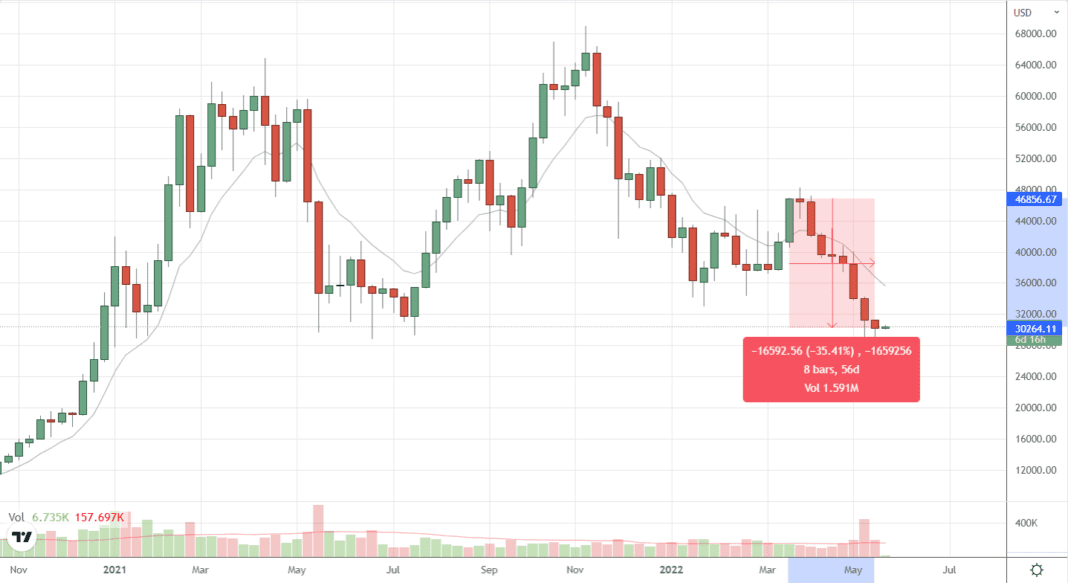

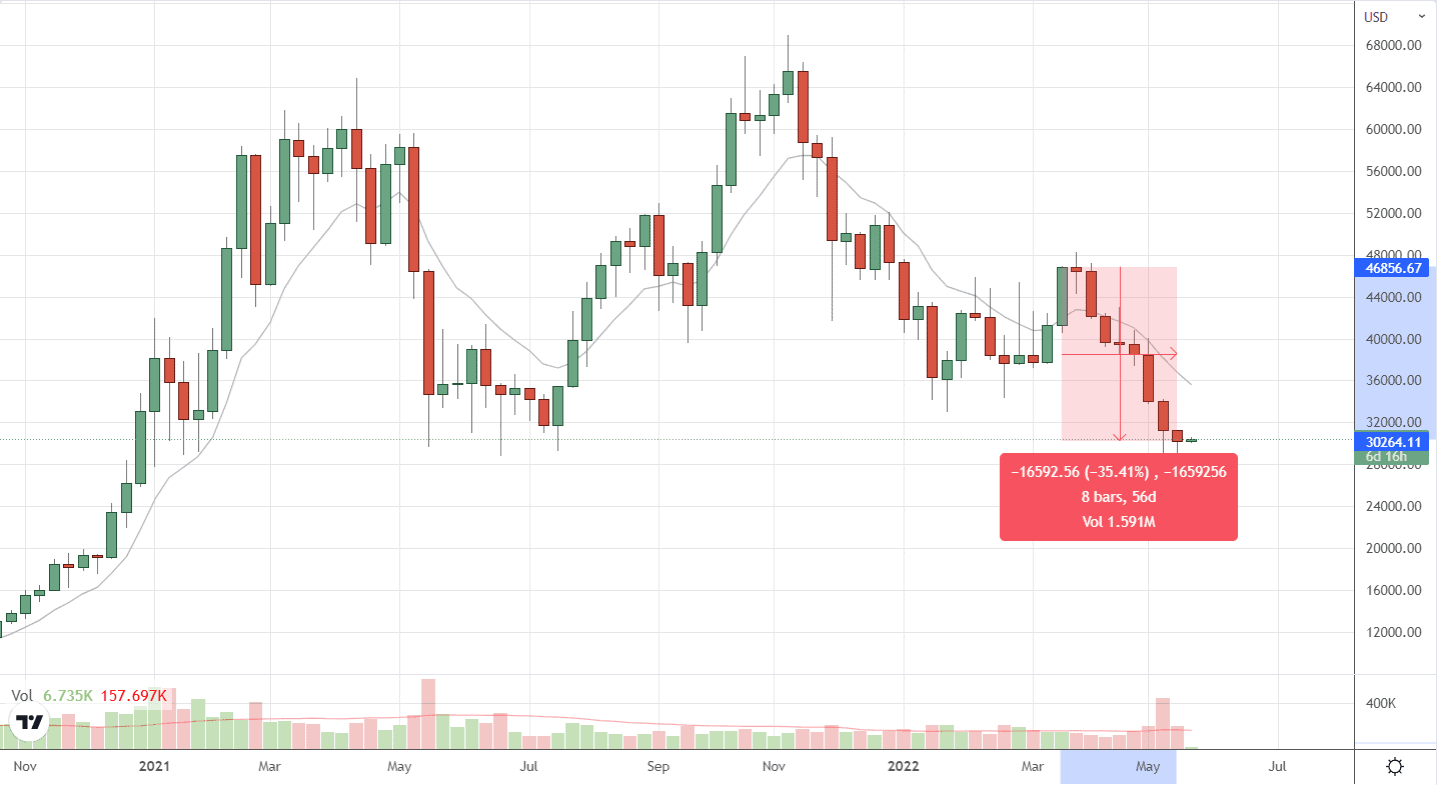

Bitcoin’s price has fallen for the eighth week in a row, setting a new record. BTC/USD declined another -3.3% percent last week, and it is down about -35% since this losing streak began eight weeks ago.

This is the longest weekly losing streak Bitcoin has ever had since it was created in 2009. The previous record was five consecutive weeks, which last happened between 1 December 2014 and 5 January 2015.

However, Bitcoin is not the only cryptocurrency stuck in a rut. In fact, four out of the top five cryptocurrencies by market cap, excluding stablecoins, are having record-setting weekly losing streaks, with BNB being the exception.

- Ethereum: Fell for the 7th consecutive week, setting a new record. ETH has fallen around -42% since this down streak began.

- BNB: Rose last week, finally ending its run of 6 consecutive weekly losses. BNB fell about -30.5% during this losing streak.

- XRP: Fell for the 8th consecutive week, setting a new record. XRP has fallen about -50.8% since this streak began.

- Cardano: Fell for the 7th consecutive week, setting a new record. ADA has fallen about -54.33% since this streak began.

On a positive note, all of these cryptocurrencies finished slightly up yesterday on the daily timeframe, ending the week strong. Holders will be hoping this strength continues into this week and that these down-streaks finally come to an end.

Stock Market Fell for the 7th Straight Week

Cryptocurrencies are not the only asset class having a bad run. The S&P 500 and Nasdaq, two leading stock indexes, have fallen seven weeks in a row, highlighting a correlation between the crypto market and the stock market. This suggests that there is a bearish sentiment in financial markets generally at the moment.

The S&P 500’s fall for the seventh week is the longest losing streak since the dot-com bubble burst over twenty years ago. Moreover, it’s only the fourth time it has had seven or more consecutive weekly losses since 1931.

The S&P 500 dropped 3% this week, its 7th consecutive weekly decline. This is longest weekly down streak since 2001 which fell 8 straight weeks (and is tied w/ 1970 for the record). Here's a look at what happened following the longest down streaks in history…$SPX pic.twitter.com/0I9yuvrEBf

— Charlie Bilello (@charliebilello) May 20, 2022

According to Charlie Bilello, CEO of Compound Capital Advisors, the S&P 500 is having its fourth-worst start to the year ever, as it’s down -18.2% in its first 97 days of trading.

Bilello says the only other years that started worse were 1970 (Vietnam War and US Recession) when it declined by -20.1%, 1940 (World War II) when it declined by -21.4%, and 1932 (Great Depression) when it fell by -32.5%.

Why are These Financial Markets Falling?

Crypto and the US stock market enjoyed a bullish run throughout most of 2020 and 2021. In fact, the fall we’re seeing now is the first major pullback since the covid pandemic crash back in Feb/Mar 2020.

Therefore, you can argue that both crypto and stocks are due a correction, and what we’ve seen recently is just part of a typical bull and bear cycle.

However, some underlying fundamental issues might also be shaking investor confidence. For example, the economy in the US and many other countries look relatively fragile at the moment, with a risk of recessions and high inflation.

Inflation and higher living costs mean many people will have less spare cash to invest or may have to sell some of their existing holdings to cover additional costs. You also have the ongoing Ukraine war with the risk of escalations and the covid-19 pandemic still lingering in the background, causing disruption to many businesses and workers.

In the crypto market specifically, we’ve just seen the collapse of Luna and UST, where both assets lost virtually all of their value. Some industry experts are saying this event is as damaging for crypto as the Mt. Gox scandal.