Introduction

Monfex is a cryptocurrency trading platform which allows its users to trade with margin. Monfex first launched in December 2018, with a mission to become one of the most accessible trading platforms in crypto.

With new users able to sign up to the exchange in just 15 seconds, and some of the lowest commissions of any crypto trading platform, Monfex certainly has all the ingredients to succeed. But with other established players like BitMEX dominating the market, what will Monfex do differently?

As a newly launched exchange, detailed Monfex reviews have been scarce up until now. Here we will provide one of the most comprehensive Monfex reviews, examining what sets the Monfex trading platform apart from its competitors.

Margin Trading

Trading with margin is the practice of ‘borrowing’ funds from a broker, in this case, Monfex, to use for a trade. This is known as ‘leverage’. Leverage magnifies gains, as users are essentially trading with more money than they actually own, but it can also result in larger losses to traders capital.

Using leverage means that in times of high market volatility, traders can be subject to a margin call when the ‘account value’, their original funds plus any unrealized profit or loss, falls below a certain unsustainable threshold.

The margin call then liquidates their position, which often results in losses of a greater magnitude than normal trading without leverage – so users should be careful to observe their limitations. Higher leveraged positions will affect traders liquidation price.

Monfex offers up to 50x leverage, which is lower and somewhat safer than the 100x leverage offered by BitMEX, which can wipe-out inexperienced users. However, Monfex users can never lose more than they deposit onto the platform.

The Monfex Trading Platform – Overview

Before we dive into how the exchange functions, let’s examine what assets are available, supported currencies, fees and supported jurisdictions.

Available Assets

Monfex offers traders exposure to 12 different cryptographic assets. It’s essential to note that users are not buying the underlying asset. Instead, users are speculating on the price of the underlying asset.

The complete range of assets Monfex offers contracts for are:

BitMEX, by comparison, offers 8 assets, including Tron (TRX).

Additionally, Monfex is planning on launching Telegram futures contracts. As crypto traders may know, the Telegram ICO was one of the most highly anticipated events in the 2018 ICO calendar. As a result, the Telegram ICO reached its hard cap without even launching a public sale, and many traders missed out.

Now, with the Telegram launch just around the corner, Monfex is offering traders access to GRAM futures contracts, a good opportunity for those who missed out on the initial Telegram ICO sale.

Supported Currencies

Although Monfex has stated that it intends to allow fiat deposits in the near future, currently traders can only make Bitcoin deposits on the platform.

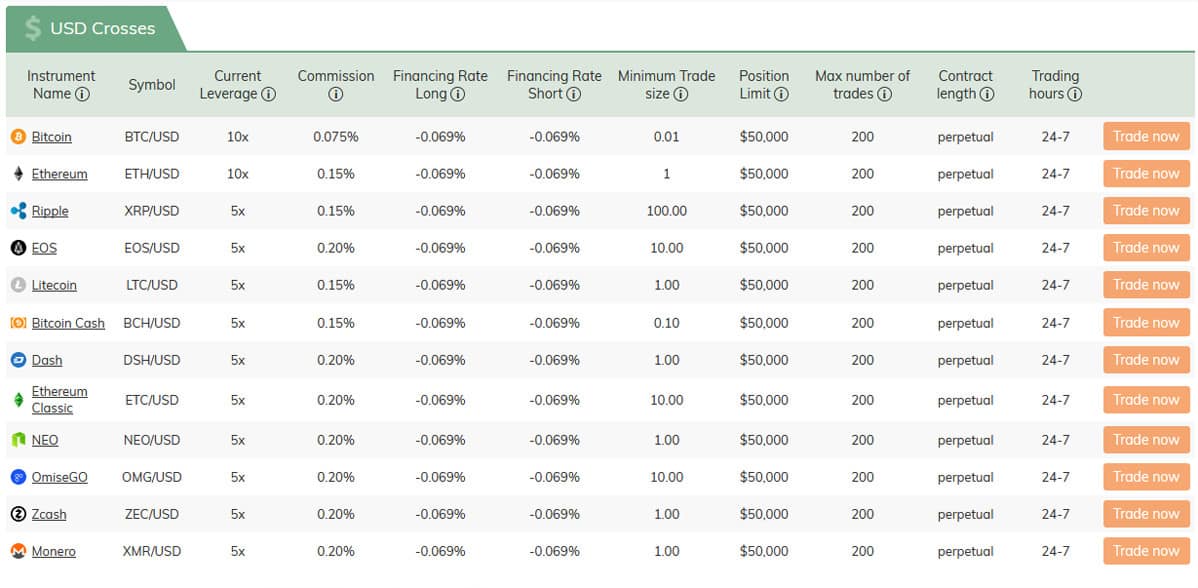

Minimum Trades & Fees

There is no fee for depositing Bitcoin to the Monfex platform, although bear in mind you will pay transaction fees to send from your wallet. As the Monfex platform offers leveraged trading products, users will pay what’s known a ‘maintenance fee’.

The maintenance fee is payable when a trader keeps a leveraged trade open overnight, for both longs and shorts.

Monfex explains its fee with this example for longs:

Likewise, users will pay either a taker or maker commission on trades, calculated as a percentage of the notional value of that trade. There are also no withdrawal fees on Monfex.

Served Jurisdictions

A huge number of jurisdictions are served by Monfex, although US users are prohibited from trading on the platform. Other countries which may not access the platform are those designated as ‘OFAC’ countries, such as the Balkans, Cuba, Iran, North Korea and more.

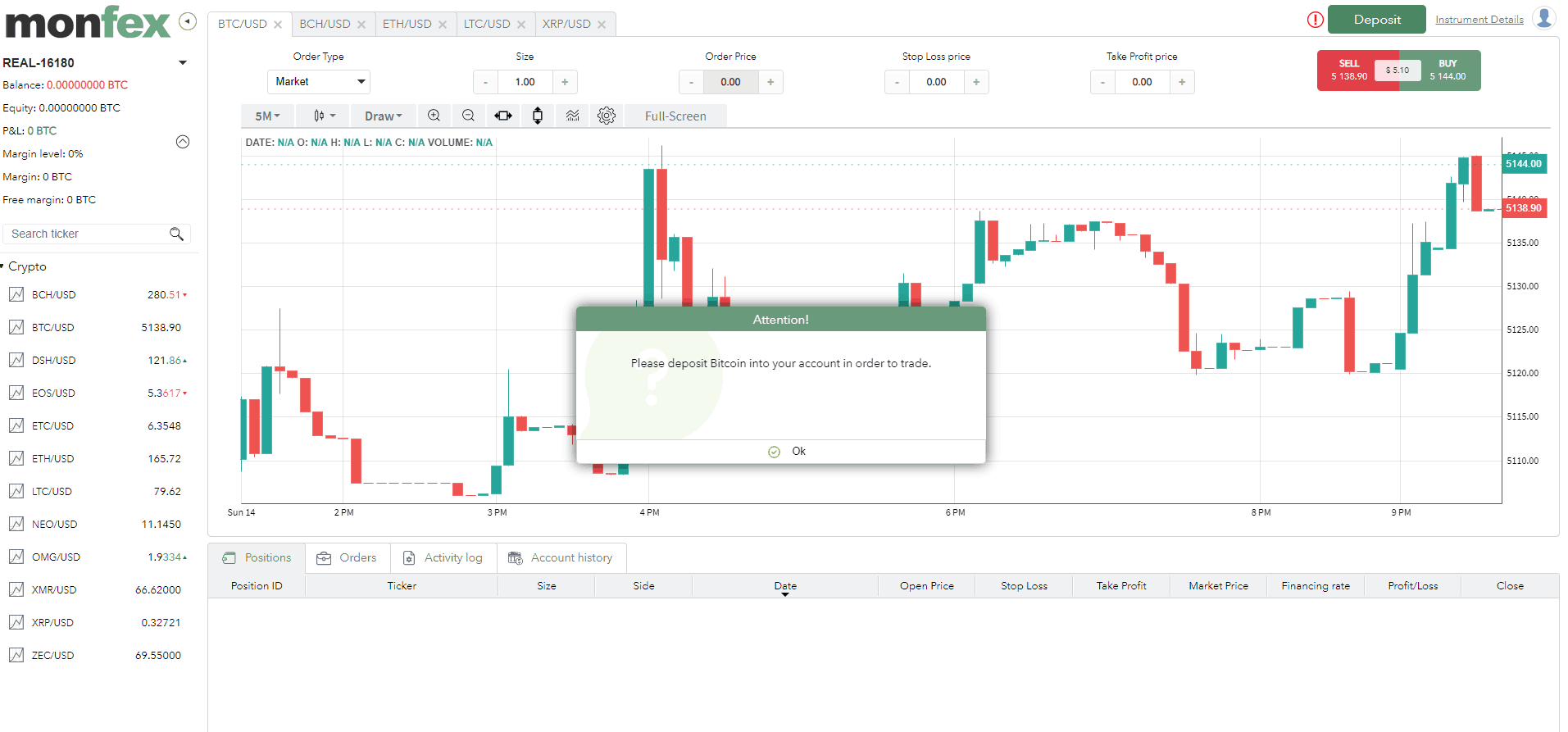

Trading on the Monfex Platform

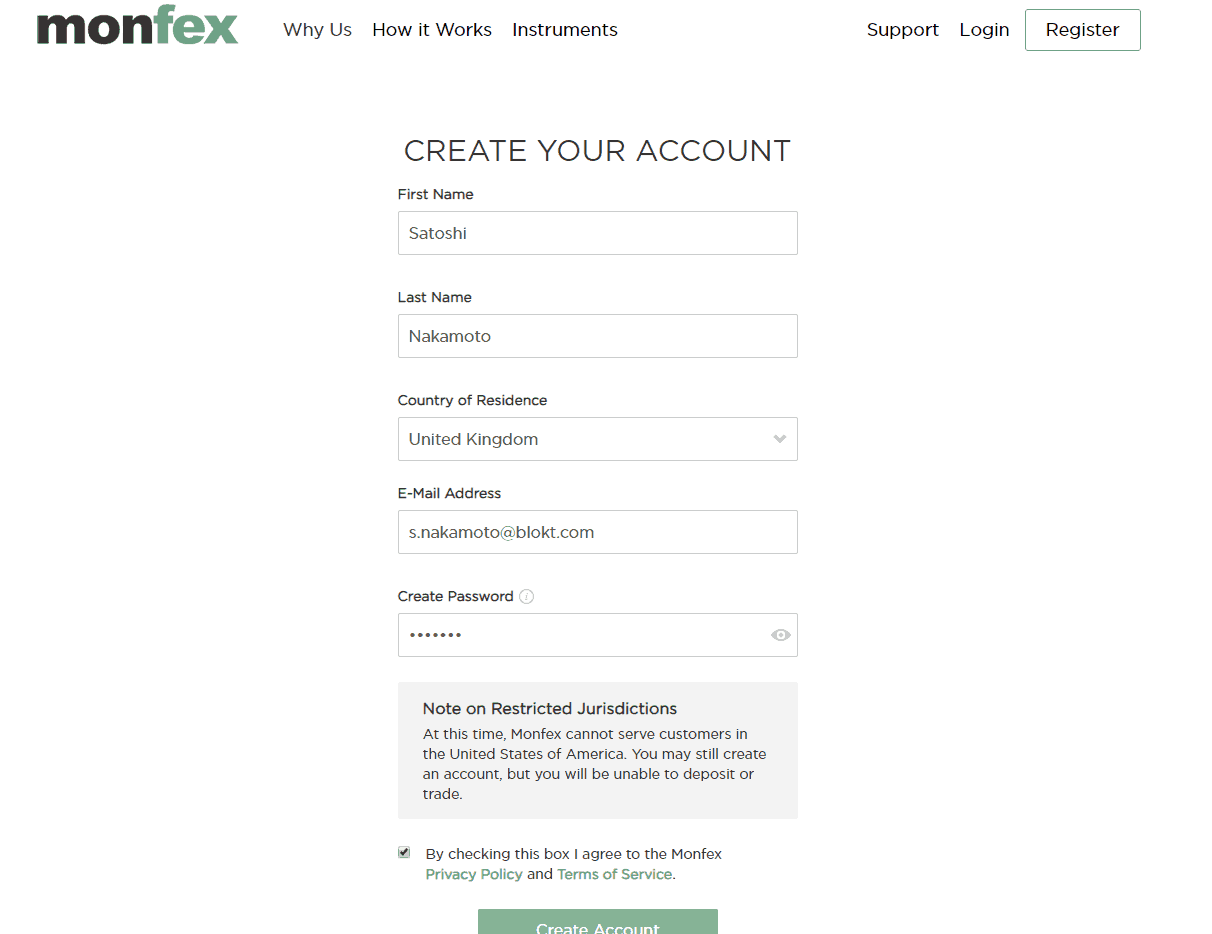

Monfex Signup

Signing up to Monfex is simple and quick, requiring just a short form as shown above. Once you’ve filled in all the relevant fields, that’s it. Your account will be ready to receive funds.

To start trading, however, users are required to verify their email and pass KYC/AML requirements by providing proof of residence.

Before users sign up, they should make sure they don’t reside in any of the restricted jurisdictions and read the terms of use.

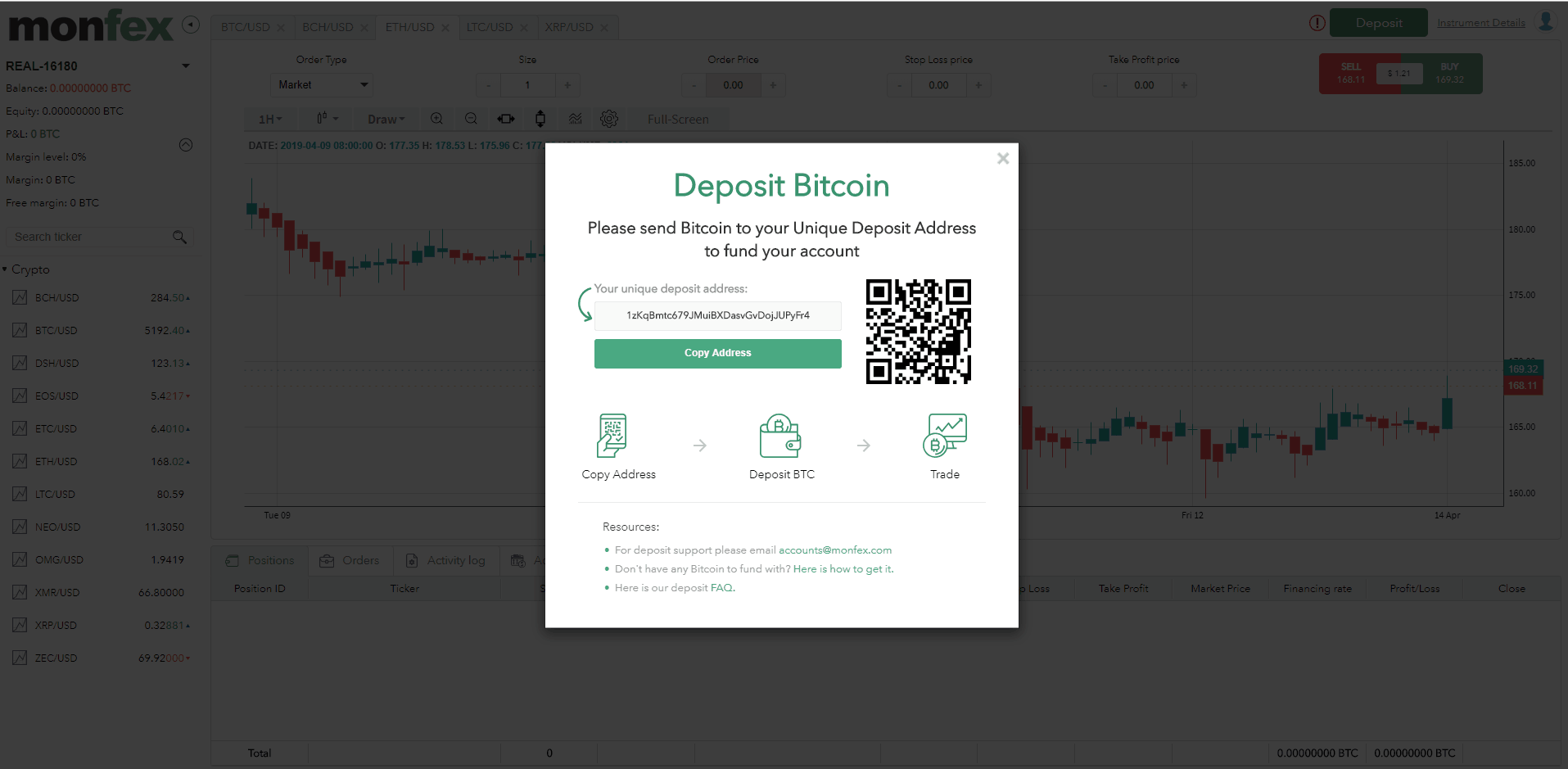

Bitcoin Deposits

Upon account creation, users will be prompted to deposit Bitcoin into their account. The deposit button can be found in the upper right-hand corner of the trading interface.

Once you click the button, a lightbox will appear with your unique deposit address, as shown below.

Users can simply copy and paste the BTC address, or scan the QR code, to send Bitcoin to Monfex. This can be done easily from a platform such as Coinbase for example. Monfex also gives its users a detailed explanation of how to buy Bitcoin.

Trading Interface

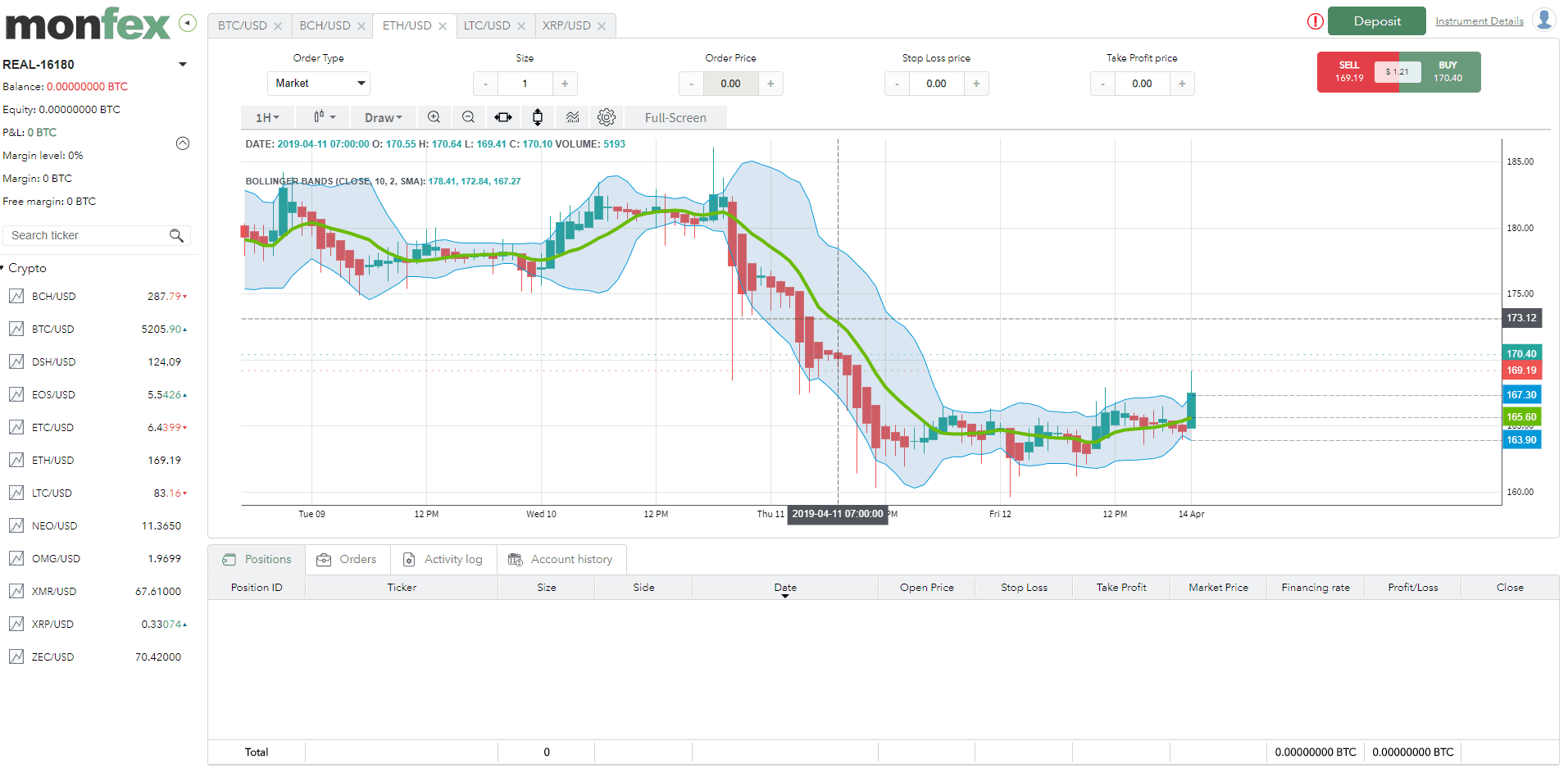

The trading interface at Monfex is sleek and easy to interpret. Unlike Bitmex, which is fast-paced, and for inexperienced traders perhaps a little overwhelming, the Monfex UI is far more simplistic.

Despite this, it has some great features. Charts aren’t just pulled from Trading view. Instead, they give users the option to trade at a huge range of time intervals, from 1 month down to ‘1 tick’, appealing to both high-frequency intraday traders or those taking longer-term positions.

Traders can choose from five chart types, including candles, bars, lines, area or Heikin Ashi charts. Likewise, Monfex offers a good range of indicators, including popular tools such as RSI, Bollinger Bands and several types of MA.

Support and Security

As a new exchange aiming to be the best crypto exchanges for margin trading, Monfex isn’t fully ‘battle-tested’ yet, but its approach to security is strong. User deposits go into cold storage, so they’re only available on the platform when actively trading.

In the settings, users can sign up for 2-factor authentication (2FA) to add an extra layer of security to their account.

Support is available 24/7, year-round. Users can currently leave a message for the support team and attach relevant files to their ticket or contact the team by phone. There’s also an extensive F.A.Q on the Monfex website.

Conclusion

So, should you use the Monfex trading platform? Although it’s early days, Monfex has excelled at making a simple UI for traders to get started with their platform.

Signup takes seconds, and Bitcoin deposits are fast and easy even for crypto novices. Users do have to pass KYC and AML to proceed, but this is standard across exchanges. Unfortunately, users from the USA aren’t eligible to use Monfex, but this also applies to BitMEX.

Monfex’s trading UI is a clean, minimalist design, which is a refreshing change from some of the other leading trading platforms; which are fast-paced and very often detract from the key elements of trading.

With up to 50x leverage, an impressive 12 assets and low fees, Monfex is looking to be an attractive platform for traders. With its impending release of GRAM futures, Monfex is potentially looking to gain some serious traction throughout 2019.

References

Disclosure: Blokt strives to provide transparent, honest reviews, and opinions. The writer of this article is a user of the product(s) or service(s) mentioned in this article and was not influenced by the respective owners.

We rarely run ads, but sometimes earn a small commission when you purchase a product or service via a link on our site. Thank you kindly for your support.

Read more or donate here.

![A Beginner’s Guide to Monero – What Is XMR? [Updated 2023]](https://cd.blokt.com/wp-content/uploads/2019/04/Beginners-guide-to-Monero-2-218x150.png)

![Best 5 Bitcoin Sports Betting Sites [2023] (Analyzed & Approved) Best Bitcoin Betting Sites](https://cd.blokt.com/wp-content/uploads/2020/05/best-bitcoin-betting-sites-218x150.png)