Coindesk that they will be helping to grow CMC further.

Binance is continuing to innovate and add to its already impressive list of products and services. Since we updated this article last, Binance has been busy adding new features, including:

Many new derivative products – Including Bitcoin quarterly futures, Algorand perpetual swap, ETH and XRP options contracts, and much more.

Binance Exchange

Despite its ventures into education, venture capital, and mobile wallets, the flagship product from Binance is still its exchange.

Binance has been one of the top exchanges for most of the last three years since its launch, but recently new challenger exchanges have begun competing with Binance for the top exchange by adjusted trading volume.

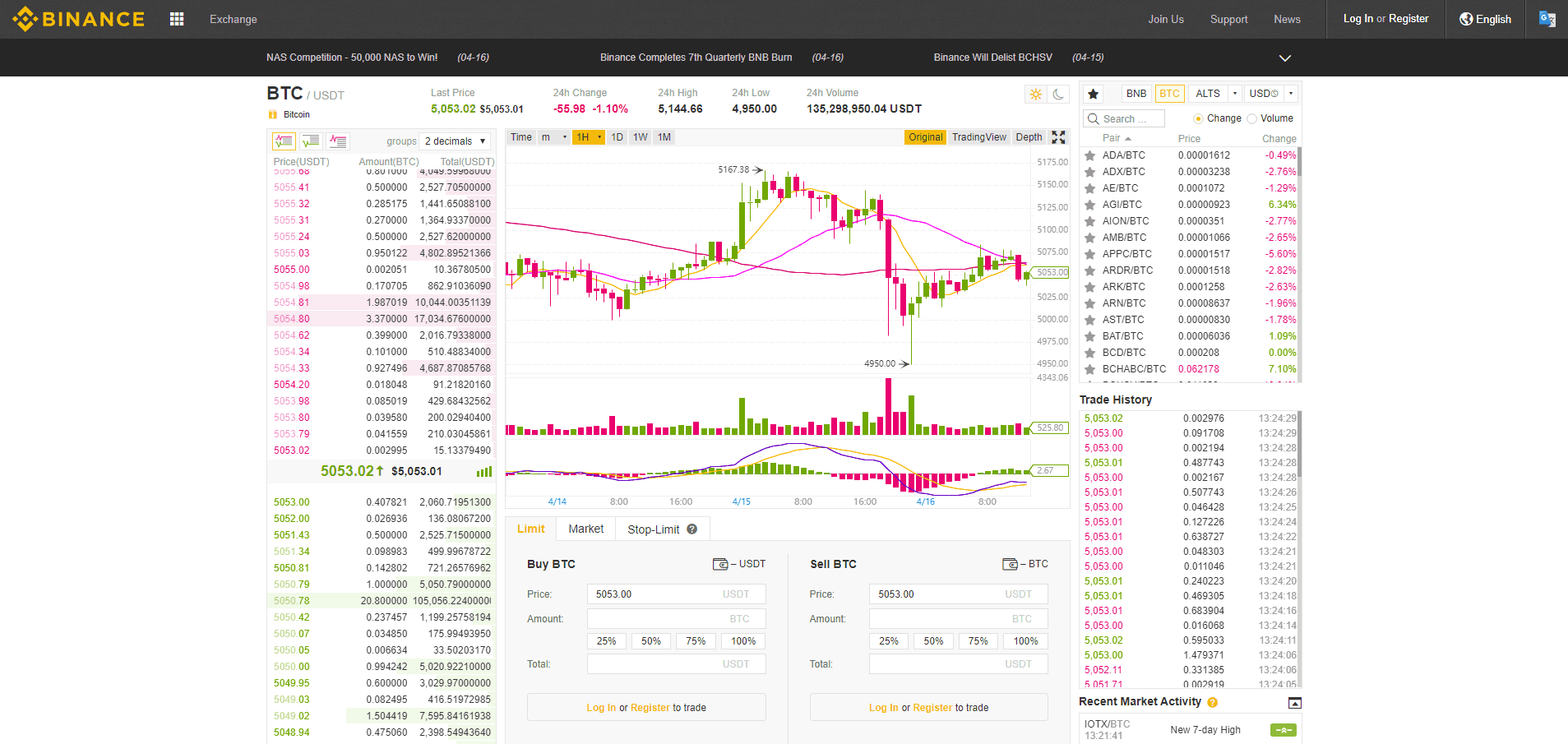

The standard exchange interface, also called the ‘spot’ exchange as traders are buying and selling for real assets on a live market, features two modes for users, ‘Basic’ and ‘Advanced’.

The basic mode provides a simple trading interface, where users can choose their trading pair, set limit and market orders, place stop-limits, and trade in a clear and easy-to-navigate environment.

Choosing the advanced mode will allow traders to access a wide range of charting instruments and technical indicators, including RSI, moving averages, Bollinger bands, and more. Traders looking to do technical analysis can also use charting tools to draw on charts in advanced mode.

The general interface in advanced mode is just as user-friendly as Binance’s basic mode, but with tools for more experienced traders. The main thing to remember about the Binance Exchange is that you’re trading here for real assets – not contracts like their futures exchange.

At the time of writing, there are 187 coins and tokens trading on Binance Exchange, with 609 trading pairs! These include BTC and major altcoins, and a huge range of smaller cap tokens and coins.

Binance Margin Trading

Binance introduced live margin trading in February 2020 after hinting for many months that the feature would arrive. Margin trading is currently available for BTC, XRP, BNB, TRX, and ETH.

Margin trading is the practice of borrowing funds from a broker, in this case, Binance, to buy an underlying asset. It is similar too, though not the same as, leverage, which involves taking on debt to increase a trading position – which Binance also offers as we’ll discover later.

To start margin trading on Binance, you’ll first need to manually activate your account for this feature. This can be done by visiting your account dashboard while logged into the standard exchange and visiting the ‘Balance Details’ tab. Here, there is an option to enable margin trading.

Clicking the margin trading tab will prompt a risk warning, at which point you’ll see an option to ‘Open Margin Account’ – click this if you’re ready and margin trading will become instantly available to you. You will need to have passed full KYC and enable 2FA to access this feature.

Next, you’ll need to fund your margin account. You can transfer funds from your regular Binance Wallet to your margin account by visiting the ‘wallet’ tab at the top of the page and navigating to ‘margin’. On the right-hand side, there will be an option to transfer balances from your regular wallets, such as BTC, ETH, or XRP, to your margin account.

You can now use the coins which you own as collateral to borrow margin. Margin can be borrowed for both long and short positions, available at a fixed rate of 5:1 (5x). For example, if you had 2 ETH, you could borrow 10 more ETH to trade with.

Once you’ve borrowed funds, these will be instantly available to trade. Margin users should note that there is an hourly interest rate on borrowed funds, and each asset has its own margin fees attached. These fees can stack up considerably over time, so don’t borrow margin unless you’re absolutely going to use it.

It should be said that margin trading is inherently riskier than normal trading, as it can magnify your losses. This doesn’t mean you will go into debt while trading, but you could lose all your original capital if the market moves against your position.

Binance Futures – Leverage Trading

In 2019, CZ announced the launch of Binance Futures at the Asia Blockchain Summit in Taipei. Futures are a type of derivative trading instrument that allows parties to buy an asset at a predetermined future data and price.

Like other derivatives platforms, Binance Futures allows users to open long and short positions on a variety of cryptocurrency assets, with up to 125x leverage.

Leverage involves the use of borrowed capital to open larger trading positions than you normally would using your own funds. For example, a leverage of 100x would allow a user with just $100 of original capital to trade with $10,000 – generating larger profits, but also risking larger losses.

Originally only catering to Bitcoin traders, Binance Futures now offers 24 contract options on cryptos such as Ethereum, Chainlink, Tron, BAT, and many more.

With a similar interface to their ‘advanced exchange’ feature, the Binance Futures exchange suits intermediate to experienced traders who have a certain appetite for risk. It’s a great option for those looking to take advantage of the daily fluctuations in the cryptocurrency markets. However, we do think anyone taking 125x leverage is really just gambling like in a bitcoin casino. Pro traders generally do go any higher than 5x on serious trades.

If you’ve got a Binance account, you can already use the Binance Futures exchange, just simply login with your credentials and make sure you’ve got some Bitcoin in your account wallet.

Orders, like Binance’s standard exchange, can be placed using a limit order to time your entry or opened at the current market price. Remember, when you ‘sell’ on Binance Futures, you’re not actually selling the asset – you’re placing a ‘bet’ that the price of the asset you’re trading will decline. Similarly, you never own the assets you trade on Binance Futures, you simply trade a contract of them.

Recently, Binance Futures have overtaken other leading futures exchanges, such as Deribit, in perpetual futures trading volume. According to CoinGecko, at the time of writing Binance Futures is the 4th highest volume crypto derivatives exchange in the world.

Binance Futures is a perfect choice for users who want to dip their feet into leverage trading, but want a familiar platform. If you’re comfortable with Binance’s advanced trading interface, you should quickly learn the ropes on Binance Futures.

Binance Options

Binance acquired derivatives exchange JEX in September 2019, with a view to turning the exchange into a leading cryptocurrency options and futures trading platform called Binance JEX.

Options are a type of trading instrument that allow buyers to purchase a contract, rather than the underlying asset. This contract gives the buyer the right to buy or sell an underlying asset, like Bitcoin, on or before a given date. Used correctly, they can be a powerful speculation tool for professional traders.

Binance JEX offers Options trading on Bitcoin, and a range of other cryptocurrencies, as well as futures, which are also hosted on Binance’s Futures trading platform. The acquisition of JEX was really Binance’s first foray into crypto derivatives and has largely been regarded as a way of Binance competing with exchanges such as BitMEX.

The futures feature of Binance JEX is the same as those described above, so let’s look at the options contracts. Binance JEX offers both standard and professional options contracts trading interfaces, both of which offer a wide range of put and call contracts.

A trader would buy a ‘call’ options contract if they thought the price of the underlying asset was going up, and purchase a ‘put’ if they expected it to go down in price. At the time of writing, traders can buy both call and put options contracts for BTC, ETH, LTC, EOS, and BNB on Binance JEX.

Traders should keep an eye on the ‘Strike Price’ of an options contract, which is the price at which that contract can be bought or sold – not like trading on a live spot market. Binance JEX lists their options strike price at the top of the exchange interface for each contract.

Binance’s trading interface for options matches the rest of their exchange themes, with a no-frills design and a wealth of trading tools, including access to full charting indicators. Overall, although options are a trading instrument for professional traders, Binance JEX has succeeded in making an easy-to-navigate exchange interface.

There are also Binance JEX mobile apps available for both iOS and Android, published by JEX Technology Limited, which let users place orders and track trades on the go.

According to CoinGecko, Binance JEX has had $1.3 million in trading volume on its derivatives products in the last 24 hours, which is markedly lower than their other volumes – probably due to appetite for options contracts and their professional nature.

For those looking to learn more about options contracts, Binance JEX publishes a whole range of beginners guides to options trading here.

Binance DEX

The Binance Decentralized Exchange, or ‘DEX’, is part of ‘Binance.org’, which focuses on building decentralized exchange infrastructure where Binance Chain-based tokens can be issued and traded.

This ties in closely with the Binance Launchpad, where new projects can be created and traded as we’ll discover later, but it’s also a decentralized exchange where users can trade peer to peer without a centralized exchange processing the orders.

Similar to IDEX for Ethereum-based tokens, Binance DEX allows users to create their own Binance Chain wallet to store and trade Binance-based tokens, and trade against BNB pairings on over 100 digital assets.

The Binance DEX has succeeded in bringing many new projects to the exchange, which have either issued a portion of their tokens as Binance Chain assets or ran token sales through the DEX.

Fees

Likes every other crypto exchange, Binance has standardized platform fees for trading and withdrawing different assets. Deposits are free, but specific withdrawal and trading fees depend on the asset that you are transacting as well as your trading volume or BNB holdings.

Trading fees are tiered by ‘VIP’ level according to how many BNB tokens a trader holds, or their 30-day trading volume in BTC. If users hold no BNB or they have traded under 50 BTC in the last 30 days, the trading fee is set at 0.1%.

For example, if you hold zero BNB tokens in your account and your 30-day trading volume is less than 100 BTC, then your general trading fees are set at 0.1%. However, if you are at the highest tier and hold greater than 11000 BNB and have a 30-day trading volume greater than 150000 BTC, then your general trading fees are only 0.02% to 0.04% depending on whether you are a market maker or taker.

| TIME | The 1st Year | The 2nd Year | The 3rd Year | The 4th Year | The 5th Year |

| Discount Rate | 50% | 25% | 12.5% | 6.75% | No Discount |

Though more common now, Binance was one of the first crypto-asset exchanges to incentivize its users to use its base token in order to receive discounted rates. Binance’s discounts for using BNB token decreases over time and is currently at 25% for those who pay fees using BNB tokens.

Binance’s fee schedules are regularly updated for specific products, and there are also overnight fees and interest fees associated with Binance’s margin, futures, and options trading.

Jurisdictions

In addition to the wide variety of tokens on Binance and their multitude of trading products, the other advantage that gave Binance a large user base in such a short amount of time was their accessibility in a wide variety of countries.

Binance is available in nearly every jurisdiction except for a small list where they currently can’t or don’t offer their services.

With the introduction of 5AML across Europe, it’s necessary for European users to complete KYC to begin trading on Binance. Other jurisdictions will have different processes, although it’s highly advisable to complete KYC regardless of where you’re from, as it helps with account security.

Credit and Debit Card Buys & Fiat-to-Crypto On-Ramps

On the 31st of January 2019, Binance announced that they would be working with payments provider Simplex to enable fiat purchases through credit and debit cards for a range of cryptocurrencies on their platform.

Simplex is a payment processing service that focuses on preventing fraud, so it is perfect for crypto exchanges such as Binance that because of the pseudonymous nature of cryptocurrencies are highly susceptible to fraudulent activity.

Originally limited only to Bitcoin purchases, Binance now offers direct fiat to crypto purchases on 15 digital assets, including:

- Bitcoin (BTC)

- Binance (BNB)

- Binance USD (BUSD)

- Ethereum (ETH)

- Ripple (XRP)

- Bitcoin Cash (BCH)

- Basic Attention Token (BAT)

- Dash (DASH)

- EOS.io (EOS)

- Litecoin (LTC)

- Nano (NANO)

- Paxos Standard (PAX)

- Tron (TRX)

- TrueUSD (TUSD)

- Tether (USDT)

The introduction of these fiat-to-crypto gateways provides some competition with the likes of Coinbase, who until recently were one of the main providers of fiat-to-crypto on-ramps for retail investors.

CZ has publicly expressed his strategy to increase the mainstream adoption of crypto assets, of which a major component is offering more ways for people to buy Bitcoin and crypto assets using fiat currency.

In addition to the partnership with Simplex, CZ has plans to launch up to 10 fiat jurisdiction-specific gateways – ideally 2 per continent. This highly ambitious plan would increase the average person’s ability to buy their first crypto asset and start investing in other tokens and coins.

Perhaps the best known of these new fiat gateways is Binance Jersey, Binance Uganda, and Binance USA, which we’ll explore below!

Binance Jersey

Binance Jersey launched in January of 2019 as its first foray into allowing direct Euro and British Pound transfers into crypto. We have written a review of Binance Jersey here if you want more information about Binance’s newly launched fiat gateway.

The island of Jersey is located off the coast of France and serves as a major offshore financial center with its lax financial and tax regulations. Binance Jersey serves a relatively simple function compared to the main Binance exchange; it is simply there for users to convert their Euros and British Pounds to Ethereum or Bitcoin.

Though this limited functionality may change in the future it is currently not needed because once users have one of these major coins, it is relatively easy to transfer them to the main Binance exchange platform and trade for the hundreds of tokens that Binance has available for trading.

Binance Uganda

Binance’s strategy of being available to as many people as possible has brought them to Africa. Though many in the crypto industry preach about blockchain being helpful to the unbanked and those living in developing countries, few make genuine efforts to really expand their product to those places.

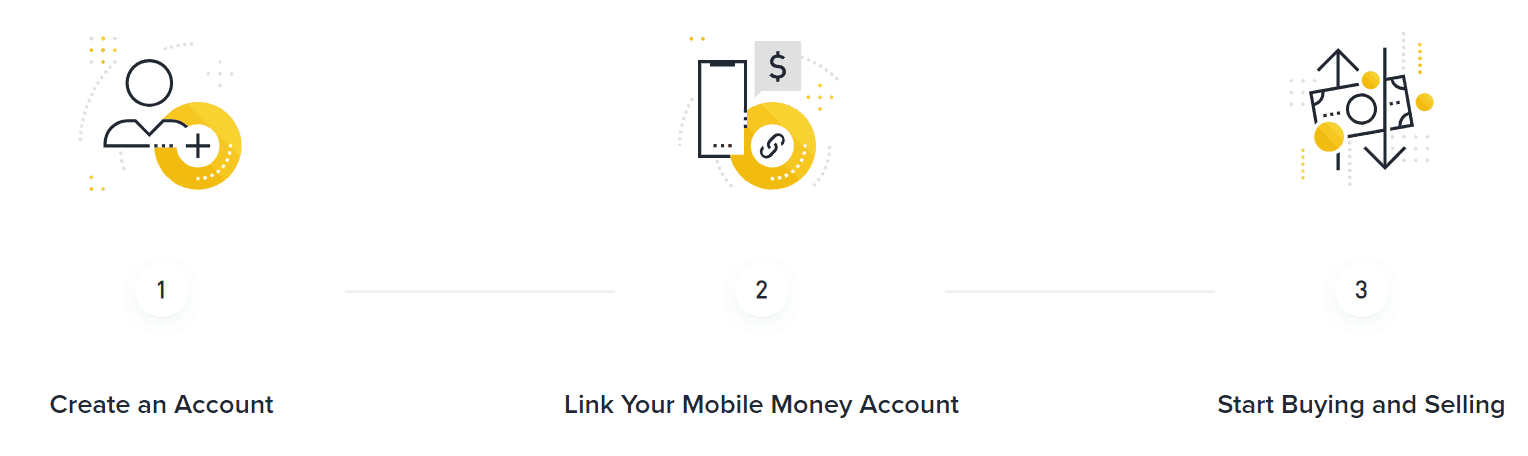

Binance is the exception in this case putting its money where its mouth is and opening a fiat-to-crypto gateway in Africa. Binance Uganda launched in June 2018 as Binance’s first fiat-to-crypto gateway and specializes in having users buy crypto assets with mobile money accounts, which is a very popular method for sending money in the region.

With the success of Binance Uganda, which signed up over 40,000 users in its first week, Binance have provided a real way for Ugandan nationals to enter the cryptocurrency markets.

Binance US

Binance US launched in late 2019, and unlike Binance Jersey and Uganda, it’s a more full-featured exchange with a larger range of assets for the American market.

Up until 2019, US citizens were still able to use the Binance platform, although they were barred from most other major exchanges like Bitfinex, Bitmex, etc. Actually, because of Bitmex’s lack of KYC, we hear many US citizens use a VPN to access it. Thus Binance USA was born.

Offering direct USD pairings, Binance US customers can trade 24 tokens, including BTC, ETH, LINK, XRP, and more, with 40 trading pairs.

In the first month of trading, Binance US jumped to a huge $15 million in daily trading volume, most likely powered through easy fiat-to-crypto on-ramps including debit cards, ACH, and bank wire deposits for USD.

US traders can also download a Binance US app for Android and iOS, for trading on the go. Binance plans to continue expanding its presence with more fiat to crypto gateways in Singapore, Liechtenstein, and other countries.

Binance Expands in to Germany

Although Binance is a global cryptocurrency exchange, it’s penetration into certain European markets has been slower, partly due to regulatory requirements, but also due to not having a strong foothold in that jurisdiction.

One of these countries has been Germany, which has traditionally been home to many high-volume crypto asset traders, and a long-term target for Binance expansion.

Recently, Binance announced that they would be working with a German traditional investment firm, CM-Equity, to expand Binance’s reach in Germany and central Europe.

CM-Equity is a BaFin authorized entity specializing in proprietary trading and brokerage services, serving a large number of high net-worth individuals and family offices, as well as institutional investors.

Together, Binance and CM-Equity will be exploring new crypto brokerage services for large investors.

Zhao said the partnership would “broaden Binance’s services in Europe while ensuring compliance with local regulations”, and representatives from CM-Equity said that working with Binance would offer the best liquidity and frictionless service to its institutional investors.

However, the partnership represents more than just an expansion strategy for Binance, it’s also a clear message that traditional trading firms and asset managers are taking the blockchain and crypto space seriously, and digital assets are gaining popularity among the average investor.

Binance Chain

As mentioned in Binance’s whitepaper, the plan has always been to eventually move BNB tokens off of the Ethereum blockchain and onto its own specially developed blockchain. The Binance Chain functions as a digital asset creation and exchange platform.

This specialized blockchain allows users to send and receive BNB tokens, issue new tokens, make trades, and even stake their BNB tokens for involvement in governance decisions.

Binance’s blockchain is non-custodial of users’ funds – in other words decentralized – able to process a large volume of transactions at high speeds and low costs, as well as offer high liquidity.

Binance Chain started producing blocks in April 2019 and now has multiple assets issued on its blockchain protocol. These tokens primarily trade on Binance.org, otherwise known as Binance DEX, which we’ve explored above!

Binance Charity

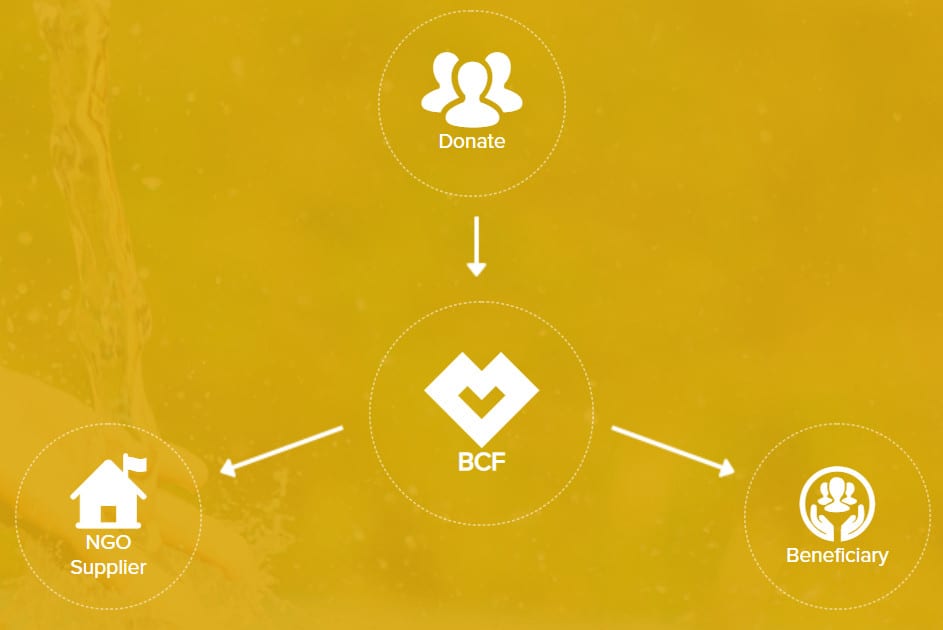

The Binance Charity Foundation was created as a way to donate to social impact projects that focus on the “bottom billion” or those living in the least developed countries. The non-profit organization records all of its transactions on the blockchain so that donations and reception of donations are completely transparent and traceable.

It also aims to promote and spread the use of blockchain technology through its efforts. The Binance Charity Foundation claims to pass 100% of its donations directly to beneficiaries.

Binance Academy

Though Binance has benefited greatly from existing crypto interest, onboarding new users is necessary in order to continue growing its platform at a rapid rate.

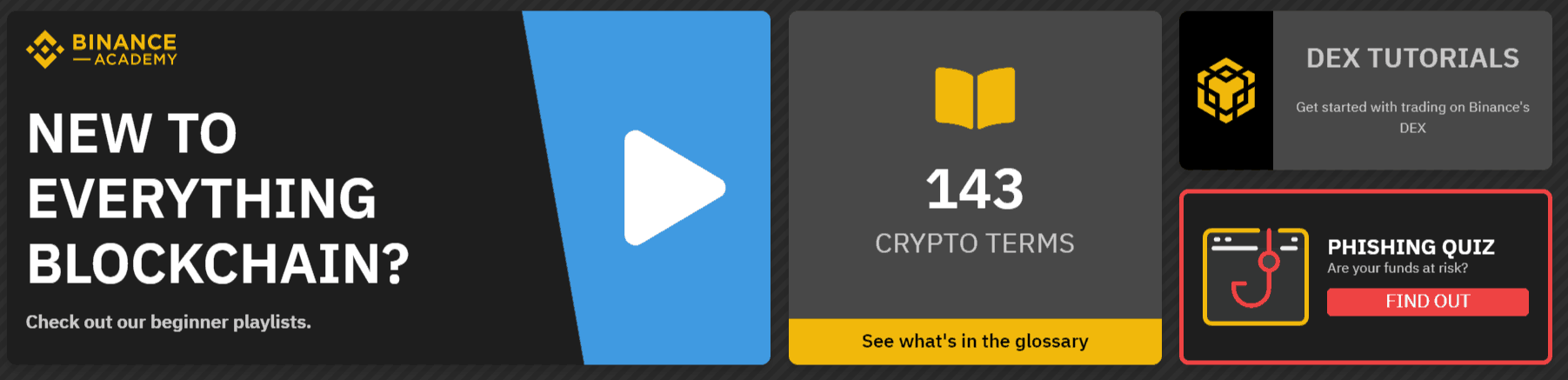

In addition to opening up in new markets and starting fiat to crypto gateways such as Binance Uganda, Binance Jersey, and Binance US, Binance has also begun creating basic educational resources for those who are new to blockchain technology.

Through Binance Academy, users are able to watch videos and read articles on a large variety of different blockchain and financial concepts.

Users can access a huge range of educational resources, on topics such as getting started with futures trading, how to prevent scams and account security.

Binance Research

Binance has also created and curated informational resources regarding different tokens and projects through Binance Research.

These resources take the form of in-depth research reports, which allow readers to make wiser investment and trading decisions.

Beyond token-specific research reports, Binance Research also offers a rating list that curates project ratings from different sources as well as broader themed reports such as investigating crypto-asset cycles and a JPM Coin Report.

Let’s look at the JPM Coin Report as a case study for the impact of Binance’s Research activities.

JPM Coin Report

When JPMorgan, the company whose CEO Jamie Dimon famously said that Bitcoin “is a fraud,”, officially announced that they were creating its own crypto asset called JPM Coin, the blockchain industry took notice. In fact, Binance’s comprehensive JPM Coin Report was even covered by several of the major crypto news media organizations.

This report broke down how a large institutional bank like JPM was going to enter the market with its own crypto offering and concluded that it offered a minimal threat to a blockchain organization such as Ripple.

Binance’s report raised the level of knowledge for the entire blockchain space as a whole with a detailed analysis of the threat that the major financial institution could pose.

Binance Labs

Binance Labs is another one of Binance’s side projects, which is looking to expand the entire ecosystem of new projects that are launching in the blockchain space.

Labs is Binance’s startup incubator and venture capital fund where it invests in new startup companies that focus on blockchain technology.

To date, Binance Labs has invested in at least 12 different startup companies. Many of these companies launch their tokens on Binance Chain, traded through Binance DEX, which naturally generates fees and revenue for Binance.

Binance Labs also runs the Ecosystem Fund, which aims to bring together one billion US dollars from twenty different funds in order to build and grow blockchain infrastructure.

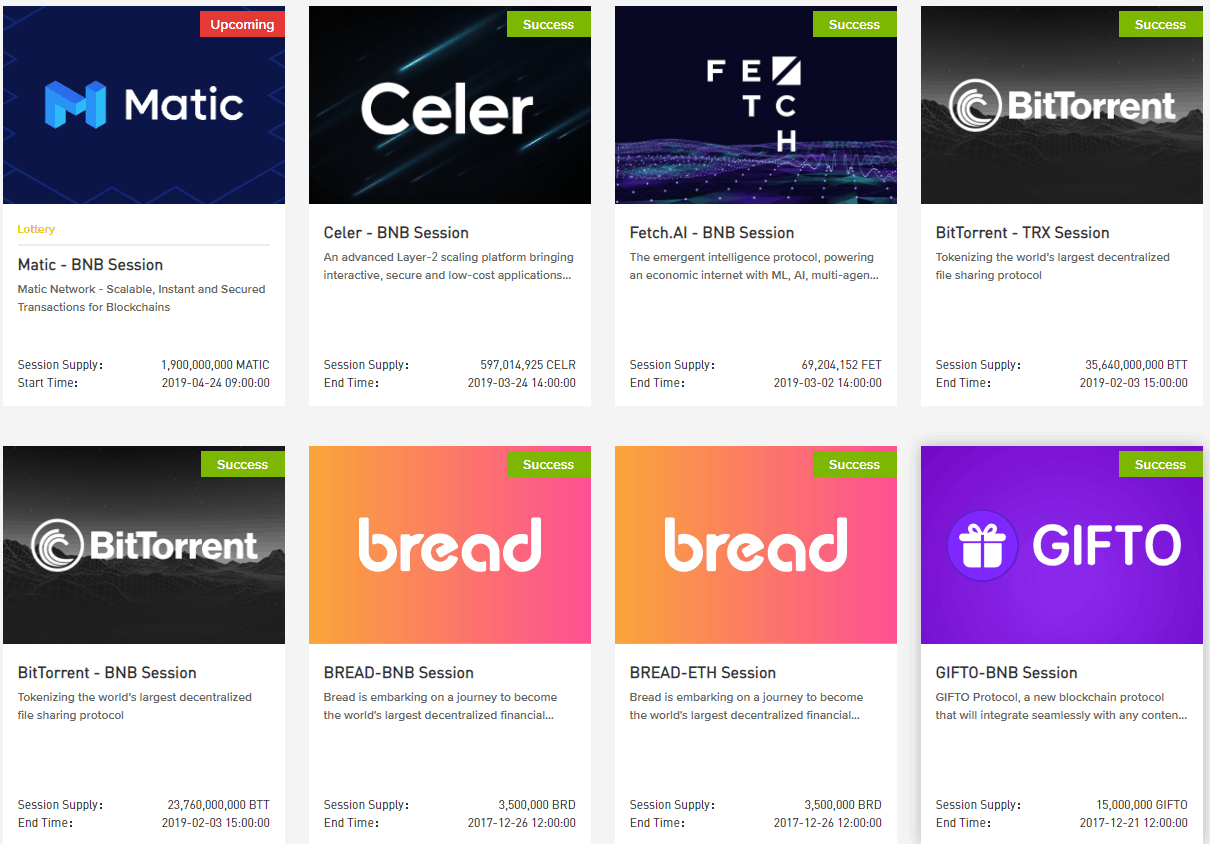

Binance Launchpad

One of the major reasons for Binance’s early success was its offering of ICO tokens or recently launched tokens that other more established exchanges were not willing to offer.

Binance is now taking this one step further by becoming a platform for new projects to launch their token sales in a way that is standardized and immediately exposed to a large market.

The Binance Launchpad allows new tokens to easily and directly be introduced to the Binance exchange platform, which creates a direct pipeline for new tokens and coin offerings.

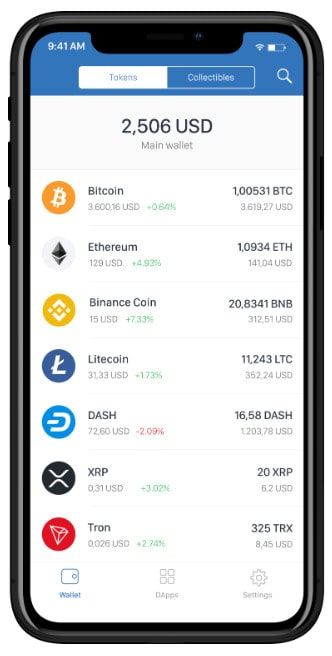

Trust Wallet

In 2018 Binance acquired Trust Wallet and brought it under the Binance umbrella. The Trust Wallet brings an extra layer of usability and functionality to Binance users and completes its very well-rounded suite of products.

As the official mobile wallet for Binance, the Trust Wallet allows users to store and transfer major crypto assets such as Bitcoin, Litecoin, Tezos, Tron, XRP, and many more.

The Trust Wallet is able to handle any ERC20 or ERC223 tokens on the Ethereum network as well as function as a browser to explore Ethereum dapps (decentralized applications).

Eventually, users will be able to stake tokens such as Tezos in order to earn staking rewards and interact directly with Binance’s upcoming decentralized exchange.

Token Listings

One of the reasons that Binance was able to gain such widespread adoption when it launched was because it offered such a wide variety of tokens to trade.

As we’ve discussed, Binance offers trading on almost 200 separate assets, which is one of the largest in the cryptocurrency space. If you’re a project manager for a cryptocurrency startup, getting listed on Binance can be a huge boost to your token liquidity and community engagement.

Binance has a listing process with only one way to apply to get a token listed, which is through its official application form.

Though there are no hard requirements published by Binance for its token listing process, guidance for listing a new token on Binance has been outlined by CZ in a LinkedIn blog post, which includes tips such as:

- Tip 4: Update your project progress on Binance Info on a weekly basis. Constant and steady progress is highly valued. This is required even after listing.

- Tip 5: If you incorporated $BNB into your ecosystem, it would help.

- Tip 7: If you have been a promoter/supporter of Binance in your community, it will help.

- Tip 20: Focus on user adoption. If you have a large number of users, your product has value. That’s the easiest to measure.

Contributing to the Binance exchange and general ecosystem is very helpful for new tokens to get listed. There is a listing fee to get added to Binance, but it is not a fixed number, and all listing fees go to the Binance Charity Foundation.

Another way to get listed is through a community coin vote. A list of coins is chosen by the community and then they are voted on. The coin with the most votes gets added to Binance. This used to be done often and it actually became a magnet for large-scale voter fraud at one point. With teams doing whatever was possible to get as many votes as they could.

Nowadays they happen less and less, although Binance just completed one in May and the winner with the most votes was Chromia.

Conclusion

Like everything else in crypto, only time will tell whether Binance’s comprehensive strategy will pay off. However, it does bode well that it has launched many of these new services and products during a time when many other blockchain organizations are laying off staff or downsizing their operations, which may signify that Binance has been more financially responsible than some of its peers.

When the crypto market turns positive again, it should be in a very favorable position to capture the wave of growth and interest that rises.

However, Binance is not the only company that has been hard at work building and expanding during the last year. There are many other exchanges and resources available, and the competition is getting tougher as is evident by the number of exchanges that have recently overtaken Binance in terms of the trading volume.

Overall, Binance, and its suite of trading instruments, is one of the most trusted cryptocurrency exchanges in the world. With an excellent security record, high level of user protection, and a huge variety of assets, it’s easily one of the best exchanges to begin your crypto journey on.

Signing up for Binance is free, so why not give it a try today?

References

- Lisa Deikun’s Explanation of Cryptocurrency

- Binance Fees

- Binance FAQ

- Binance Chain FAQ

- Binance Charity FAQ: Empowering the Bottom Billion with Blockchain Technology

- Trust Wallet Help Center

- Investopedia’s Definition of ICO

- Changpeng Zhao’s Twitter Account

- Changpeng Zhao’s Bio

- Binance Whitepaper

- BNB Token Details

Disclosure: Blokt strives to provide transparent, honest reviews, and opinions. The writer of this article is a user of the product(s) or service(s) mentioned in this article and was not influenced by the respective owners.

We rarely run ads, but sometimes earn a small commission when you purchase a product or service via a link on our site. Thank you kindly for your support.

Read more or donate here.

![A Beginner’s Guide to Monero – What Is XMR? [Updated 2023]](https://cd.blokt.com/wp-content/uploads/2019/04/Beginners-guide-to-Monero-2-218x150.png)

![Best 5 Bitcoin Sports Betting Sites [2023] (Analyzed & Approved) Best Bitcoin Betting Sites](https://cd.blokt.com/wp-content/uploads/2020/05/best-bitcoin-betting-sites-218x150.png)