Most new cryptocurrencies come into existence to solve some real-world problem using blockchain technology. Polkadot on the other hand, came into existence to solve the problem of blockchain itself.

Polkadot, as the official website states, is a “heterogeneous multi-chain technology.” Essentially, it is (or rather intends to be) a blockchain that connects many different blockchains. It is designed to solve some of the major problems that are preventing blockchain technology from reaching large-scale, real-world application. Two of the main issues are:

- Scalability – Quite simply, blockchain technology as it exists today cannot run the number of transactions in the envisioned decentralized world. Today, network nodes process transactions on a one-on-one basis, forming a bottleneck that limits higher volumes.

- Isolation – Blockchain networks remain discrete and independent, lacking intercommunication and interoperability.

Polkadot is still in its development stage with a targeted launch date of its Genesis block in the fourth quarter of 2019.

The Polkadot Structure

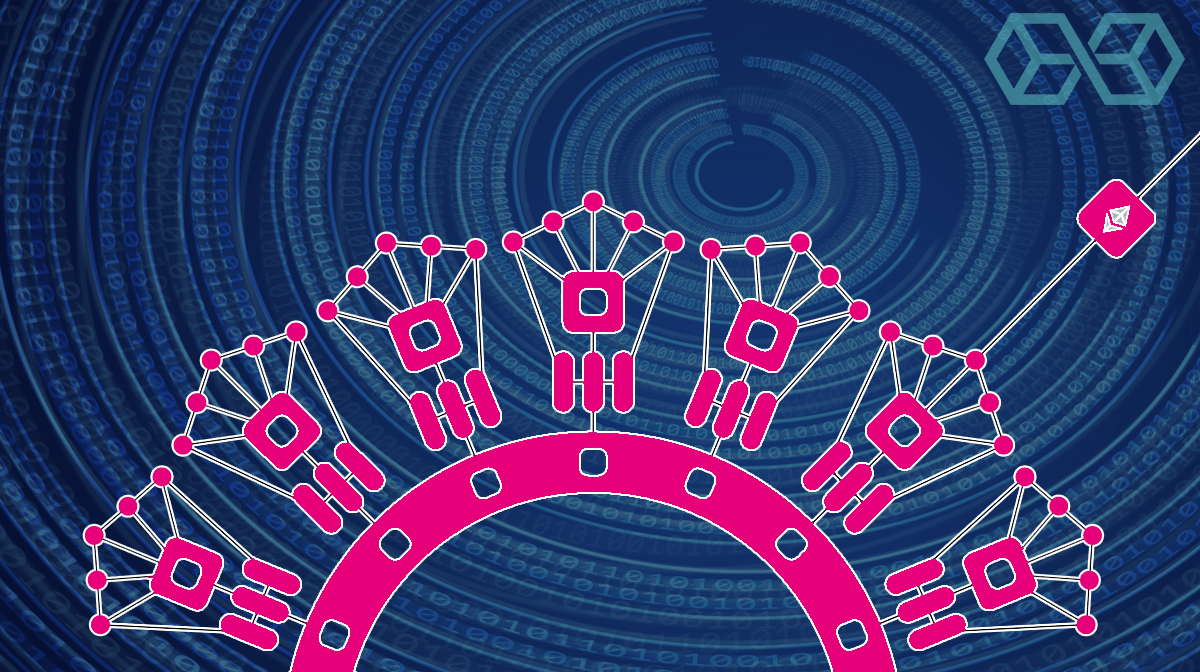

To understand how Polkadot intends to solve these issues, let’s take a look at its structure. There are three terms that Polkadot uses within its light paper that make up the core of Polkadot’s structure. They are:

- The Relay Chain – This is the main Polkadot chain that all the individual blockchains will connect to.

- The Parachain – Short for ‘parallelized chains,’ these individual blockchains will run in parallel through the Polkadot network.

- The Bridge Chain – The bridge chain is built to connect blockchains that do not use Polkadot’s governance protocols.

From reading the brief description of the three components above, you’ve probably already started to get a high-level vision of how the Polkadot network will operate. Connecting to the relay chain is to solve the interoperability issue, with its smart contracts feature ensuring that any transactions between individual chains are faithfully executed. Parachains can solve the scalability problem by processing transactions in parallel.

One further idea behind the Polkadot network is shared security. Security resources will be pooled within the Polkadot network. This will allow individual chains to leverage collective security without having to start from zero.

Governance Protocols

Polkadot will implement a proof of stake protocol. Validators will secure the relay chain by staking DOTs (the Polkadot token), participating in consensus with other validators and validating proof from collators. The role of Collators is to maintain the parachains by collecting parachain transactions from users and producing state transition proofs to be given to the validators.

The two final roles are Nominators and Fishermen. Nominators select good validators and stake DOTs, helping secure the relay chain even further. Fishermen are the final security frontier; they monitor the network and prove bad behavior to validators.

The Role of the DOT Token

The DOT token will serve three main purposes within the Polkadot network. They are:

- Governance: Token holders will have complete control over the protocol. Privileges which are normally reserved for miners on other platforms including determination of fee structures, protocol changes, and parachain additions or removals, will be given to the token holders. These functions are not formally granted to token holders, but they will be able to participate in the decision-making process by virtue of being token holders. This participation function will be built into the underlying code.

- Operations: DOT tokens will facilitate the underlying consensus mechanism of the Polkadot network. Token holders need to be active participants and ‘bond’ tokens (putting them at risk) to discourage malicious behavior.

- Bonding and Payment: This is the value mechanism. DOTs will be given out as rewards for active participation in the network. You will also need to bond DOTs to add new parachains, which is a type of proof of stake.

The initial supply of DOTs for the Polkadot Genesis block will be 10 million. 5 million of these DOTs were auctioned off at Polkadot’s ICO in October 2017. 2 million more DOTs are for further pre-launch contributions, and the remaining 3 million are reserved for the Web3 Foundation.

However, this 10 million initial supply is not a hard cap. The creators envision the supply to be inflationary to give incentives to participate in the proof of stake mechanism. The inflationary supply model has yet to be determined at the time of this writing.

Use Case Examples

Polkadot is designed to have a bare-bones structure, with most of the complexity addressed at the middleware level. At this early development stage combined with the continued fast-paced evolution of blockchain technology, it is hard to say how Polkadot will specifically fit in within the future landscape. Nonetheless, here are a few of the prospective use cases mentioned in its paper.

- A blockchain project wants to raise ETH but requires verification by a private bank chain before accepting ETH.

- Similar to the above, a payment processor may require the same sort of verification before accepting payment in BTC.

- A decentralized exchange parachain allows BTC deposits using Zero-knowledge proofs from a Zcash parachain.

- Internet of Things: There’s a hurricane. The weather oracle confirms it, and the IOT oracles confirm the damage. Private insurance chain issues a token payout.

The Creator and Team behind Polkadot

Polkadot was founded by Gavin Wood, who is the co-founder and former CTO of Ethereum. He is also the founder, CTO, and Chairman of Parity Technologies Ltd, which is supplying the development team behind Polkadot. He is also the founder and President of the Web3 Foundation, which aims to nurture technologies that can benefit the envisioned Web3 ecosystem of a truly decentralized Internet.

Polkadot’s ICO Was One of the Largest of 2017

Polkadot’s ICO was one of the most successful ICOs of 2017. The final DOT price was 0.109ETH meaning that a total of 485,331 ETH was raised from the sale of the 5 million tokens. The auction was completed on October 17, 2017, when the price of ETH was about $320, translating to a total value of approximately $150 million. A few months later, however, ETH traded as high as $1400.

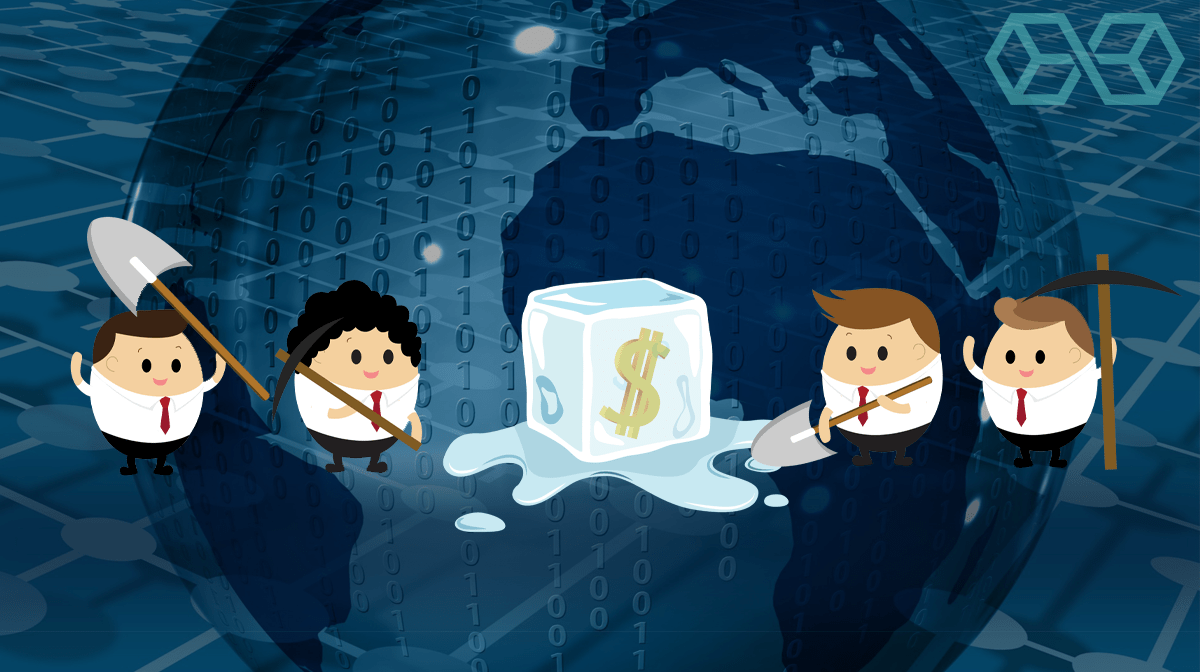

A Bump in the Road - Frozen Funds

Parity Technologies, the company developing Polkadot, declared a major vulnerability in its Ethereum Parity Wallet library contract. While no funds have been reported stolen, a significant amount of funds (over 500k ETH) remain frozen, around 68% of the total Ether raised in the ICO.

As of this writing, Parity has yet to resolve the issue. In December 2017, they proposed doing a hard fork, which would have involved changes to the entire Ethereum platform. The last hard fork to Ethereum resulted in a spin-off cryptocurrency, Ethereum Classic. However, this proposed hard fork was rejected by the community, and the issue remains unresolved and the funds still inaccessible.

Where Can I Purchase or Trade DOT tokens?

The short answer is, you can’t. If you purchased any DOT tokens during the October auction, you would only receive your tokens when and if the Genesis block is launched. This is a significant risk, but it shows that those who invested in the ICO were clearly not looking to ‘pump and dump.’ In a sense, these early token holders are probably true believers in the vision and what Polkadot is trying to achieve.

Did Polkadot Deliver On Its Q4 2019 Launch Date?

Despite having the majority of its funds frozen, the Polkadot team originally claimed that the timeline and targets would remain unchanged.

Many experts predicted that if they managed to deliver, it could be a game-changer for the whole blockchain space. If they failed, then all those people who participated in the ICO might be left with nothing at all.

Well, while there was indeed a slight delay in the rollout of the Polkadot network, their highly-anticipated full release finally happened in May 2020, which built on their Kusama canary network release earlier in 2019. Let’s explore the release in more detail below.

Polkadot Network Release and Kusama Alpha

The Kusama canary network was the Alpha release of Polkadot’s network, and since its launch it has attracted thousands of developers and enthusiasts who wanted to build on the Polkadot network.

Kusama was designed to allow developers and community members to quickly build and deploy decentralized application ideas, without the rigorous testing required to launch on Polkadot’s mainnet. Therefore, it was able to attract many innovators who wanted to explore Polkadot’s technology, and the Kusama network will continue to run for developers to trial new ideas.

May’s release, launched by the Web3 foundation, is the first iteration of Polkadot mainnet. At its core, Polkadot is a sharded protocol which allows decentralized blockchains to operate together - known as interoperability.

The problem of connecting separate blockchains together has long been a major problem for the blockchain world, and Polkadot’s solution will open up a whole host of new exciting use cases.

The Polkadot team hope that their interoperability solution will make it easier to exchange data and parallelize the workload between blockchains - solving throughput issues that have been a stumbling block to dApp adoption, and increasing network scalability across multiple blockchains.

There are already multiple participants in the Polkadot mainnet, including well-respected dev teams such as Acala, Moonbeam, Chainlink, Laminar, and more.

Together, these teams are building and deploying solutions for a myriad of real-world applications, such as cross-chain stablecoins, blockchain agnostic smart contracts, privacy preserving protocols, and oracle networks.

Overall, the Polkadot network rollout has been a resounding success, and many blockchain experts are now looking to the protocol for its role in scaling the usefulness of the overall blockchain industry.

What do you think of Polkadot’s new interoperability and scalability solutions? Will it change the whole blockchain landscape? Let us know your views in the comments below! You can follow the technical developments on Polkadot here.

References

- Polkadot Light paper

![A Beginner’s Guide to Monero – What Is XMR? [Updated 2023]](https://cd.blokt.com/wp-content/uploads/2019/04/Beginners-guide-to-Monero-2-218x150.png)

![Best 5 Bitcoin Sports Betting Sites [2023] (Analyzed & Approved) Best Bitcoin Betting Sites](https://cd.blokt.com/wp-content/uploads/2020/05/best-bitcoin-betting-sites-218x150.png)