The recent rise of blockchains based on Proof-of-Stake (POS) has provided a new way for crypto holders to increase their holdings for relatively little work. Once unproven and untested, POS is now becoming more and more common among top blockchain networks.

As an alternative to Proof-of-Work (POW), this POS allows more users to participate in maintaining and validating the network without the need for expensive equipment and high electricity usage. In this article, you will learn how POS and POW are similar, how they differ, and how you can start earning rewards through staking right away.

Consensus

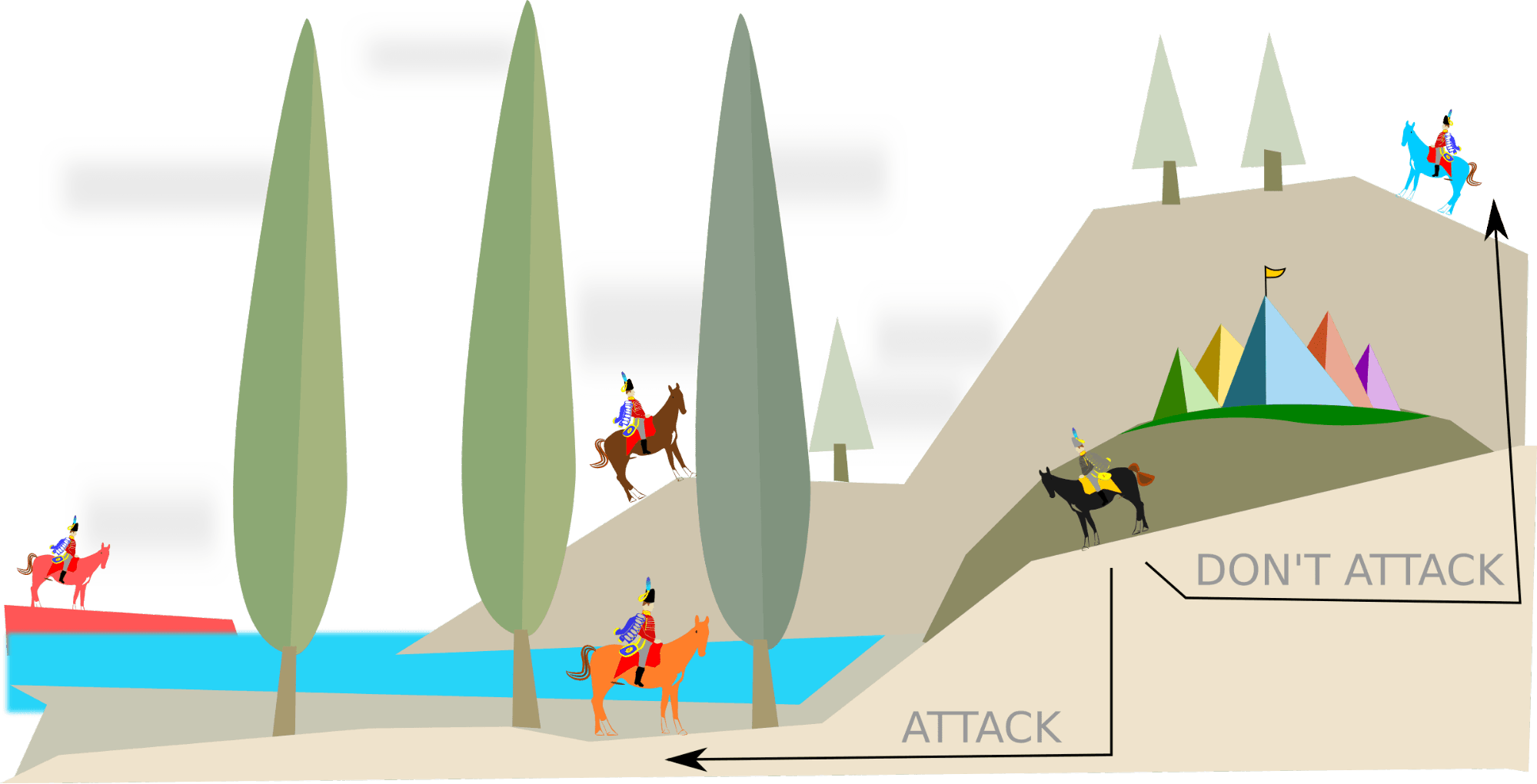

Both POS and POW are different methods for reaching the same end goal, which is to coordinate agreement in a decentralized network. Consensus simply means a general agreement, but on a peer-to-peer network of computers that have no hierarchy, manager, coordinator, or director, reaching consensus requires the right combination of cryptography, rewards, and punishments.

These computers in the network, also known as nodes, must have some basic set of rules of how to agree or determine what is true. The rule set in which they agree to participate in is called a consensus protocol, mechanism, or algorithm.

The nodes are allowed to participate in the network by running software that has the same underlying consensus protocol at its root. In general, the consensus mechanism is how these nodes come to an agreement even if some (normally up to 1/3) of those nodes disagree or behave badly. This is also known as a Byzantine Fault Tolerant system.

Proof of Stake (POS) vs Proof of Work (POW)

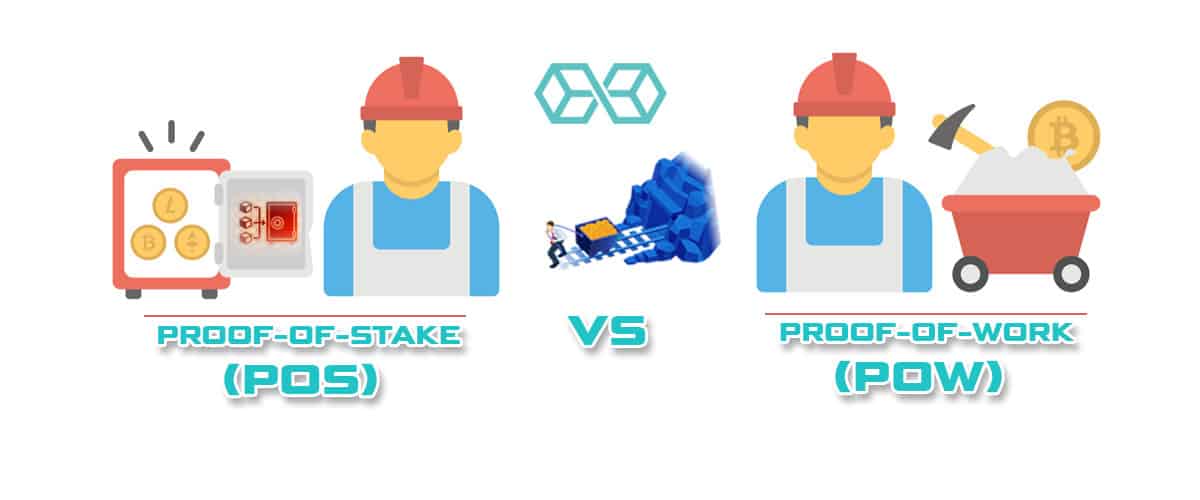

Proof-of-Work (POW) was a breakthrough technology because it provided, for the first time, an effective and reliable mechanism for reaching consensus in a way that was secure and decentralized. Therefore, to truly understand Proof-of-Stake (POS), it is important to understand how POW works.

POW Costs

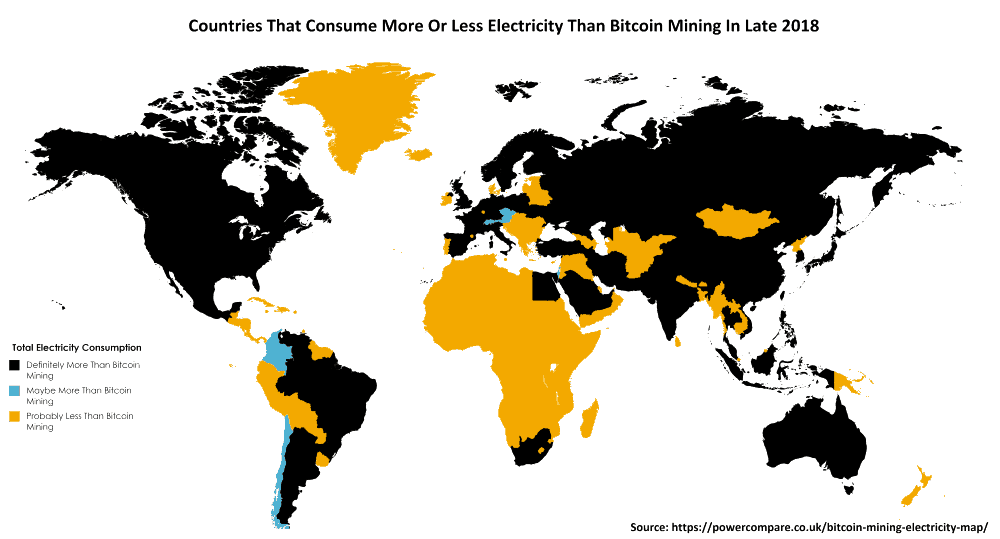

If POW works and works very well, then why does there need to be POS at all? The answer is electricity. The primary input of a POW system is electricity and this real material cost to our environment and planet is one of the main reasons why so many of the major existing and upcoming blockchain networks have plans or are already dedicated to alternative consensus mechanisms such as POS.

Bitcoin was the first application to use POW and did not consume massive amounts of energy in its initial years. However, as the Bitcoin asset became more valuable and thus more profitable to mine, competition increased and so did the electricity needed to mine profitably. Bitcoin mining has now reached the point where the entire mining process consumes more electricity than many small and even some medium-sized countries.

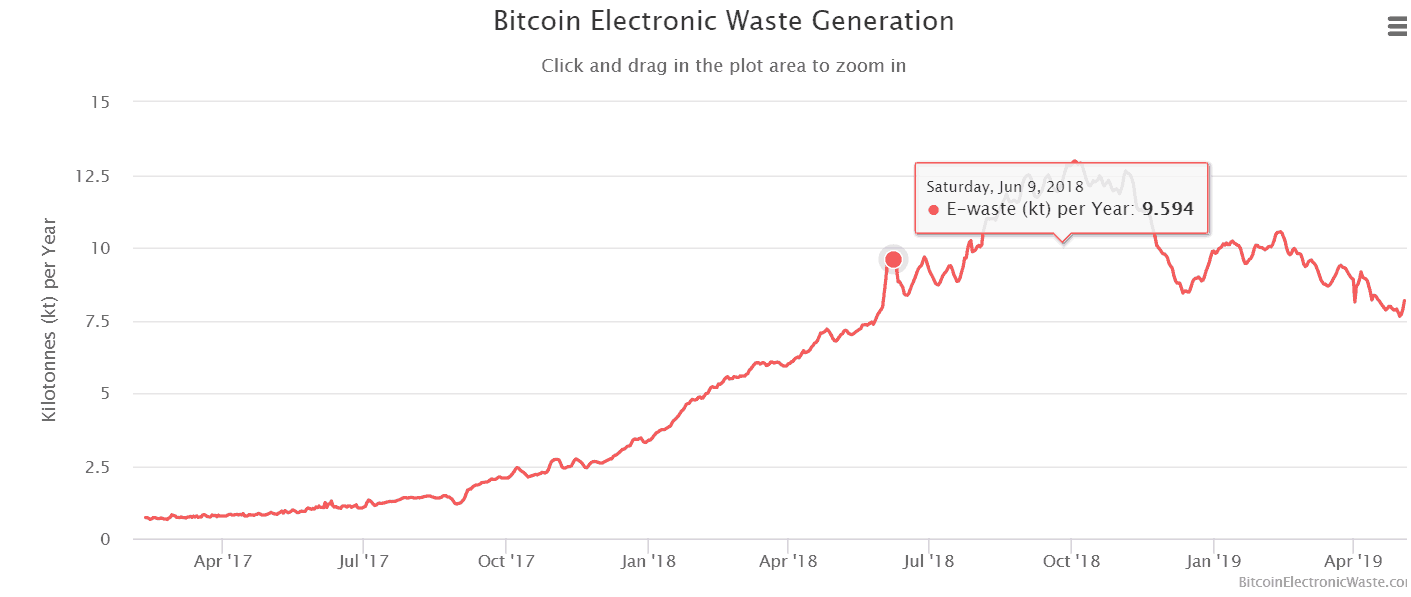

In addition to the massive energy costs involved in POW, the process also requires highly specialized computers called ASICs, which has resulted in massive electronic waste when the ASICs become obsolete or unprofitable. These very real and significant costs to our environment will likely increase as POW blockchain assets like Bitcoin rise in value.

Similarities Between POW and POS

Like POW, POS requires a minimum amount of participants to secure or maintain the network. If there aren’t enough participants then the network will be easily attacked and not very secure. In addition, the asset on the network needs to have a minimum amount of value.

The fact that the crypto asset has value makes the network more secure because the POS or POW systems can reward participants with coins produced by the consensus mechanism. The rewards for participating in consensus combined with the transaction fees on the network, which generally go to POS and POW participants, are the necessary financial incentives that keep a blockchain growing.

Differences

| Proof-of-Work | Proof-of-Stake | |

| Significant Costs | Equipment + Electricity | Crypto Asset |

| Hardware | ASIC / GPU | General Computers |

| Rewards | Fixed | Variable |

| Cooperative Options | Cloud Mining / Mining Pools | Delegating / Staking Services |

| Disadvantages | High Energy Consumption, High Barriers to Entry | Less Proven and Test |

| Participants | Miners | Validators |

The primary difference between POW and POS is the activity that participants engage in in order to secure the network. In POW, participants are called miners, and they must solve complex and difficult mathematical equations through a process of trial and error.

The mining process relies heavily on powerful computers and large amounts of electricity consumption. In a POW system, new tokens are produced to reward miners thus keeping a fixed supply of new tokens that enter the economy with every block mined.

In POS, validators must stake or deposit their crypto assets in order to engage in proposing and voting on the next block in the chain. Instead of investing electricity like miners, validators stake their capital in the form of network coins and the network rewards these validators by producing new coins over time as a reward for validators. Because the barriers to entry are much lower than in POW, nearly anyone is able to participate in POS.

Centralization

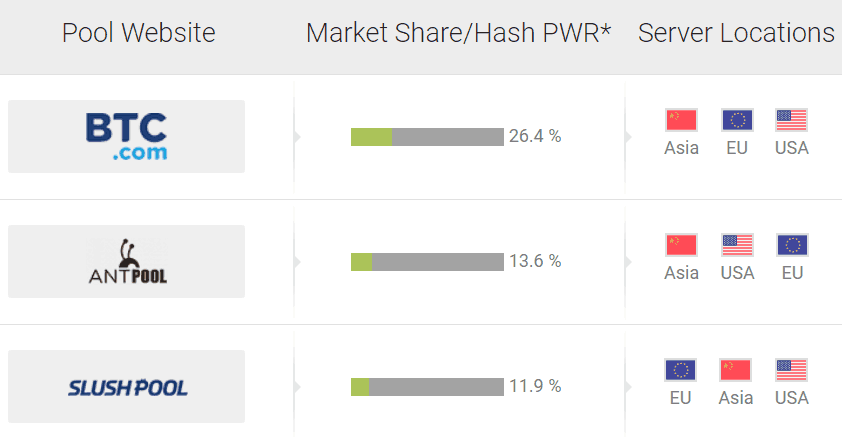

Because it is easier to become a validator than a miner, more people are likely to run nodes and become validators, which means a more diverse and decentralized group are securing the network. In order to be profitable more regularly, miners in POW tend to pool resources into mining pools. As a result, three mining pools already control more than 51% of the Bitcoin network.

Validators

Though there are many different types and designs for POS systems, with a variety of different terms, the most general name for participants in POS is validators.

Validators are users who stake or deposit their crypto assets for a certain length of time and run specialized software in order to validate and maintain the blockchain network.

What is Staking?

Staking is generally done by sending some minimum amount of crypto assets into a smart contract or specific destination that is used for validating. These stakes are coins of the POS network and are essentially deposits that are frozen and cannot be moved for a certain amount of time. This freezing of assets leaves the validator vulnerable to slashing as a way to deter bad behavior.

There is normally also a period of time when a validator wants to stop staking tokens, but cannot move them. This time period is called an unbonding period where crypto assets are not being staked, but are also still frozen. All blockchains differ on the length of the unbonding period, which can last from three days with EOS or up to three weeks with Cosmos Hub.

Rewards

Validators are incentivized to lock up their precious capital because they will be rewarded, generally in both network transaction fees and staking rewards. The reward amount in POS systems is usually variable and can change depending on how many total validators are participating at the same time.

If the rewards are too low, there won’t be enough validators participating and if the rewards are too high, it will cause the value of the crypto asset to decrease because it will increase the supply of coins too quickly. The economic and monetary incentives must be carefully balanced.

Punishments

In POS, because there is no electricity being sacrificed to secure the network, there needs to be another deterrent used to prevent attackers from trying to cheat the system. Therefore a necessary component of an effective POS system is a penalty mechanism used to punish those that are misbehaving or simply breaking the rules of the protocol.

Breaking the rules could mean trying to disrupt the consensus of the system or simply not running the software during the validating process. It does not have to be intentionally harmful.

This penalty or punishment is sometimes referred to as ‘slashing’. Each POS protocol has its own rules for what actions are punishable and how severe the punishment is, but in general, the punishment is removing a part of the stake that a validator has locked into the network.

The risk of losing crypto assets should be significant enough to prevent harmful actors in the system. Many POS systems also have reputation systems attached so that good validators who have a long history of good action will be seen as more trustworthy.

POS Costs

The primary cost in POS is the value of the crypto asset which must be purchased or staked in order to participate in POS. The cost of validating on the network is in running the equipment and software. Though, not nearly as intensive and costly as in POW, it does still require some cost. For example, in Ethereum’s upcoming POS system, the cost of staking is around ‘$120/year for a beacon node and $60/year per validator client’.

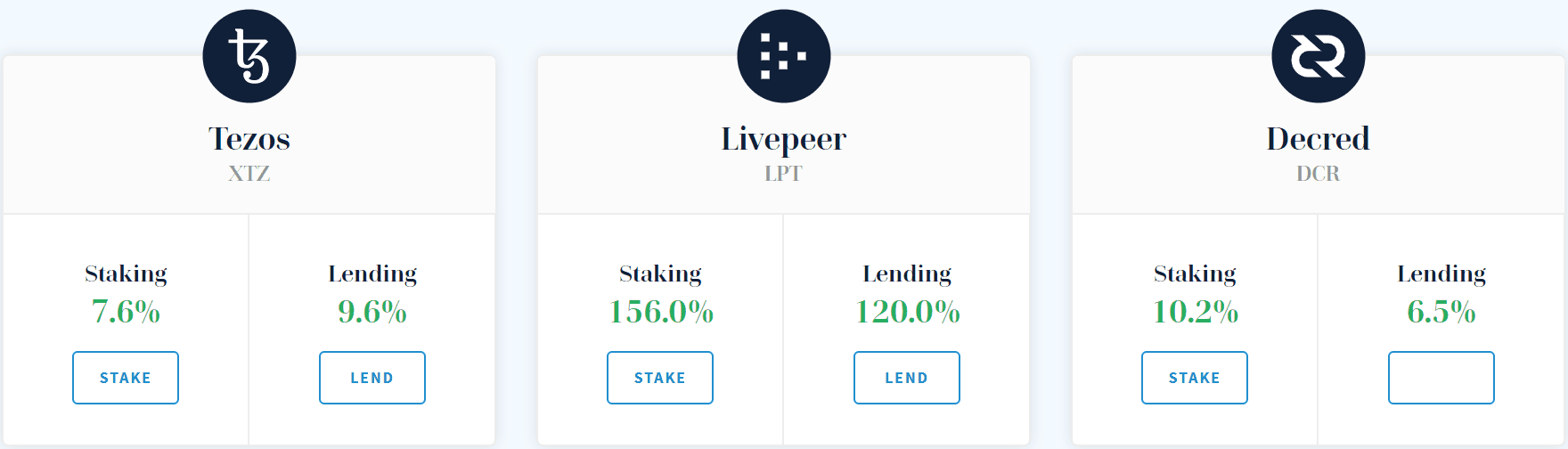

Besides the material cost, there is an opportunity cost of not being able to access your crypto assets, which can be used in other decentralized financial application such as lending. These alternative uses for your crypto assets may offer higher returns but must be given up in order to participate in staking.

Selection

Not all validators produce the same blocks at the same time. Instead, validators are chosen individually or as a set to determine which one will produce and validate the next block. Each POS design has its own method of determining, which validator(s) is chosen, but the election process is normally a combination of random selection or the total value of the validator’s stake.

Risks

Participants have to trust the POS system that they are locking their precious crypto assets into. If the network has a fatal flaw or bug then you could easily lose your staked coins. At the very least, the discovery of a major bug in the system will mean that your coins lose significant value and because you are locked in the system for a certain amount of time, you will likely not be able to sell very quickly.

You are also trusting that the POS design’s slashing and punishment mechanisms work as intended and you are not mistakenly slashed.

Staking in a network that promises higher yields usually means staking in smaller networks that are less proven and therefore have higher risks. POS protocols have not had to deal with anywhere near the amount of value in existing POW protocols such as Bitcoin or Ethereum so it is a valid argument to say that POS has not been tested against attackers in the same way that POW has been.

Known Issues With PoS

Some cryptographic researchers have pointed out some pressing issues with PoS consensus. These issues don’t afflict every PoS blockchain, and there are some which have effectively solved many of these limitations – which we’ll discuss later.

These issues include:

- The nothing at stake problem – As there’s no hashing power required to build a PoS blockchain, and therefore no or little computational effort, blockchain validators can exploit the network. They do this by building on all of the past versions of the blockchain, which allows them to claim fees for validating transactions on both the chain that becomes the most used, and any legacy chains which continue to be used.

- Negative feedback loop – Proof of stake encourages the staking of coins or tokens, which effectively removes them from the circulating supply. This means there are less tokens to be used as digital cash within a blockchain ecosystem, potentially negatively affecting the economics of the underlying network. However, scarcity via staking could also increase the price of the token.

- Goldfinger attacks – Goldfinger attacks can seek to bribe the node operators or staking pools, rent more stake to launch an attack on the protocol, or build a pool to try and seize a majority. Goldfinger attacks are named after the James Bond villain, who undermined the US Treasury to his own gain.

- Security – PoS is a relatively new technology, and so the security has not yet been proven. PoS has been in use for some time and so far it seems to be secure, but there is no guarantee as of yet.

Certain blockchains have sidestepped these issues. For example, third-gen blockchain protocol Cardano use the Ouroboros consensus mechanism, which uses sidechains to avoid Goldfinger attacks, and solves nothing at stake issues by using forkable strings.

Similarly, Tezos uses a security deposit to ensure that double staking or validating on simultaneous chains is prevented.

Delegating

The easiest way to get involved and start earning rewards in most POS systems is not through validating directly, but through delegating. Delegators participate in POS by staking their crypto assets with a trusted or reliable validator who runs the software and equipment, but pools the capital from different delegators.

In other words, instead of running the software yourself, you can send your tokens to a validator who will do it for you for a small fee and share of the rewards.

Like with ‘validators’ and even ‘staking’, many different terms are used when a user must trust another party to handle the technical staking, but we will stick to delegating. As a delegator, there is a risk in choosing and trusting validators because you will both share in the rewards and the punishments if they occur. As with validating directly, there is the danger of getting punished or slashed if the validator that you are delegating to misbehaves.

Delegating can normally be done on-chain so that the validator does not own or control the delegator’s tokens and can only use those tokens in staking. Delegating to participate in POS involves the same basic steps:

- Step 1: Get Coin

- Step 2: Download Wallet

- Step 3: Delegate to Validator

Staking Comparison

The blockchain networks below are active today and anyone can become a validator or delegator to earn rewards on them. We will describe the unique POS mechanisms of each one as well as how to start staking in them.

| Cosmos

|

Tezos

|

TRON

|

EOS

|

Dash

|

|

| Native Coin | Atom (ATOM) | Tez (XTZ) | Tronix (TRX) | EOS (EOS) | Dash (DASH) |

| Consensus Mechanism | Tendermint | Liquid Proof of Stake | Delegated Proof of Stake | Delegated Proof of Stake | Proof of Work + Masternodes |

| Market Cap (as of 2 May 2019) | $874 Million | $800 Million | $1.5 Billion | $4.5 Billion | $1 Billion |

| Annual Staking Yield (as of 2 May 2019) | 13% | 7% | 4% | 2% | 6% |

| Minimum Staking Requirements | 1 ATOM | 1 XTZ | 1 TRON | 1 EOS | 1,000 DASH |

| Active Validators (as of 2 May 2019) | 109 Validators | 220 Bakers | 27 Super Representatives | 21 Block Producers | 4800 Masternodes |

| Annual Token Supply Growth | 7% | 5.5% | 336,384,000 TRX | 5% | 8% |

Cosmos

The Cosmos network aims to become an interoperable blockchain protocol that allows many different blockchains to communicate, share data, and transact with each other. Cosmos also easily allows developers to build their own specialized blockchain on their Tendermint consensus protocol, which uses POS.

One of the biggest and best crypto exchanges in the world, Binance has created its own blockchain, Binance Chain that is built on the Tendermint protocol.

ATOMs

The Cosmos Hub is the first hub that will connect many different blockchains and its native token is ATOM. Holders of ATOMs are able to participate in POS to earn more ATOMS as well as vote on governance decisions on Cosmos Hub.

Validators

There are currently over 100 validators on Cosmos, but there are plans to have up to 300 over time. Validators are chosen based on their own self staked ATOMs and the ATOMs of those who have delegated tokens to them. The top 100 validators with the most self and delegated stakes are chosen as the validators of the system so it is important for a successful validator to attract stakes through delegators.

If you want to start running your own validator on the Cosmos network, you can follow its instructions using command line.

Delegators

All validators in the Cosmos network can be delegated to and this happens as an on-chain function. To become a delegator, you must hold ATOMs and send a ‘delegate transaction’ indicating how many ATOMs to stake and to which validator.

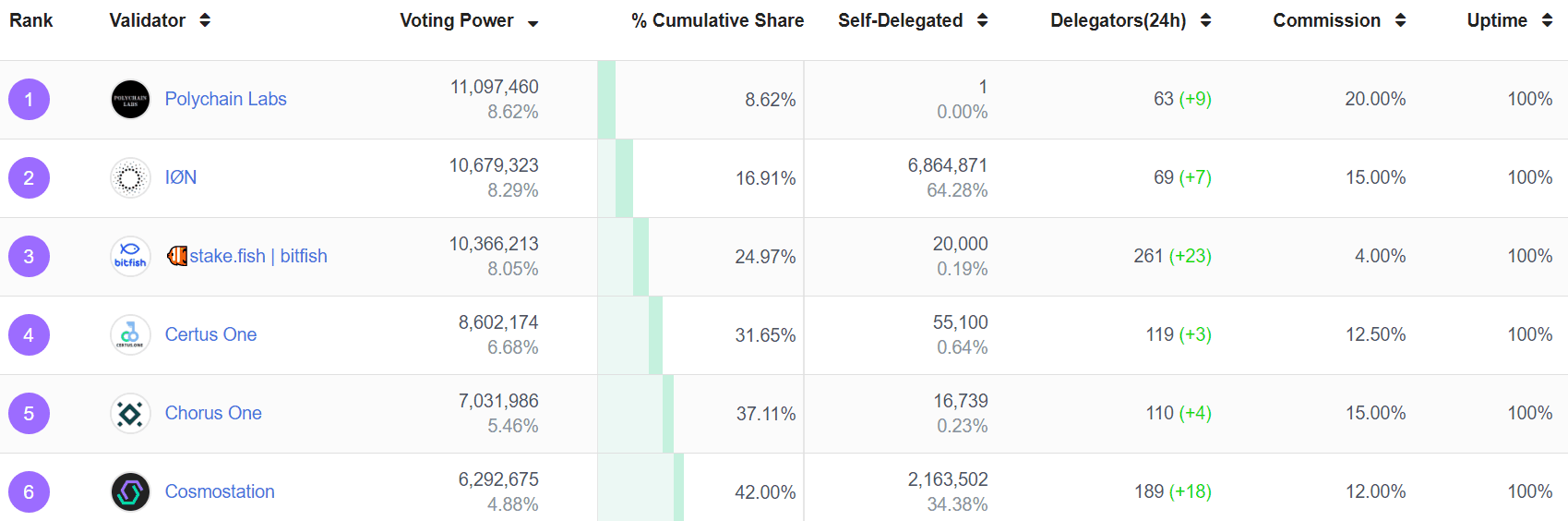

The top active validators on the Cosmos network can be seen below:

Polychain Labs is the top validator on Cosmos and delegating your ATOMs to Polychain Labs can be done on-chain via the command line interface:

Tezos

Tezos is a smart contract platform where holders of the Tez (XTZ) tokens are able to participate in POS and governance decisions.

Baking

The Tezos POS system works through ‘baking’ in which holders of XTZ tokens sign and publish blocks to the Tezos blockchain. Bakers in Tezos are basically the validators that we have been describing in other POS systems. Bakers get the right to create a new block by being randomly selected.

The baker is notified that they have the right to bake blocks weeks in advance and is required to place a deposit or ‘bond’ that changes depending on how many blocks the baker needs to create. The rewards for baking changes depending on the total number of bakers, but the system will create roughly 5.5% of the total token XTZ supply each year in baking rewards.

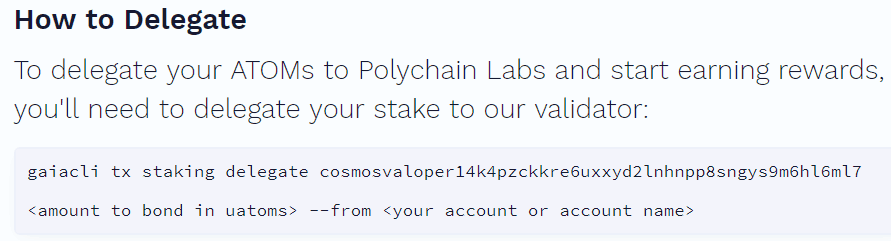

A list of active bakers and tools for calculating rewards based on how much XTZ is staked and which baker is chosen can be found at mytezosbaker.com.

Delegating

Like Cosmos, Tezos also allows its coin holders to delegate their crypto assets to chosen validators or bakers. To get started delegating, you need to download and use a wallet, which will likely have a delegation feature from which you can choose the baker that you want to trust to bake for you and share rewards with you.

Delegating can be done through the Galleon Wallet by following these simple instructions:

Dash

DASH is meant to be a private and secure cryptocurrency that can be transferred quickly and easily.

Dash has a consensus system that is a hybrid of POW and POS so it still has miners maintaining the network. However, we will focus on the POS portion of the DASH protocol, which revolves around a concept known as Masternodes.

Masternodes

Masternodes are servers that are dedicated to maintaining the DASH network. These Masternodes host full copies of the DASH blockchain and must contain a minimum stake of 1000 DASH in order to earn network rewards. In order to host a DASH Masternode, you will need 1000 DASH, a wallet that stores DASH, and a Linux server. For complete steps on how to run a DASH Masternode, please see the instructions here.

Hosting Service

Delegating your stake of DASH to another party to do the difficult technical work is known as a ‘hosting service’ in DASH. There are several hosting services available that are recommended on the official DASH website such as CrowdNode, SID Hosting Service, and AllNodes.

TRON

TRON is a fork or copy of Ethereum that was redesigned to be optimized for performance. Specifically, TRON is much faster than Ethereum, being able to handle up to 2000 transactions per second compared to Ethereum’s 15 transactions per second. TRON is able to accomplish this speed and throughput because it uses a delegated POS protocol while Ethereum still uses POW.

Super Representatives

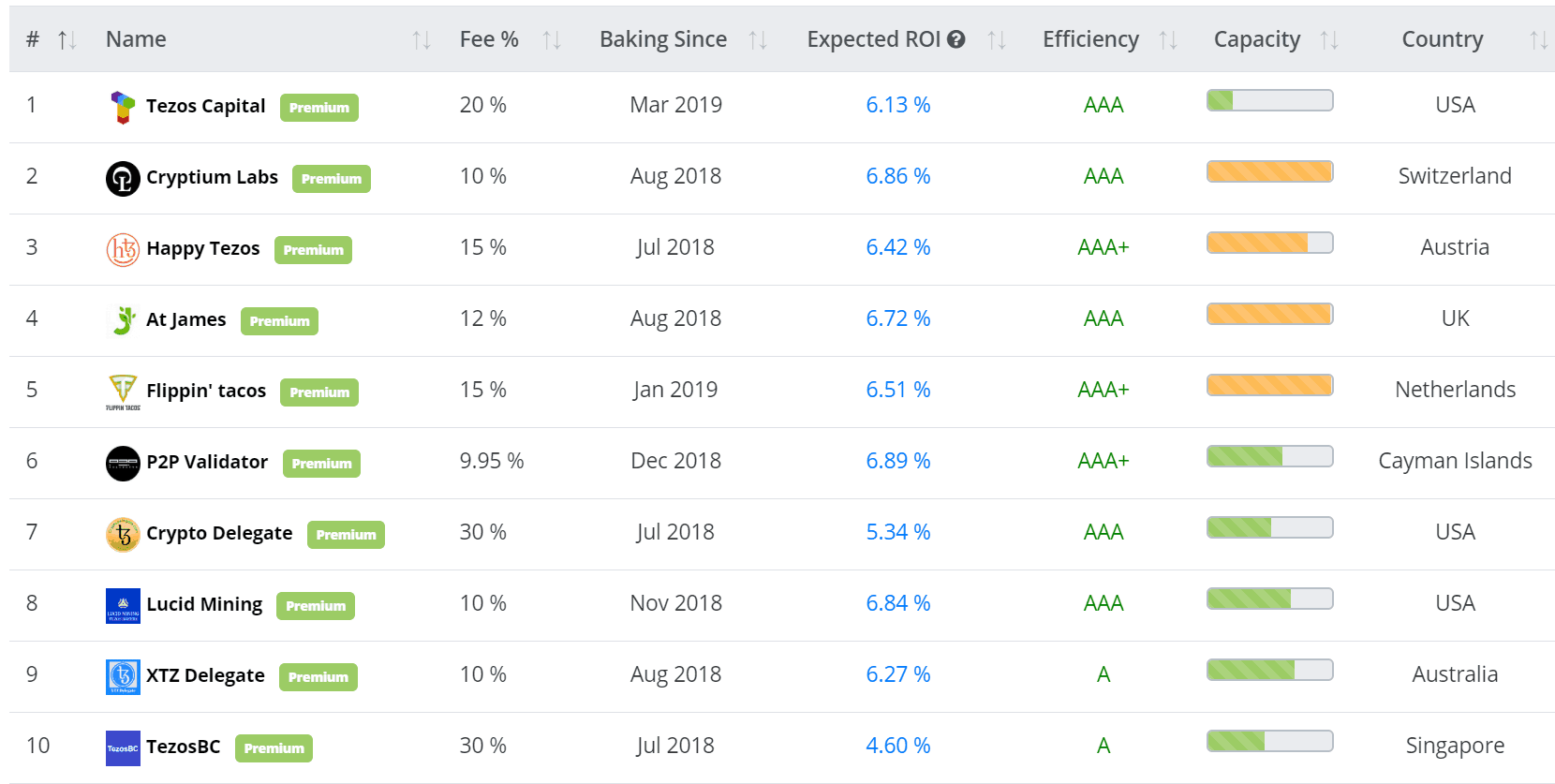

TRON has implemented a delegated POS consensus protocol and staking occurs through 27 validators that are called Super Representatives (SR). Staking in TRON is done through a system of freezing TRX tokens and voting for SRs. You can see all the current Super Representatives as well as the SR candidates on the tronscan.org block explorer:

Delegating your TRX to an SR is done by ‘voting’ for them. The top 27 SRs with the most votes gets to participate in the block producing process. To start delegating or voting, you can follow these instructions.

EOS

Like TRON, EOS is also a smart contract platform that has become scalable by using the Delegated POS system.

Block Producers

The EOS delegated POS system relies on 21 elected Block Producers to actively maintain and build the network. The system is also similar to TRON in that Block Producers are voted on or selected by EOS holders. Voting happens in rounds where the 21 Block Producers are selected by EOS holders and the more EOS tokens a voter has, the more their vote is weighted.

You can participate in voting on EOS through a wallet such as SimpleEOS, EOS Voter, or Scatter.

For a comparison between EOS, Ethereum, and TRON, check out our in-depth guide.

Cardano

In July 2020, Cardano completed its move to a fully decentralized blockchain with the release of the Shelley era. The blockchain underwent a continuous hardfork which welcomed the beginning of staking and delegation on the network.

ADA holders can currently delegate their stake through the official Daedalus wallet, and soon the Yoroi wallet from Cardano’s partners, EMURGO; and also eventually through Binance!

Although staking has been live for less than a month, there’s already almost one thousand stake pools live, making Cardano one of the most decentralized blockchain protocols almost overnight.

Staking has proven very popular on Cardano, and although it’s currently too early to give a detailed breakdown of staking rewards here, you can find out how much you could earn through ADA staking by checking out their staking calculator.

Ethereum 2.0 Staking Plans

The world’s largest crypto network after Bitcoin is Ethereum and the protocol plans to switch to POS in what is being known as Ethereum 2.0. Though the plans for Ethereum 2.0 are constantly changing, the first step in the POS specification is being planned for completion by 30 June 2019.

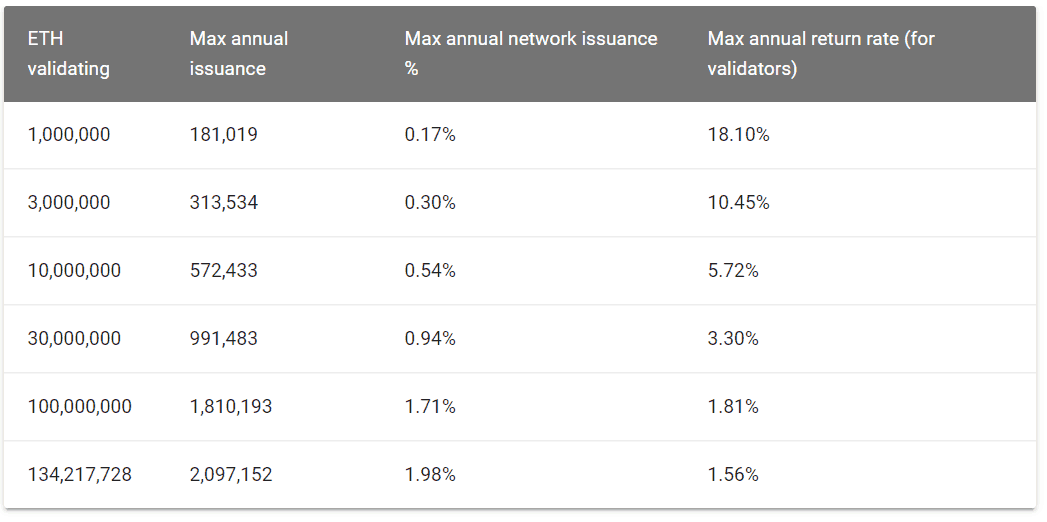

At the latest specification, a validator would need a minimum of 32 ETH staked in order to participate in POS on Ethereum. The amount of ETH designated as rewards for staking will depend on the total number of validators in the system. Though exact figures are still unconfirmed, resources are available to estimate how much return can be expected by staking a certain amount of ETH.

Adjustable calculators can be used to view interest rates and returns depending on different things like total staked and supply. Since the final release of Ethereum 2.0 is still probably at least a year away, many of these parameters will likely continue to change.

The Future of POS

The environmental impact and cost of POW have meant that POS is becoming the preferred consensus protocol for both new and existing blockchain networks. By allowing coin holders to participate in maintaining the network and incentivizing them with rewards in the form of native tokens, POS is a simple way to earn money without selling your crypto assets.

As POS becomes more well-known and popular, we will also likely see a rise in staking services that will offer easy user experience and handle all the intricacies and work of staking for the user while sharing the rewards for a small fee. The blockchain industry continues to evolve rapidly in all aspects from basic infrastructure to the user interface.

References

- EOS.IO Technical Whitepaper v2

- Tron Whitepaper v2.0

- Blockchain Explained

- Opportunity Cost Defined

- ETH 2.0 Economics

- Bitcoin Electronic Waste Monitor

- Bitcoin Energy Consumption Index

- Application-specific integrated circuit Explained

- What is Byzantine Fault Tolerance?

- Peer-to-Peer Defined

- Ethereum 2.0 roadmap

![A Beginner’s Guide to Monero – What Is XMR? [Updated 2023]](https://cd.blokt.com/wp-content/uploads/2019/04/Beginners-guide-to-Monero-2-218x150.png)

![Best 5 Bitcoin Sports Betting Sites [2023] (Analyzed & Approved) Best Bitcoin Betting Sites](https://cd.blokt.com/wp-content/uploads/2020/05/best-bitcoin-betting-sites-218x150.png)